Business

Trump Administration to Garnish Wages of Defaulted Student Loan Borrowers

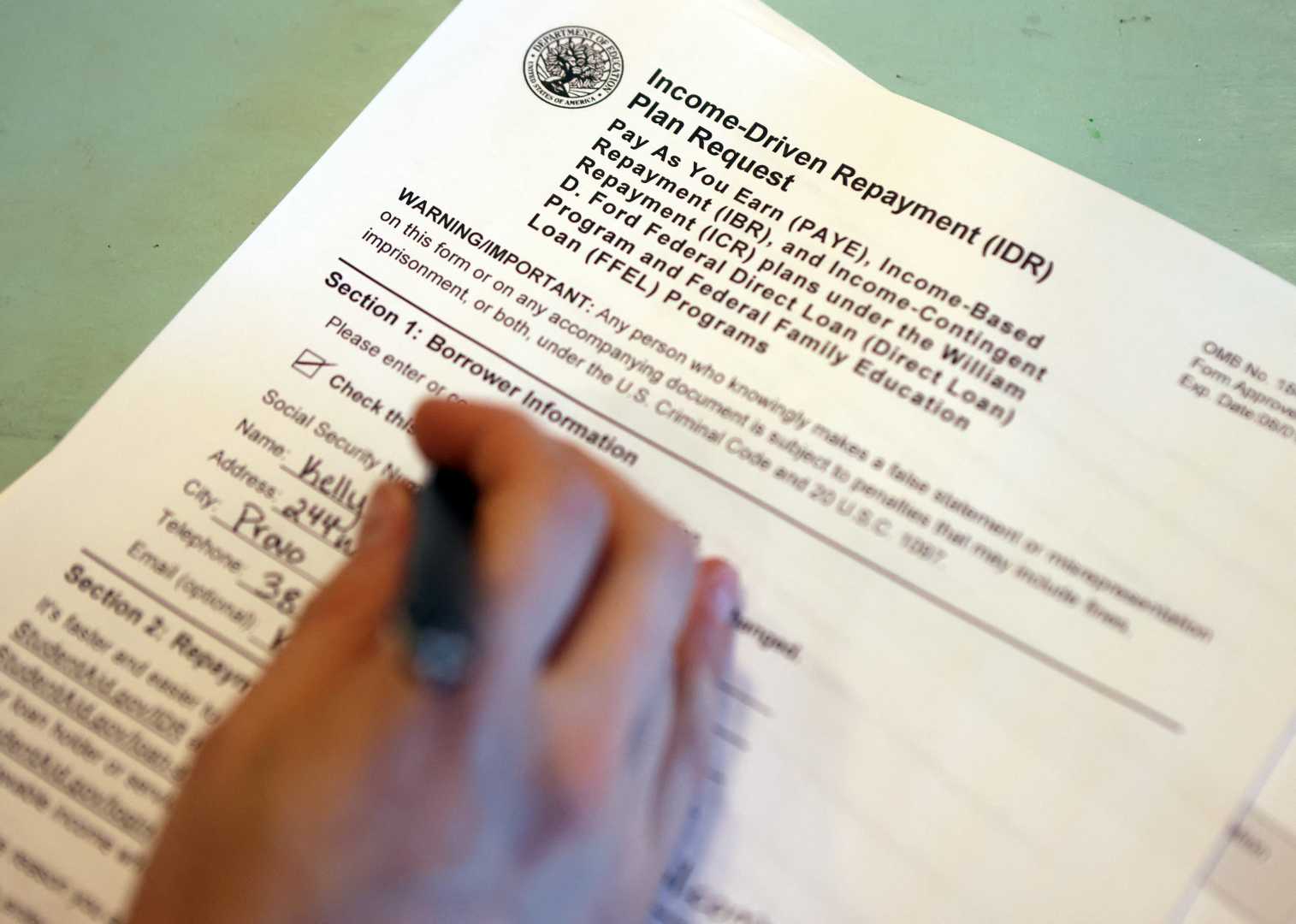

Palm Beach, Florida – The Trump administration will begin garnishing wages for student loan borrowers in default starting January 2026, the U.S. Department of Education confirmed Tuesday. This marks the first time since the onset of the COVID-19 pandemic that borrowers’ paychecks could be affected by wage garnishment.

The Department of Education expects to send out notices to around 1,000 borrowers during the week of January 7. These notices will escalate in frequency each month as the department ramps up its collections efforts. “We anticipate a significant number of borrowers will be contacted as we move further into the new year,” a department spokesperson said.

This action is part of a broader resumption of collections on defaulted federal student loans that were suspended at the start of the pandemic in 2020. The wage garnishment process authorizes the federal government to instruct non-federal employers to withhold as much as 15% of a worker’s after-tax income in order to settle outstanding student loan debts.

Currently, more than 5 million borrowers are in default, with approximately 10 million expected to default soon. The Education Department has reported a growing number of borrowers, with millions having not made payments for over 90 days.

Consumer advocates warn that this move could exacerbate financial difficulties for many borrowers already facing increased living expenses. “Garnishing wages will undoubtedly add stress to families struggling to make ends meet,” said Persis Yu, Deputy Executive Director of Protect Borrowers.

Moreover, earlier this year, the Trump administration enacted significant changes to student loan repayment options, capping the amount students can borrow for graduate studies and eliminating certain deferments. The recent modifications aim to streamline collections but critics argue they disproportionately affect low- and middle-income borrowers.

In addition, the Trump administration has also announced plans to reverse the SAVE plan, a previous student loan repayment program, further complicating borrowers’ options.

In light of the upcoming changes, the Department of Education encourages borrowers facing financial hardship to reach out and explore their repayment options, including potential bankruptcy discharge.