Business

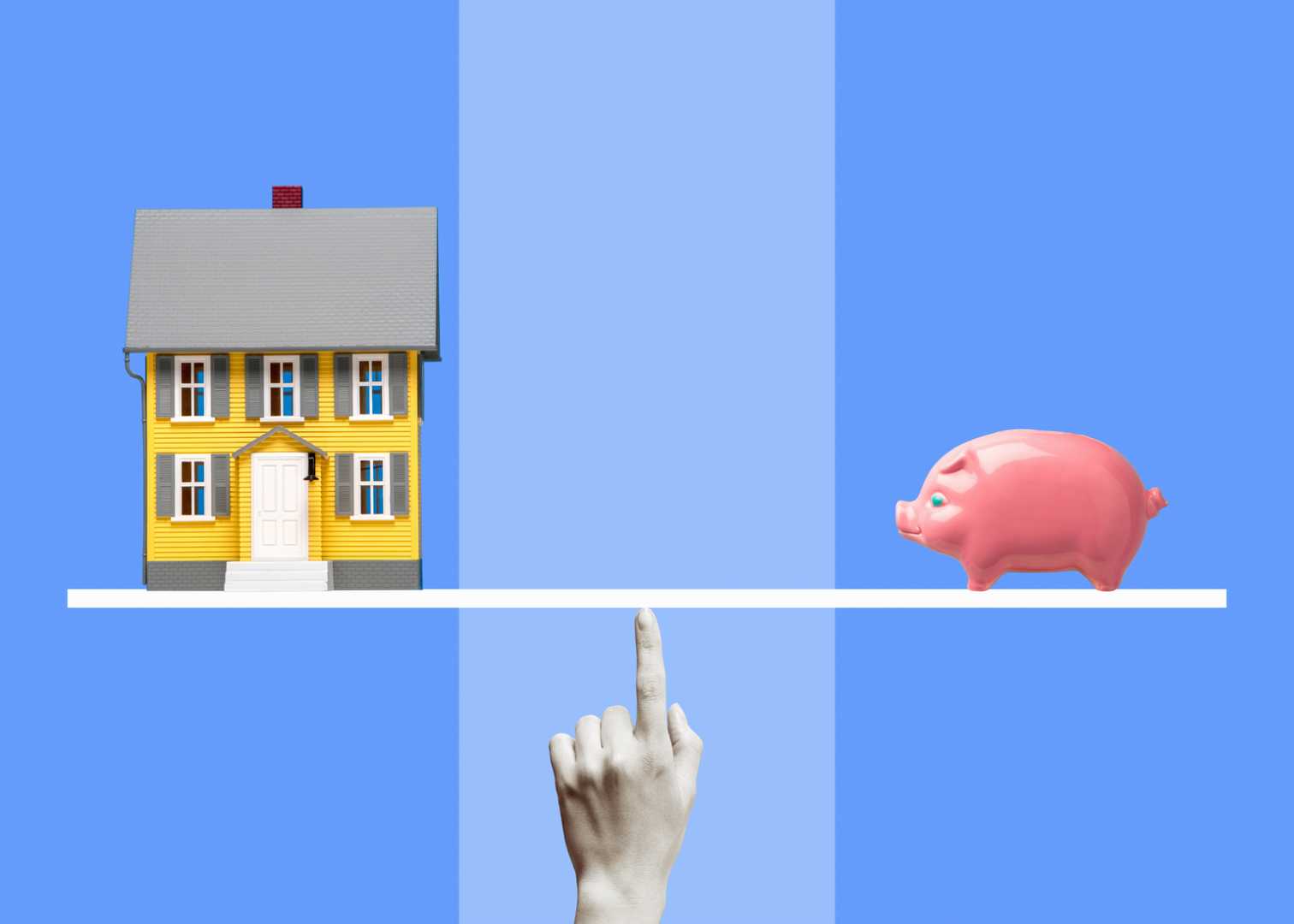

New York Mortgage Trust Prices $85 Million Senior Notes Offering

NEW YORK, June 30, 2025 (GLOBE NEWSWIRE) — New York Mortgage Trust, Inc. (Nasdaq: NYMT) announced today the pricing of a public offering of $85 million in senior notes that carry an interest rate of 9.875% and are due in 2030. This offering is expected to close on July 8, 2025, subject to customary conditions.

The company has given underwriters a 30-day option to purchase up to an additional $12.75 million of the notes to cover any over-allotments. If approved, the notes will be traded on the Nasdaq Global Select Market under the ticker symbol “NYMTH.”

Investors can expect quarterly interest payments starting on October 1, 2025, with a maturity date set for October 1, 2030. The company also retains the option to redeem the notes in whole or in part at any time after October 1, 2027.

The funds raised from this offering will be allocated for general corporate purposes, including the acquisition of targeted assets and support for various mortgage- and credit-related investments.

As part of the offering, major financial firms such as Morgan Stanley, Keefe, Bruyette & Woods, and Wells Fargo Securities are acting as joint book-running managers, overseeing the deal.

New York Mortgage Trust, based in Maryland, primarily focuses on acquiring and managing mortgage-related residential assets.