Business

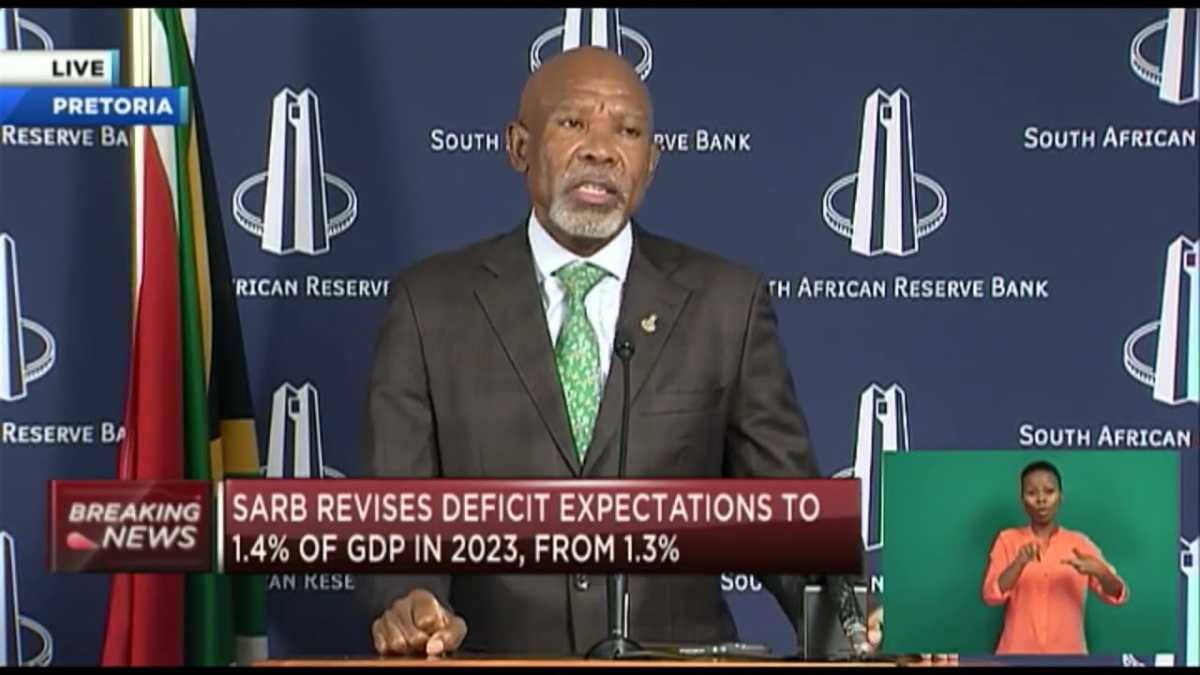

South African Reserve Bank Keeps Repo Rate Unchanged at 8.25%

The South African Reserve Bank (SARB) has announced that it will maintain the repo rate at 8.25%, according to Governor Lesetja Kganyago. The decision was made by the Monetary Policy Committee (MPC) and reflects the need to address rising inflation expectations.

Kganyago emphasized the importance of achieving a permanently lower inflation rate and interest rates and stated that inflation expectations should be anchored to the mid-point of the target rate. The current inflation rate stands at 5.1%.

Policy decisions, such as keeping the repurchase rate unchanged, are part of an effort to address serious upside risks to the inflation trajectory from global and domestic sources. The economic outlook is described as highly uncertain, and future decisions will depend on data and the balance of risks to the outlook.

The updated Quarterly Projection Model (QPM) provides a broad policy guide that may change from meeting to meeting in response to new data. Kganyago stressed the importance of guiding inflation back towards the mid-point of the target band of 3 to 6% to improve the economic outlook and reduce borrowing costs.

In addition to maintaining the repo rate, the MPC has recommended measures to strengthen economic conditions, including achieving a prudent public debt level, increasing the supply of energy, keeping administered price inflation low, and aligning real wage growth with productivity gains. These steps aim to strengthen monetary policy effectiveness and its transmission to the broader economy.

This decision by the Reserve Bank comes at a time of uncertainty and highlights the need to carefully monitor economic data and associated risks. The repo rate will remain at its current level as the bank continues to assess the impact of global and domestic factors.

Sources:

- South African Reserve Bank (SARB)

- Monetary Policy Committee (MPC)

- Reserve Bank

- Quarterly Projection Model (QPM)

- SAnews.gov.za