Politics

Potential Employer National Insurance Levy Considered Amid Budget Preparations

Officials from the UK Treasury are reportedly examining the feasibility of imposing a levy on employer pension contributions, a move that financial experts suggest could potentially generate as much as £17 billion for the exchequer. This consideration comes as part of efforts to raise revenue in the upcoming budget, set for October 30. Labour’s commitment to protecting working families from tax hikes appears to exempt this proposed levy, which would fall on businesses rather than individuals.

According to sources within the Treasury, the levy remains a potential policy under review. Reflecting on Labour’s manifesto, senior officials have indicated that the tax lock applying to national insurance, VAT, and income tax pertains specifically to working people, and not businesses. “The commitments in the manifesto were clear and about protecting the incomes of working people,” stated a Treasury source.

Steve Webb, a former Liberal Democrat pensions minister and currently a consultant at Lane Clark & Peacock, endorsed the idea, describing it as politically less contentious. “It’s a tax on employers, and although the money is coming from somewhere, it’s much less immediately obvious to voters what you’ve done,” Webb explained. “It’s got a lot of attractions and could be implemented gradually.”

The Institute for Fiscal Studies (IFS) supports the notion, noting that applying employer NICs at a full rate of 13.8% on pension contributions could yield approximately £17 billion annually. IFS suggests that under the current system, substantial tax breaks are undeservedly extended to those with significant pensions and retirement incomes.

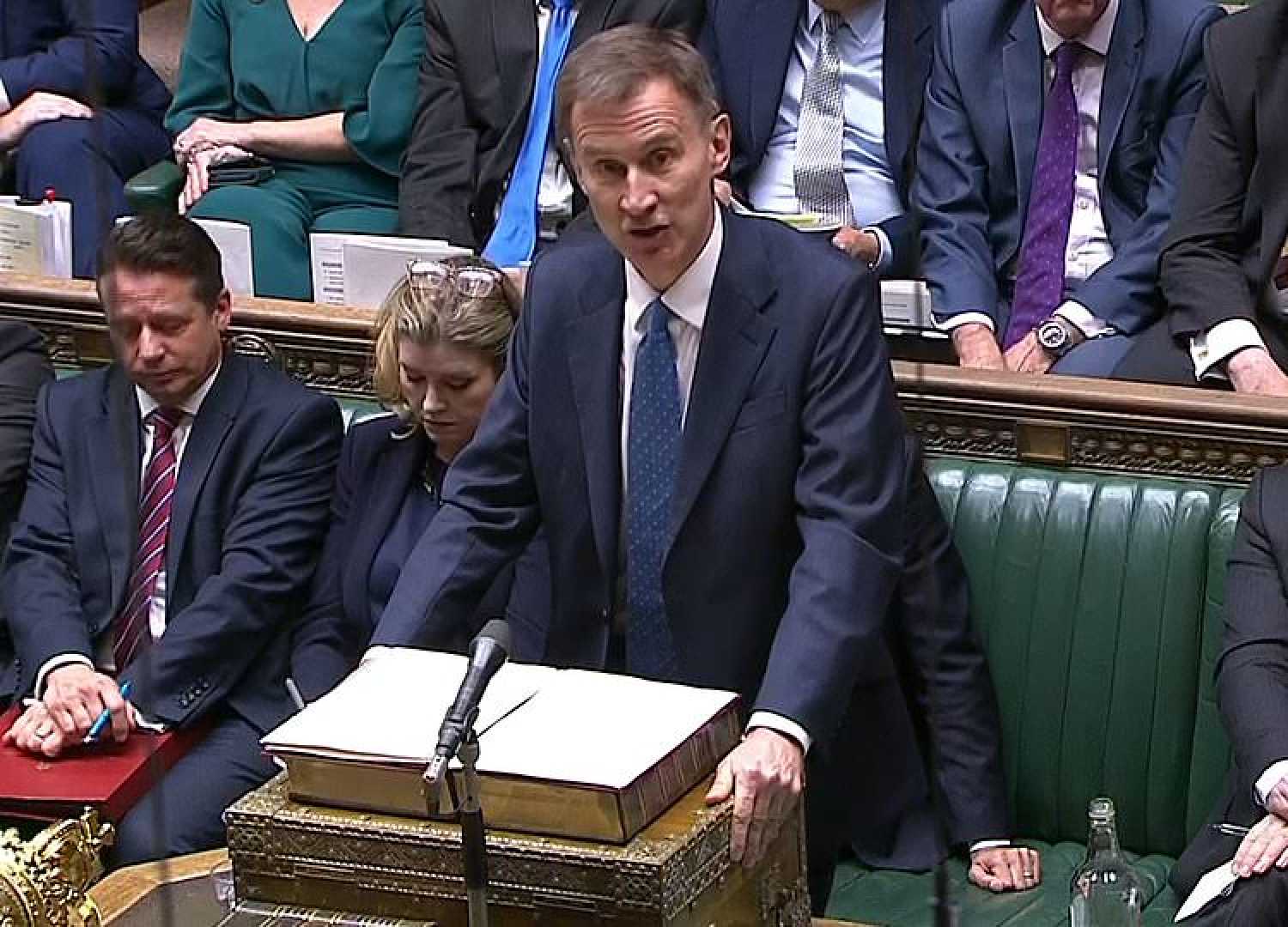

Despite these arguments, Labour leader Keir Starmer has faced scrutiny over maintaining or altering the pledge concerning employers’ national insurance contributions. During a Commons session, Starmer was pressed by Prime Minister Rishi Sunak, who argued, “It is clear he’s opened the door to raising employer national insurance contributions, including on pensions.”

A Labour spokesperson reinforced the party’s stance on taxes, emphasizing consistency with the manifesto that assures working people will not face increased national insurance, income tax, or VAT. Rachel Reeves, Labour’s shadow chancellor, confirmed the party’s intention not to raise taxes on working families or cut public services.