Business

Firefly Aerospace Launches into Stock Market After Successful Moon Landing

AUSTIN, Texas — Firefly Aerospace, the first private company to successfully land on the moon, is set to begin trading publicly on Nasdaq under the ticker symbol “FLY” this Thursday morning.

The company, founded in 2017 by former SpaceX engineer Tom Markusic, has achieved a valuation exceeding $6 billion in its initial public offering. This valuation is triple the amount reached when it was a private entity, according to estimates from Pitchbook.

Firefly raised over $868 million, with shares priced at $45 each. Much of this capital will aid in the company’s ambitious plans, including landing the first U.S. spacecraft on the moon’s far side by 2026, alongside developing mid-size rockets and a spacecraft for satellite maintenance.

“There’s so much demand right now from national security and space exploration and commercial customers that we want to supercharge and accelerate that growth by ramping up our production lines even faster,” Firefly CEO Jason Kim told CNN.

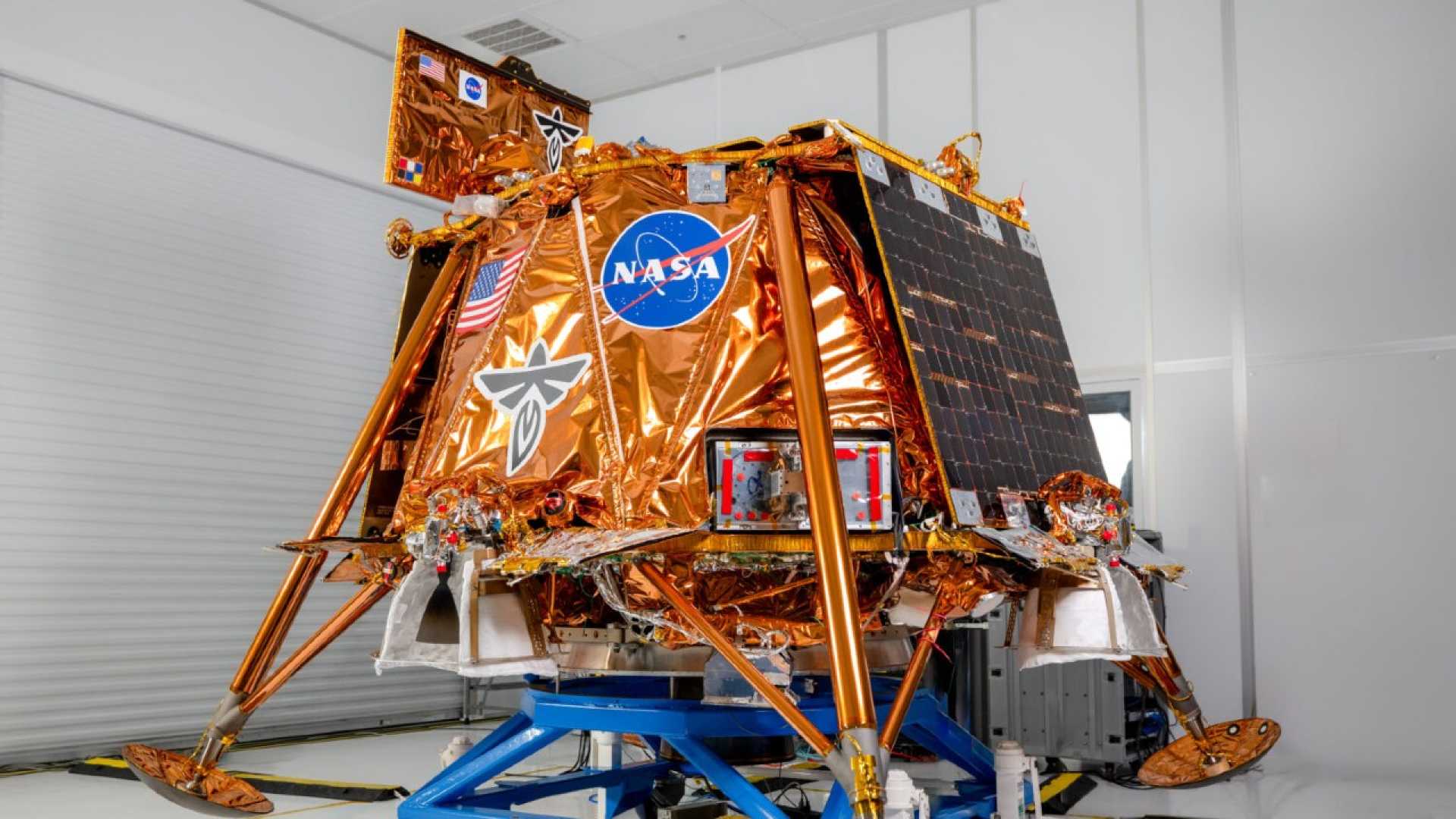

The IPO follows the success of Firefly’s Blue Ghost lunar lander, which completed a successful mission on behalf of NASA in March. The company’s upcoming mission will aim to reach the far side of the moon, a region only China has successfully explored.

Kim remarked that the timing of the IPO is favorable, noting, “This is kind of a time when all the planets are aligned.” Investors are currently receptive to initial public offerings after the company’s recent lunar landing success.

Firefly also has exciting developments, including its Alpha rocket, which has been in operation since 2021, and a larger model co-developed with Northrop Grumman, called Eclipse. The company plans to introduce its “space-tug” Elytra, which can assist satellites in orbit, later this year.

According to investment expert Andrew Chanin, the interest in Firefly’s stock may stem from a desire among some satellite manufacturers to diversify away from SpaceX due to geopolitical tensions. Chanin added, “Being able to bring in cash and build out what they’re working on is something they can take advantage of by raising capital now.”

Kim confirmed that transparency would be a priority for the company to foster investor trust. “This company is always open and transparent, even through successes and anomalies. I think that’s really helped us gain a lot of support and advocacy from the public,” he said.