Health

Wisconsinites Face Higher Health Insurance Premiums Amid Congressional Gridlock

EAU CLAIRE, Wis. — Open enrollment for health insurance under the Affordable Care Act (ACA) has begun, but many Wisconsinites are facing significant increases in their premiums. This situation arises along with uncertainty regarding the renewal of enhanced federal tax credits that have helped offset costs since 2021.

Cyan Kelly, a Greater Marshfield resident with multiple sclerosis, expressed her alarm upon discovering her monthly premium had surged. “I need health insurance,” said Kelly, who works as an independent research contractor and in retail. Experts attribute the rising premiums to inflation, tariffs, and the high costs of new medications.

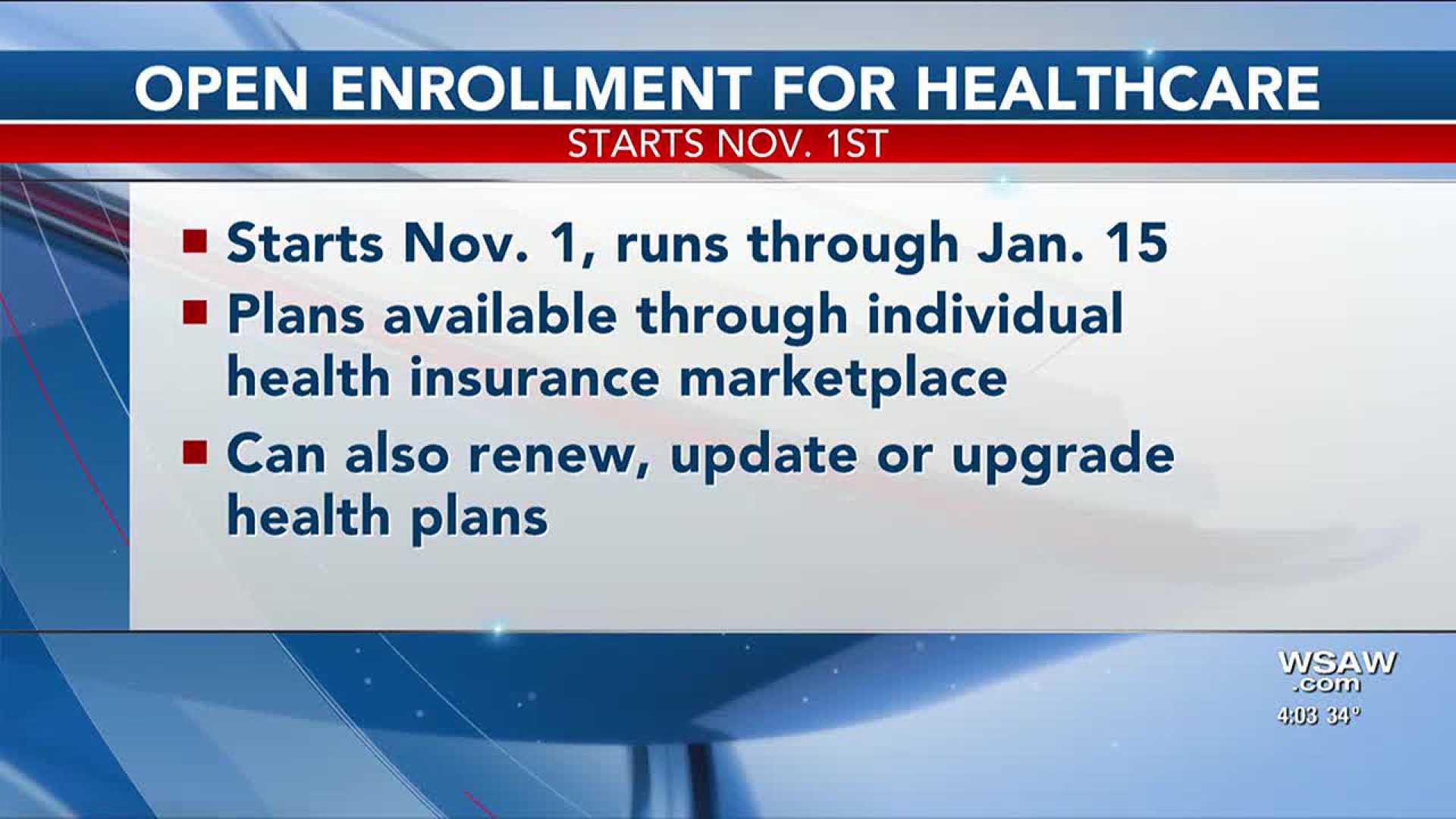

Currently, many Wisconsin residents are anxious as they navigate the open enrollment period, which runs through January 15, 2026. However, for coverage to take effect by January 1, the deadline to enroll is December 15. The uncertainty surrounding the ACA subsidies makes this period especially disconcerting.

In a press conference, Wisconsin Insurance Commissioner Nathan Houdek urged residents to explore their options. Houdek warned that if the subsidies lapse, consumers are likely to experience “sticker shock.” A report from the Kaiser Family Foundation indicates that a typical 40-year-old in Wisconsin could see their monthly premium rise by 23 percent, from $495 to $611 for the second-lowest cost silver plan.

In some instances, increases are much steeper. A Dane County family of four with an income of $130,000 may witness their premium more than double, going from $1,026 to $2,073. Furthermore, a 60-year-old couple in Eau Claire County earning $85,658 could see their premiums skyrocket from $396 to $3,103.

The potential expiration of the enhanced subsidies, initially provided as part of COVID-19 relief measures, has sparked a partisan dispute in Congress. Senate Democrats have resisted passing a short-term spending bill unless it addresses the subsidies, prompting a deadlock with Senate Republicans.

Allison Espeseth, director of Covering Wisconsin, a nonprofit organization assisting individuals with health insurance enrollment, emphasized the importance of securing coverage. “There’s a lot of risk if you don’t sign up for a plan. It’s something that most people can’t afford to go without,” she said.

Currently, about 310,000 residents qualified for enhanced tax credits in Wisconsin, which significantly impacted enrollment numbers. Espeseth advised individuals to begin shopping for plans now, mentioning the uncertainty of the process to renew the credits if Congress acts.

“What we’re encouraging people to do is go ahead and start shopping for your plan and even enroll,” she stated. Kelly, concerned about the potential expiration of the enhanced credits, remains hopeful but unsure about her next steps.

“I hope they are extended,” Kelly said. “But I don’t have anything beyond hope.”