Business

Chevron Releases First-Quarter 2025 Earnings Amid Oil Market Challenges

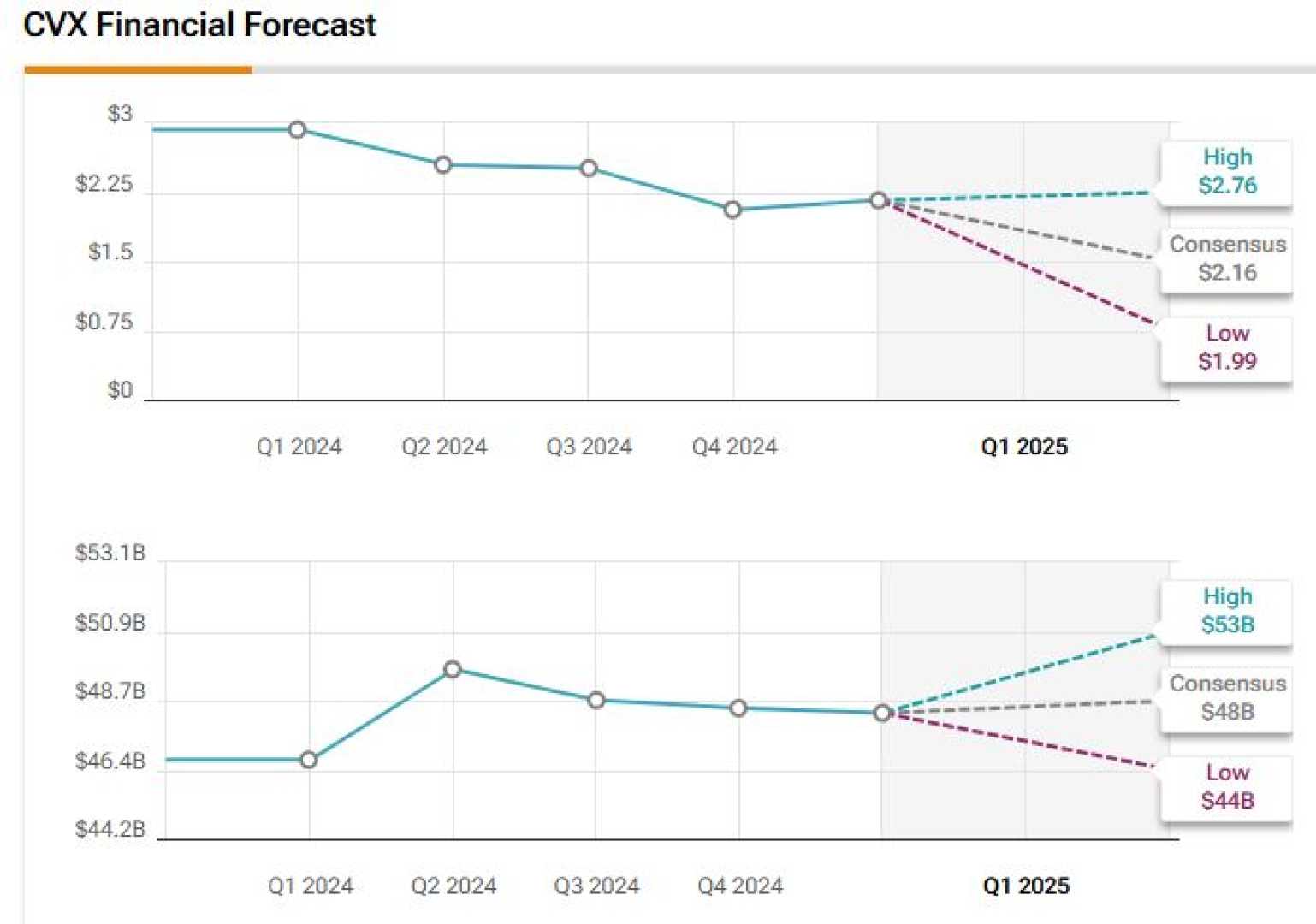

HOUSTON, Texas — Chevron Corporation announced its first-quarter 2025 earnings last Friday, revealing adjusted earnings of $2.18 per share. This figure exceeded analyst expectations but marked a 26% decline compared to the same period last year. Revenue also fell by 2.3% year-over-year to $47.6 billion, missing estimates for the quarter.

The earnings report elicited a tepid reaction from investors, as they grapple with mixed signals regarding Chevron’s financial performance, valuation, and the overall macroeconomic environment. Currently, Chevron’s stock is trading just above $135, sitting close to its 52-week low of $132.04. Over the last three years, the company’s shares have dropped around 15%, in contrast to ExxonMobil, which has seen a 24% rise.

While Chevron’s earnings beat expectations, the overall quality of these results is under scrutiny. The stronger performance can be attributed to unexpectedly high U.S. natural gas production, although oil margins and refining results lagged behind. Upstream earnings fell by 28.3% year-over-year, mainly due to lower oil prices and stagnant production levels. In the downstream segment, profits plummeted nearly 60% due to diminished margins.

Chevron reported a free cash flow of $1.3 billion, significantly less than the previous year, yet it returned $6.9 billion to shareholders through dividends and stock buybacks. The company has reduced its second-quarter buyback targets to $2.5-$3 billion, down from $3.9 billion in the first quarter, reflecting a cautious approach to the unpredictable commodity market.

Despite these challenges, Chevron maintains a high-quality asset base, benefiting from operations in the Permian Basin, where about 80% of its acreage has low or no royalty obligations. This factor supports both production efficiency and long-term returns. Chevron’s ongoing capital discipline is noteworthy; it allocated just $3.9 billion in capital expenditures for the first quarter while also implementing a $2-$3 billion cost reduction initiative through 2026.

The stock’s near-term outlook is further complicated by a pending $53 billion acquisition of Hess Corporation, which includes a 30% stake in the Stabroek block offshore Guyana. Complications arise as ExxonMobil and its partner CNOOC have initiated arbitration claims regarding their right of first refusal on the acquisition. The outcome of these proceedings, with hearings scheduled for late May, could dictate the future of Chevron’s growth strategy.

Chevron’s management insists the company can still deliver growth without the Hess acquisition, but the pending deal introduces uncertainty for investors. This challenge comes amid falling oil prices driven by global trade tensions and potential demand weaknesses. Over the past week, consensus earnings estimates for Chevron in both 2025 and 2026 have declined, signaling reduced confidence in the company’s prospects.

Despite these hurdles, Chevron’s valuation may offer some respite, trading at an EV/EBITDA multiple of 5.83, which remains attractive when compared to ExxonMobil and past averages. The company continues to uphold a solid dividend yield of 5%, boasting 38 consecutive years of dividend growth.

Chevron’s performance in the first quarter illustrates its capabilities while also highlighting significant challenges ahead. The company’s strong balance sheet and disciplined approach to capital management position it well, but the ongoing obstacles from declining oil prices and pending legal matters necessitate close monitoring by investors.