Business

Tech Sector Rebounds With Standing Giants: Nvidia, TSMC, and Netflix

New York, NY — Following a tumultuous April stock market sell-off, the tech sector has rebounded remarkably. As of June 30, the Nasdaq Composite has transitioned back into a bull market, reaching record highs and signaling renewed investor confidence.

Leading the charge is Nvidia, the largest company by market capitalization at $552 billion. Nvidia has seen a staggering 628% increase in revenue since the launch of ChatGPT on November 22, 2022, with recent earnings showing $44.1 billion. While some analysts warn of potential overvaluation, Nvidia’s financial performance continues to attract attention and investment.

Nevertheless, some industry giants, including Alphabet and Amazon, have started developing their own AI chips, reducing their dependence on Nvidia’s products. Despite this competition, Nvidia’s GPUs remain essential, and the company is expanding globally, including plans to build AI data centers in Saudi Arabia.

Meanwhile, Taiwan Semiconductor Manufacturing Company (TSMC), which holds a 68% share of the global foundry market, also boasts a robust position. TSMC manufactures chips for major clients such as Apple and Sony, and its revenue for Q1 2025 climbed to $25.5 billion, marking a 35% increase year over year. Currently, TSMC’s forward P/E ratio stands at 24, making it a compelling investment for those interested in the semiconductor industry.

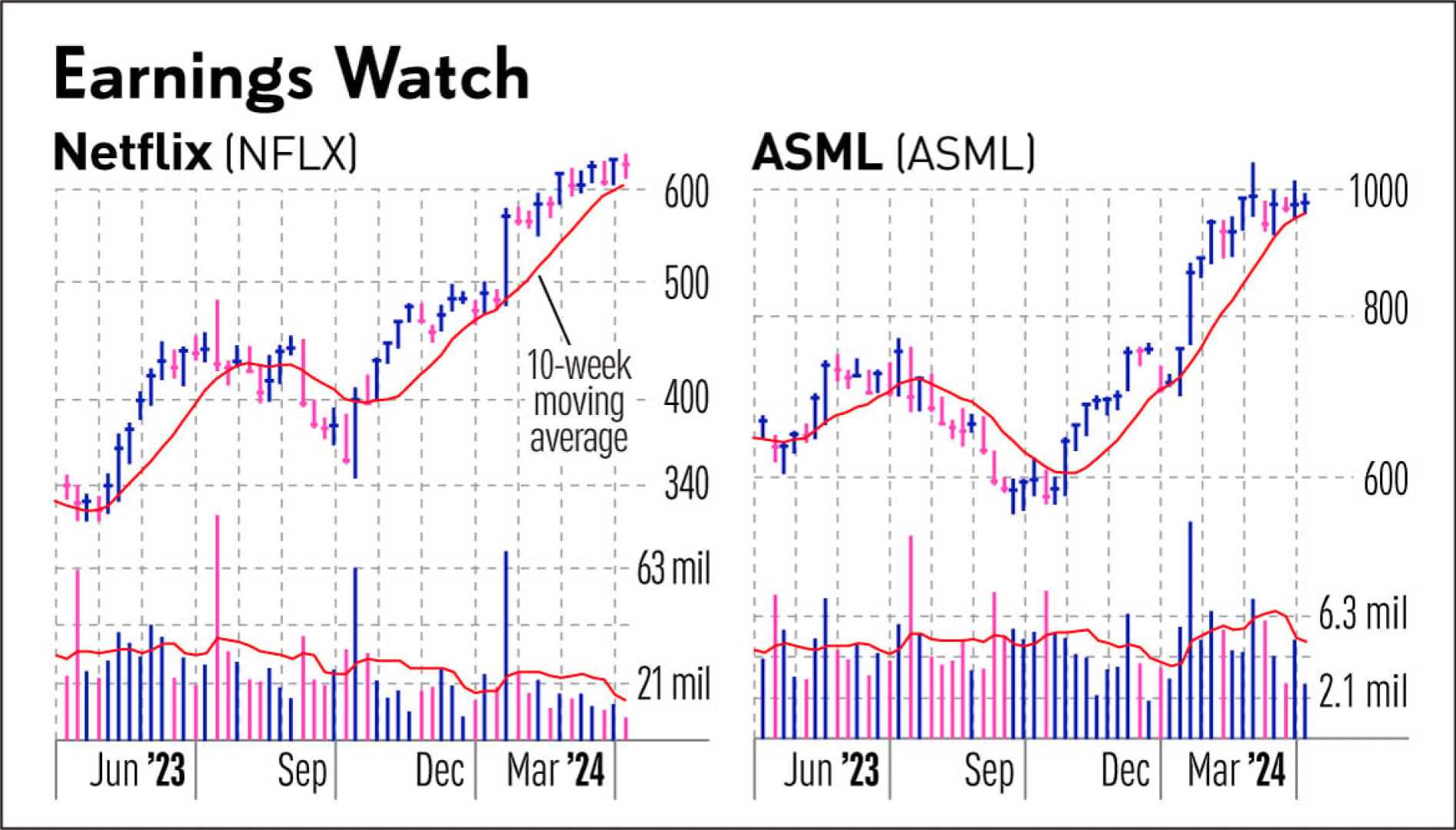

Netflix has maintained its lead in the streaming sector with 301.6 million subscribers, significantly outpacing its competitors. The company’s shift to ad-supported plans initiated in 2022 has resulted in a surge of 94 million active users on these plans, boosting revenue by 13% and operating income by 27% year over year. Although Netflix trades at a high forward P/E ratio of 52.2, its expanding ad revenue, projected to reach $2 billion this year, suggests solid growth potential.

Investors looking to enhance their portfolios with tech stocks may consider these three companies—Nvidia, TSMC, and Netflix—as they continue to navigate and dominate their respective sectors.