Business

Experts Say Sub-6% Mortgage Rates Needed to Revive Housing Market

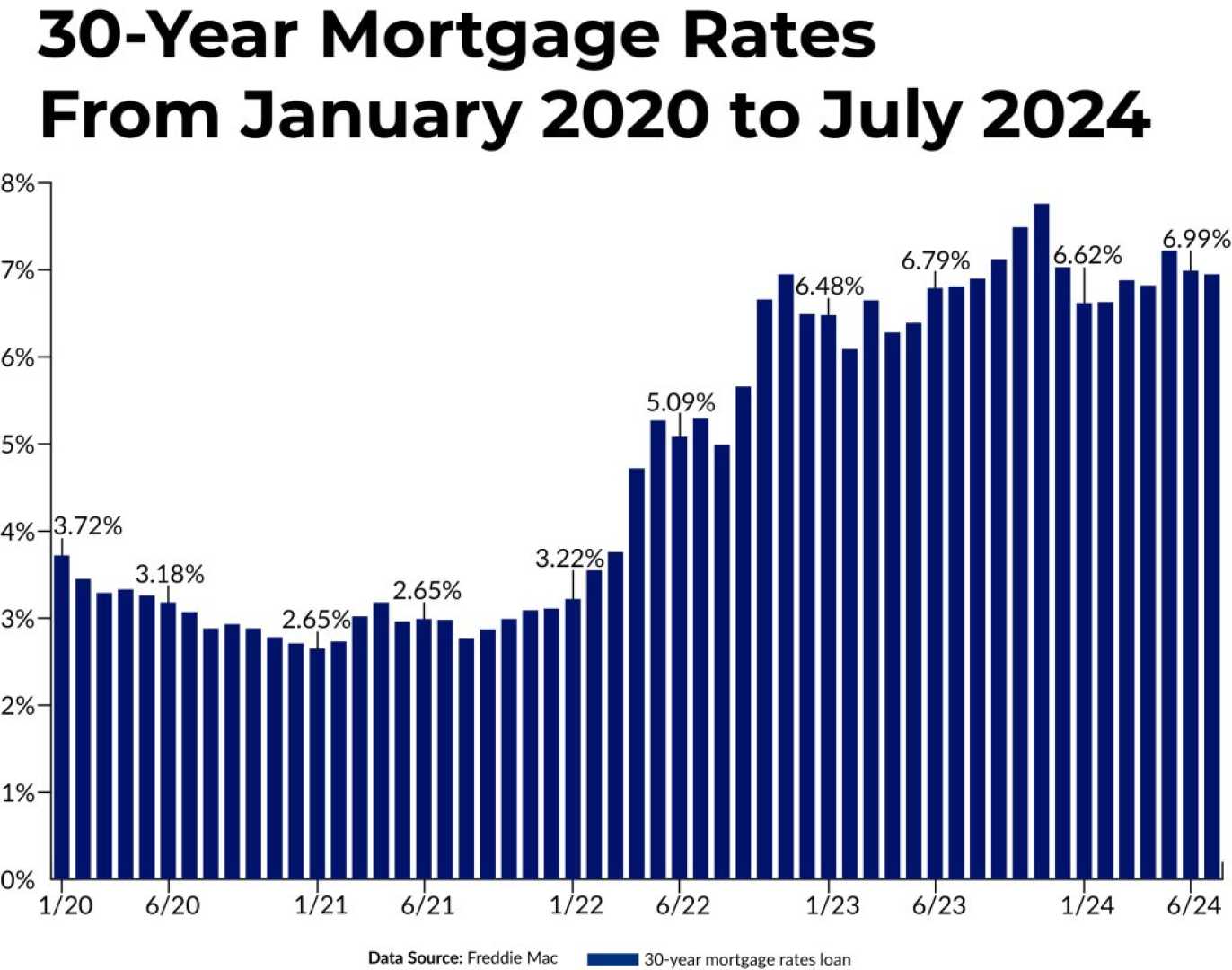

Washington, D.C. — Economists from the National Association of Realtors (NAR) have indicated that the housing market requires mortgage rates to fall below 6% to see a significant revival. As of now, a 30-year fixed-rate mortgage at 6% would make homes affordable for an estimated 5.5 million more households, NAR shared during the Real Estate Forecast Summit on July 16.

“If rates were to hit that magic number, it’s likely that about 10%, or 550,000, of those additional households would buy a home over the next 12 or 18 months,” said NAR in a statement. However, experts do not foresee rates reaching this level until next year.

According to mortgage forecasts, rates are predicted to remain at 6% or higher for the near future. National housing expert Jonathan Miller, CEO of a prominent appraisal firm, stated that, even with expectations of rate cuts from Wall Street analysts later this year, mortgage rates are unlikely to decrease significantly.

“There’s just a lot of concern and uncertainty about the economy and the impact of tariffs,” Miller explained. Banks typically hesitate to reduce rates in volatile economic climates, where loan funding carries greater risk.

NAR’s deputy chief economist, Jessica Lautz, urges buyers not to postpone mortgage applications for years. “It’s actually a really good moment for homebuyers when rates are flat,” Lautz noted. She added that stagnant rates could lead to reduced competition in the housing market.

Lautz elaborated that while interest rates may be historically high, they have remained relatively stable, hovering around the mid-6% range since January. This stability allows buyers to plan the homebuying process with less pressure.

In preparation for a potential home purchase, Lautz advises potential buyers to use this period to improve their credit scores and save for down payments. She emphasized, “There are so many factors that go into what someone is paying every month for their mortgage,” including credit scores and debt-to-income ratios.

Despite predictions that mortgage rates could decline in 2026, the ongoing housing shortage suggests that home prices may not decrease. The actual cost of properties could be influenced by various factors beyond mortgage rates alone.