Business

JPMorgan Predicts S&P 500 Gains Amid Economic Uncertainty

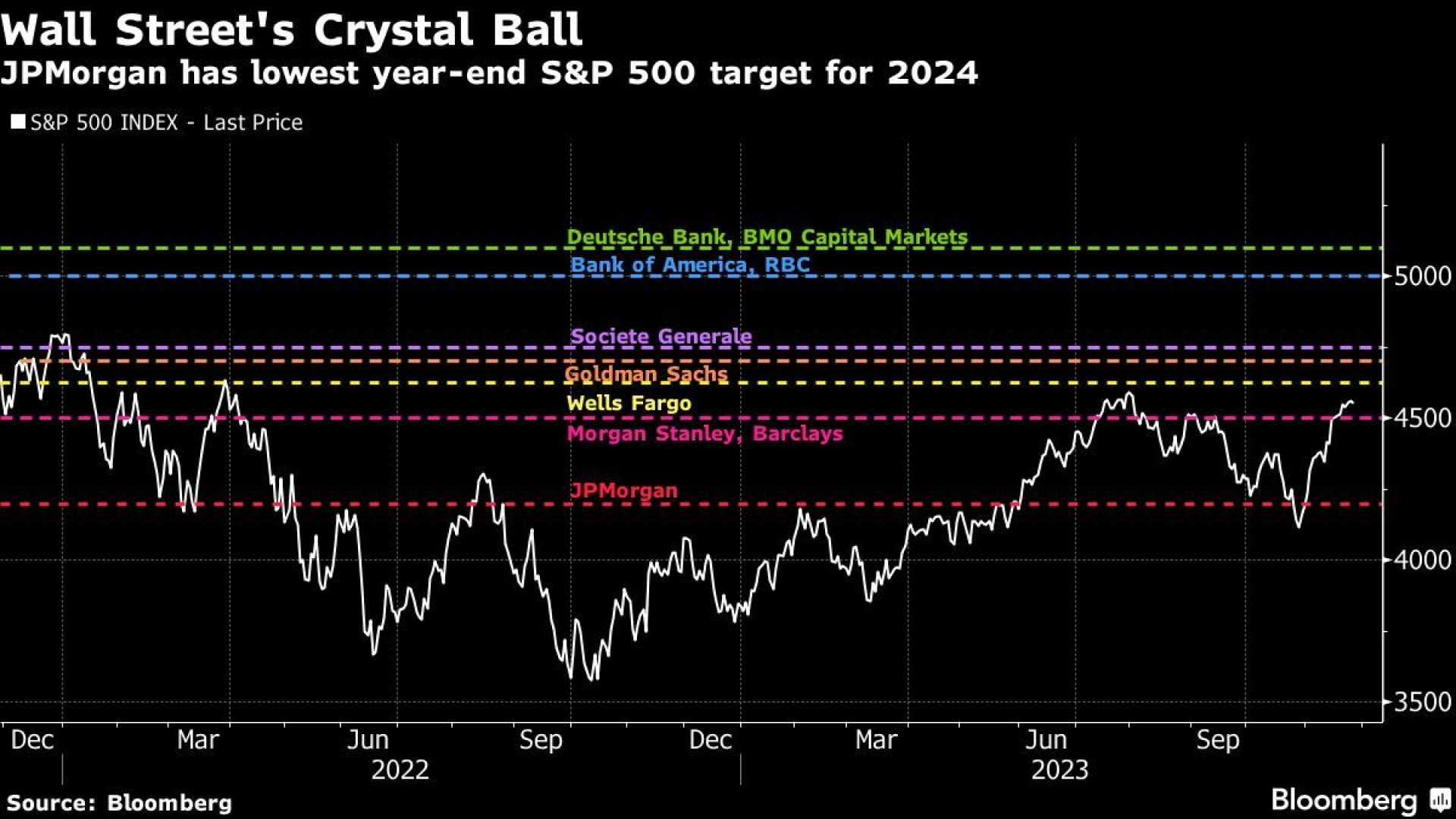

NEW YORK, NY — JPMorgan Chase has outlined a cautiously optimistic forecast for the S&P 500 index, predicting high single-digit gains over the next 12 months. This outlook is based on strong corporate earnings and favorable macroeconomic conditions, as announced on August 10, 2025.

According to the firm, more than 80% of S&P 500 companies exceeded earnings expectations, a trend that supports their positive assessment. Dubravko Lakos-Bujas, head of Global Markets Strategy, noted that the resilience in earnings and investor risk appetite are essential factors driving this forecast.

Furthermore, the forecast extends to other equity markets, particularly large-cap tech and industrial sectors, which are anticipated to thrive from ongoing economic strength. Jamie Dimon, CEO of JPMorgan, expressed confidence in the U.S. economy, describing it as “resilient” in light of changing market conditions.

Analysts have raised their earnings forecasts for the S&P 500, now predicting an 11.8% increase in 2025 and a further 13.9% rise in 2026. This comes as the S&P 500 enjoyed a 2.4% gain for the week ending August 10, 2025.

Despite the bright outlook, JPMorgan warns of potential risks. The bank has assigned a 40% probability of a U.S. recession occurring in the latter half of 2025, reflecting macroeconomic uncertainties and possible policy challenges.

The current forecast for economic growth in 2025 has adjusted to 9.6%, down from an earlier projection of 14% in January. This shift indicates a more cautious approach by analysts and investors as they adapt to the evolving economic landscape.

Historically, significant earnings reports have often preceded substantial market rallies, as noted in 2017 and 2020. However, JPMorgan’s current insights focus on traditional financial markets and do not include recommendations for cryptocurrency or alternative investments.

As the S&P 500 continues to gather momentum, investors are looking for further signs of economic stability and strong corporate performance. JPMorgan’s projections may serve as a guiding point for future evaluations, while also highlighting the volatility that often accompanies such optimism.