Business

Mortgage Rates Hit 11-Month Low, Offering Hope to Buyers

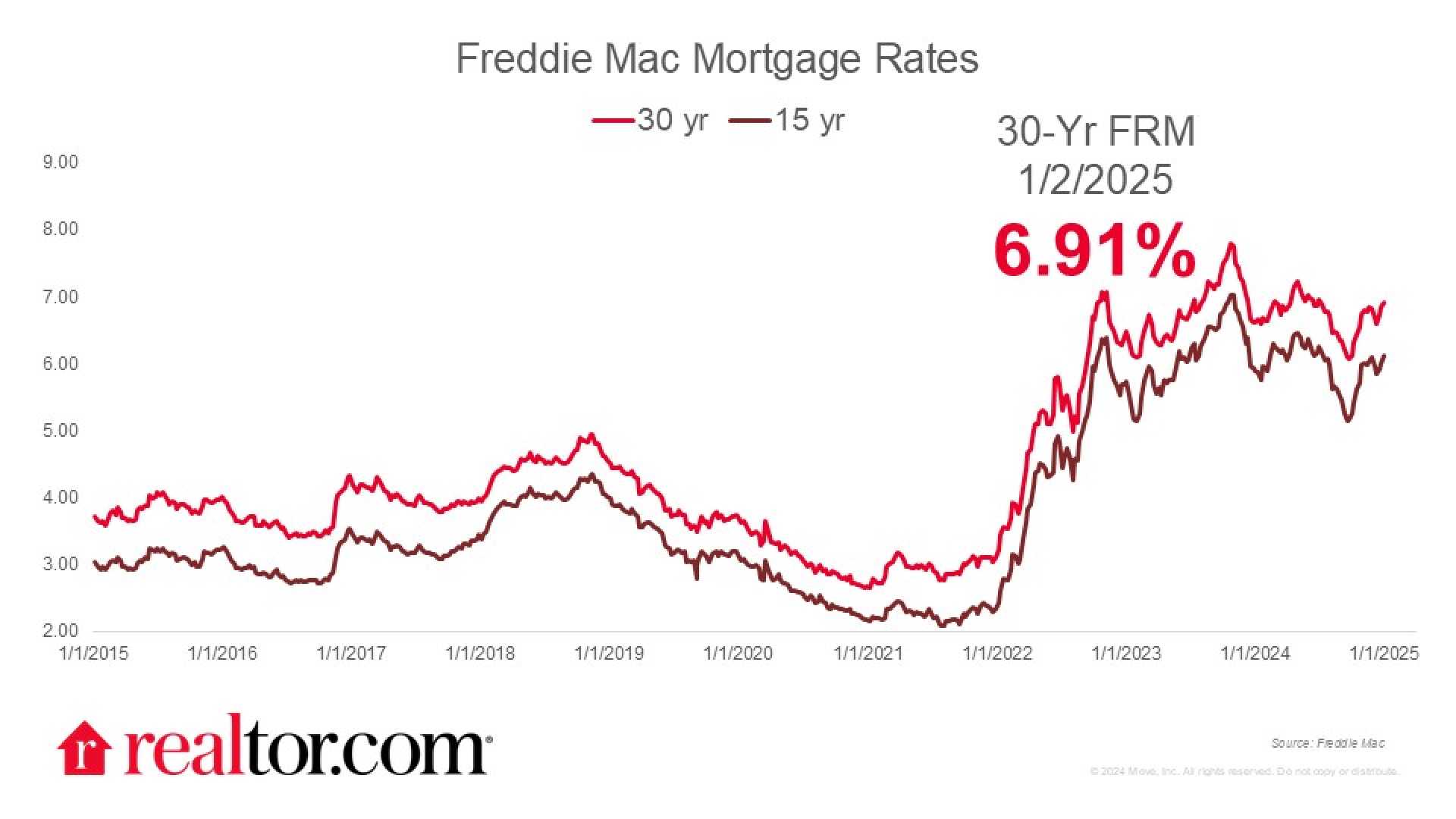

WASHINGTON, D.C. — Mortgage rates saw a significant drop this week, providing encouragement for both homebuyers and homeowners looking to refinance. The average rate on a 30-year mortgage decreased from 6.56% to 6.50%, reaching its lowest point since October 2024, according to new data released Thursday.

The 15-year mortgage rates also fell, from 5.69% to 5.60%. This trend of declining mortgage rates has been ongoing, with rates falling steadily throughout much of 2025. Analysts expect additional drops in the coming weeks due to anticipated cuts from the Federal Reserve.

“Mortgage rates continue to trend down, increasing optimism for new buyers and current owners alike,” said Sam Khater, chief economist at Freddie Mac. “As rates continue to drop, the number of homeowners who have the opportunity to refinance is expanding.”

The recent drop in rates is partially driven by speculation surrounding Federal Reserve rate cuts, which may occur during their next meeting on September 17. Historically, mortgage lenders often lower rates in advance of such cuts.

The 10-year Treasury yield also plays a crucial role in mortgage pricing. A decline in Treasury yields tends to lead to lower mortgage rates, and recent reports indicate that bond yields have cooled. These developments suggest the potential for further rate reductions.

Despite lower rates, the housing market remains affected by persistent affordability challenges. According to Hannah Jones, a senior economic research analyst, many buyers are feeling sidelined due to high prices and mortgage rates, prompting some sellers to remove their listings rather than accept lower offers.

“The market remains in stasis,” said Jones. “Inventory improvements notwithstanding, persistent cost burdens and economic uncertainty continue to suppress demand throughout the home-buying season.”

The situation is compounded by increasing financial burdens related to insurance and climate risk. Nearly 26.1% of U.S. homes value face significant environmental threats, which could deter buyers further.

As homebuyers evaluate their options, real estate experts suggest taking advantage of the current declines in mortgage rates while they last. However, reluctance among buyers is still evident, with mortgage applications seeing a slight decrease after weeks of increases. The constant changes in the economic landscape mean that both buyers and sellers need to proceed with caution and strategic planning.