Business

Tilray Brands Gains Momentum Amid Regulatory Change and Partnerships

New York, NY — Tilray Brands (NasdaqGS:TLRY) is gaining attention from investors as discussions about potential reclassification of marijuana to Schedule III gain traction in Washington. The shift could significantly impact the U.S. cannabis industry.

On August 23, 2025, news broke that Tilray is collaborating with Italian pharmaceutical group Molteni to expand its medical cannabis offerings in Europe. This partnership is drawing interest amid a backdrop of evolving regulations.

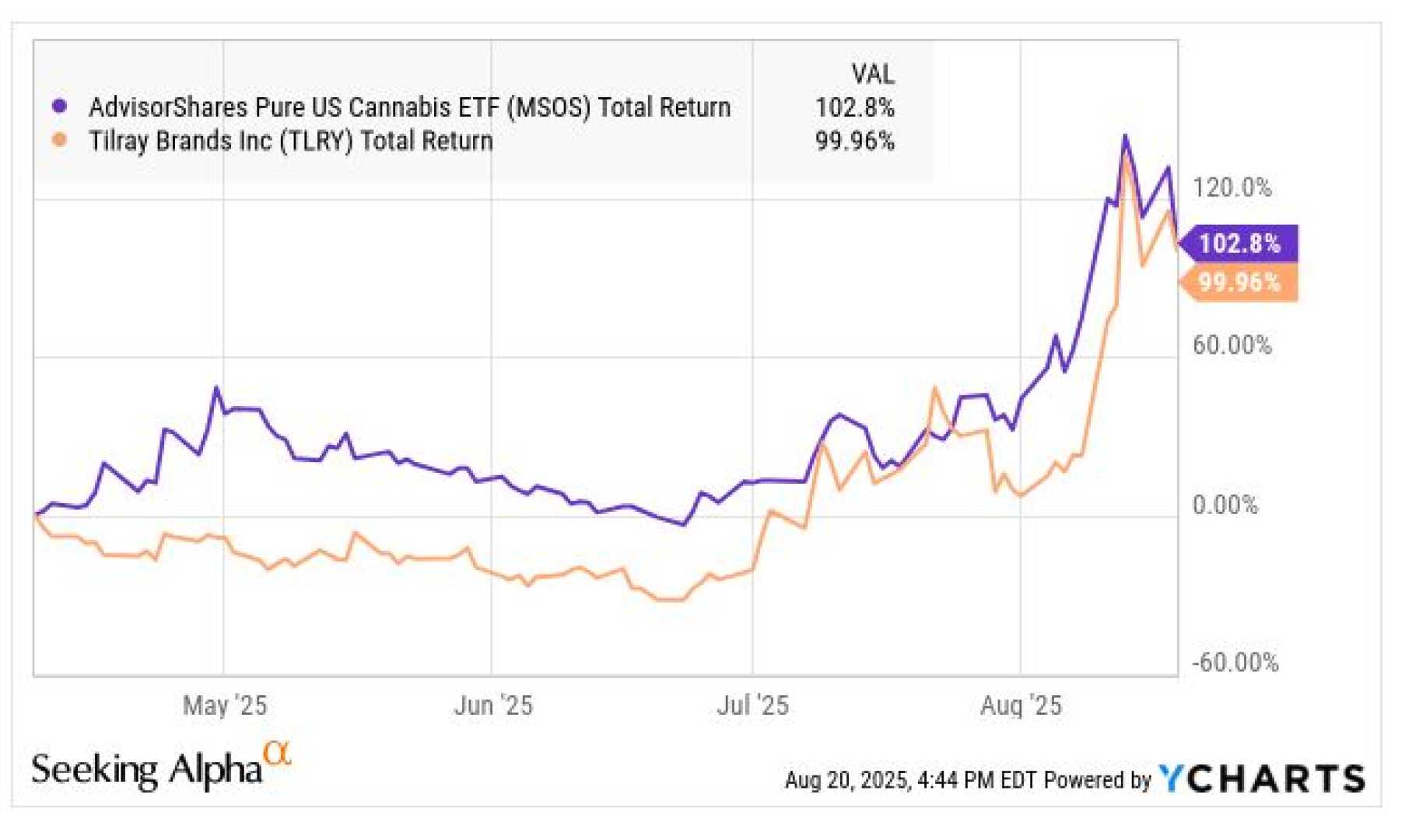

Despite its recent volatility, Tilray’s stock has surged 37% in the last week and increased 160% over the past three months. This turnaround follows a year of declines, leading many to question whether the company’s stock is currently undervalued.

Financial analysts suggest that the current share price may be based on optimistic assumptions about future growth, particularly in wellness and plant-based products. They cite sustained innovation and a focus on consumer trends as key factors that could drive revenue.

“Sustained innovation and consumer focus in wellness, energy drinks, non-alcoholic beverages, and hemp-based foods positions Tilray to capture the surge in demand,” stated a market analyst. However, some voices within the industry argue that the stock may be overvalued compared to its future earnings.

The consensus fair value estimate puts Tilray’s stock at $0.93, indicating it is currently overvalued. Analysts warn that slow U.S. legalization and rising competition in Canada could challenge Tilray’s long-term prospects.

While some analysts see an attractive price-to-sales ratio compared to the industry, others argue the discounted cash flow model indicates a disconnect between Tilray’s market pricing and its actual value creation potential.

Simply Wall St, which provides daily discounted cash flow analysis, continues to track Tilray’s stock performance and potential investment opportunities. As trends evolve, investors are encouraged to conduct thorough research to form their perspectives on the stock.

This article is for informational purposes only and does not constitute financial advice. Readers should consider their own financial situations before making investment decisions.