Business

Nike Shares Soar Following Announcement of New CEO

The stock value of Nike surged dramatically on Friday in response to the announcement of a significant change in leadership at the iconic sportswear company. Investors are optimistic that the newly appointed CEO, Elliot Hill, can revitalize the company’s performance, reversing the declining fortunes seen under the current CEO, John Donahoe.

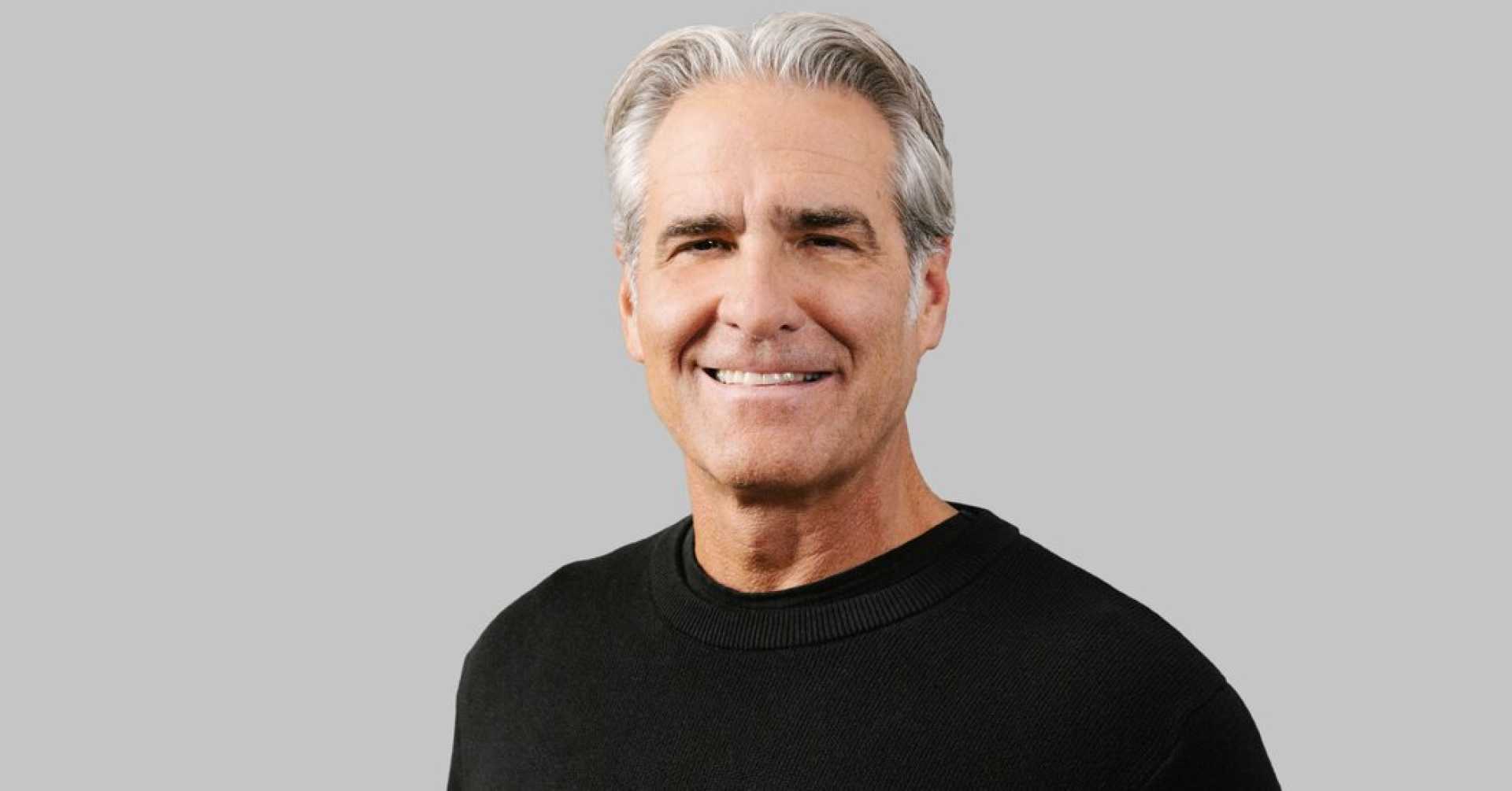

Nike made public on Thursday afternoon that Elliot Hill will take over as CEO starting October 14. Hill, who previously retired in 2020 after leading the company’s commercial and marketing operations, will succeed Donahoe, who has held the position since January 2020.

This strategic leadership change is expected to “inject a much-needed sense of urgency,” according to Krisztina Katai, an analyst at Deutsche Bank, in a note shared with clients. Katai highlighted Nike’s prolonged struggles with profit growth under Donahoe’s leadership, which has hindered stock performance.

The market seemed to support this view, with Nike shares climbing by as much as 8.7% to $88 on Friday, reaching their highest intraday value since June 27. This rise marks Nike’s most substantial stock gain since November 10, 2022; however, the shares still remain more than 50% below their peak levels in 2021.

Bank of America analyst Lorraine Hutchinson stated that Hill would be responsible for driving Nike’s efforts to “rejuvenate innovation, rekindle wholesale relationships, and rebuild sales,” essential elements for the company’s growth journey ahead.

Since Donahoe’s tenure began, Nike stock has returned -16.5% to investors, a stark contrast to the S&P 500’s 87.3% return over the same period, based on data from FactSet. This downturn occurred alongside a challenging phase for key competitors such as Adidas and Lululemon, which saw returns of -26.6% and 10.4%, respectively.

An analyst at Bernstein, Aneesha Sherman, commented that “the turnaround will take time, but the market will be more forgiving under a new leader.” The urgency for change was underscored by Wall Street’s reaction to Nike’s recent financial disclosures, which saw a 20% drop in shares in June to a four-year low, following the revelation of an expected 10% annual decline in sales for the quarter ending in August.