Business

Vanguard S&P 500 ETF Drops Amid Mixed Market Sentiment

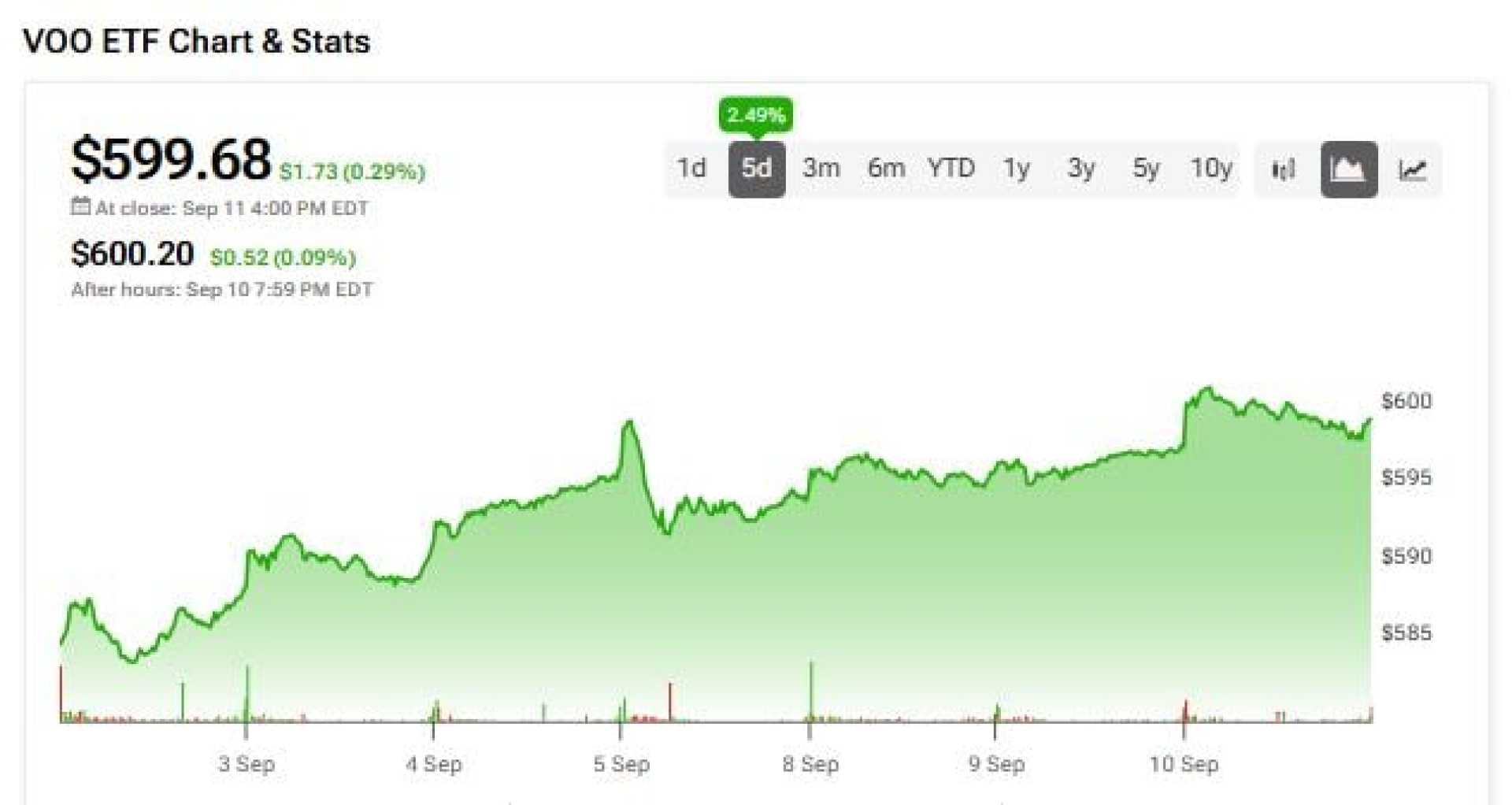

NEW YORK, NY — The Vanguard S&P 500 ETF (VOO) fell 0.94% on Monday as fears spread across the market due to weakness in key sectors. Investors are also keeping an eye on Nvidia‘s upcoming earnings report, which is expected to shed light on tech demand and the outlook for stocks in the sector.

VOO closely tracks the S&P 500 Index, which was down by 0.92%. The tech-heavy Nasdaq Composite Index also dropped, losing 0.83% on the same day. Despite these declines, VOO continues to show steady investor demand according to TipRanks data, with an analyst consensus rating of Moderate Buy.

The average price target for VOO is $794.23, representing a potential upside of 29.77%. Its holdings expected to perform well include Loews, Fiserv Inc., Norwegian Cruise Line, Oracle, and Netflix. Conversely, companies like Albemarle, Micron, Incyte, Expeditors International, and Paramount Skydance are viewed as having the greatest downside potential.

In addition to tracking performance, VOO provides dividends every quarter to shareholders. These payments vary based on dividends paid by companies in the S&P 500, reflecting changes over time.

Investors are currently reflecting on market trends as the S&P 500 approached all-time highs earlier in the month but faced pressure from global uncertainties. Caution is prevalent as they weigh the implications of interest rate policies and economic growth projections.

Overall, the recent downturn highlights ongoing complexities in the market environment as stocks navigate changes in investor sentiment and macroeconomic variables.