Politics

Donald Trump’s Proposed Tax Rebates Spark Debate Amid Economic Changes

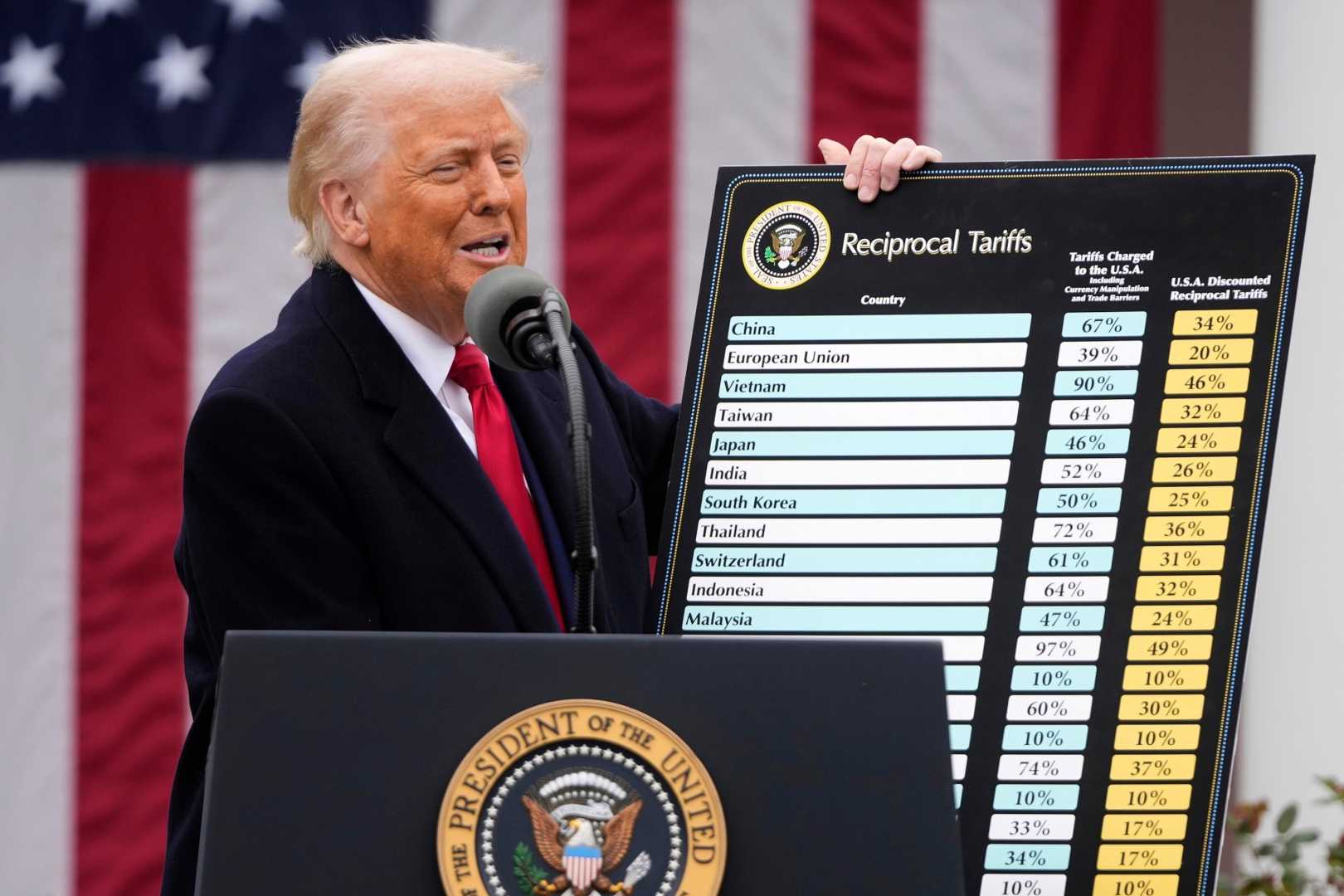

Washington, D.C. — President Donald Trump announced on July 27, 2025, that he is considering issuing rebate checks to Americans, using tariff revenue accumulated during his administration. Trump emphasized reducing the national debt, which has surpassed $36 trillion, as a crucial priority.

The president stated that the proposed rebates could target “people of a certain income level,” although he did not clarify what that threshold would be. The U.S. government has collected approximately $100 billion in tariffs this year, a figure that Treasury Secretary Scott Bessent predicts may rise to $300 billion annually.

These tariffs are levied on American importers and manufacturers. While some companies have absorbed these increased costs, inflation data indicates that these expenses are beginning to reach consumers. This move is not the first time Trump has suggested rebate payments.

In February, he proposed using 20% of savings from Elon Musk’s initiative in the Department of Government Efficiency (DOGE) for direct checks to taxpayers. This idea follows the precedent of three rounds of rebate checks issued during the COVID-19 pandemic, two during Trump’s presidency and one under President Biden.

For the rebates to be distributed, congressional approval is necessary to allow the Treasury Department to initiate payments through the tax code. Recently, a major tax and spending bill titled “One Big Beautiful Bill Act” was signed into law on July 4, but it did not include a rebate provision. However, the bill does feature new tax cuts, such as a $6,000 deduction for senior citizens, which phases out for single filers earning over $75,000.

While the notion of rebate payments is under consideration, it remains speculative and would encounter legislative hurdles.