Business

KeyBanc Reiterates $575 Target on Microsoft Stock Amid Azure Growth

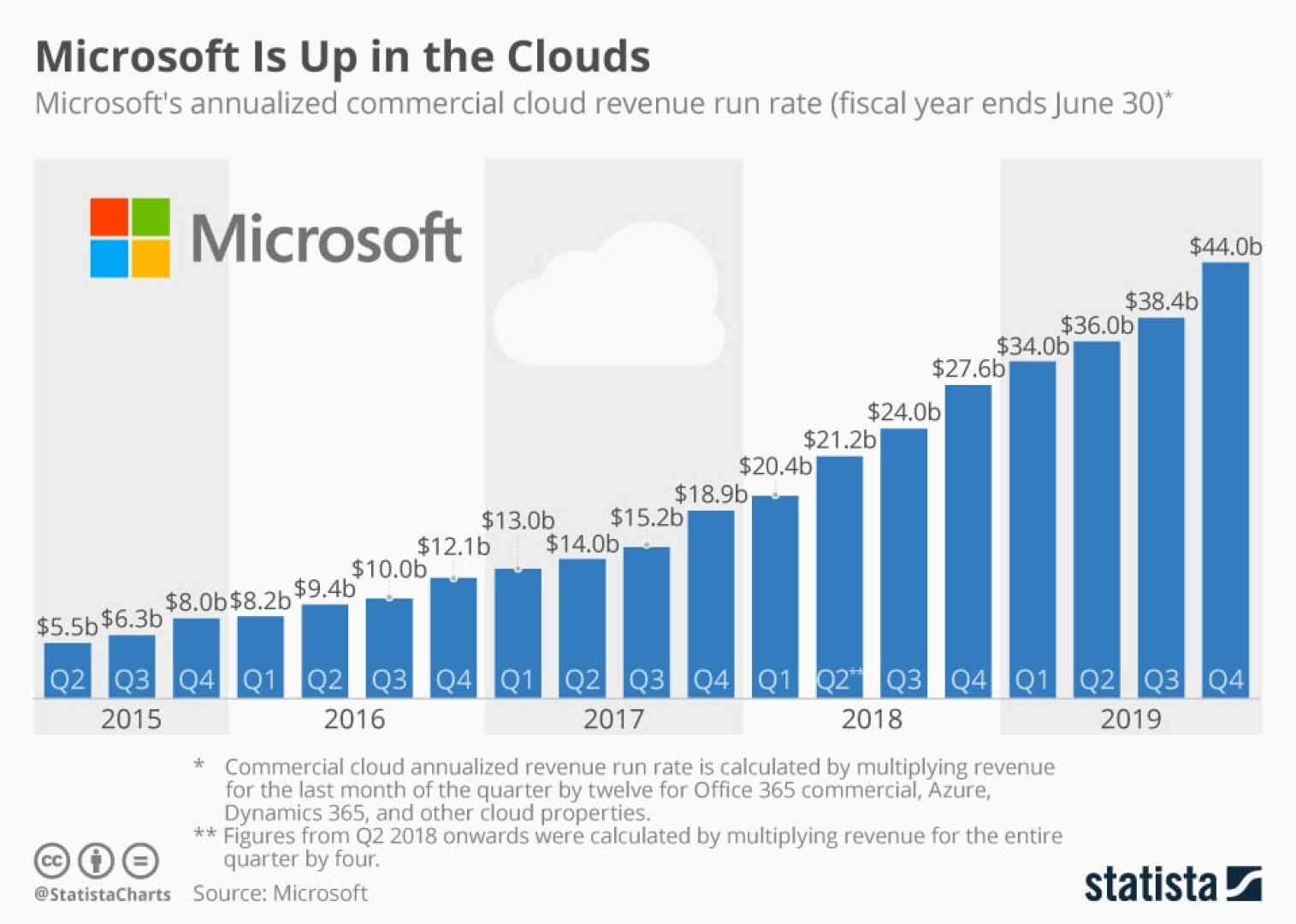

REDMOND, Wash. — KeyBanc Capital Markets reaffirmed its Overweight rating on Microsoft Corporation (NASDAQ: MSFT) with a $575 price target, citing robust growth in the company’s Azure cloud computing platform. The tech giant, valued at $3.32 trillion, continues to demonstrate strong financial health, with low price volatility and impressive profitability metrics.

In its latest analysis, KeyBanc highlighted a 17.3% sequential increase in Azure instances during the December quarter, marking a 28.0% year-on-year rise. This growth, driven by increased CPU usage, represents multi-year highs for Microsoft’s cloud services. The surge is attributed to the launch of Microsoft’s Azure CPUs, which contributed 2.5% to sequential growth and 2.8% to year-on-year growth. Intel and AMD CPUs also played significant roles, collectively accounting for 99.8% of instance growth in the quarter.

KeyBanc’s report emphasized that the growth in Azure instances is primarily driven by CPU-based services, suggesting that AI-related capacity constraints remain unresolved. While GPU availability for advanced applications is still limited, the firm remains optimistic about non-AI Azure revenue, projecting a $250 million increase over consensus estimates for the second fiscal quarter of 2025.

Microsoft’s overall revenue growth of 16.44% over the past year underscores its dominant position in the tech industry. The company’s upcoming earnings report, scheduled for release in five days, is expected to provide further insights into its financial health and growth prospects.

In related developments, Microsoft is poised to benefit from the Stargate Project, a $500 billion initiative aimed at expanding AI infrastructure in the U.S. Additionally, a $100 billion joint venture involving SoftBank, OpenAI, and Oracle Corp. seeks to fund AI infrastructure, with Microsoft and Nvidia providing technological support.

Despite these advancements, challenges remain. UBS analysts noted limited immediate upside for Azure, while Kopin Corp. has expressed interest in the U.S. Army’s recompetition process for Microsoft’s Integrated Visual Augmentation System (IVAS) production contract. Meanwhile, Microsoft announced the resignation of Christopher D. Young, Executive Vice President of Business Development, Strategy, and Ventures, though no immediate changes to the executive team or business strategy are expected.