Business

IMF Downgrades US Growth Forecast Amid Ongoing Tariff Concerns

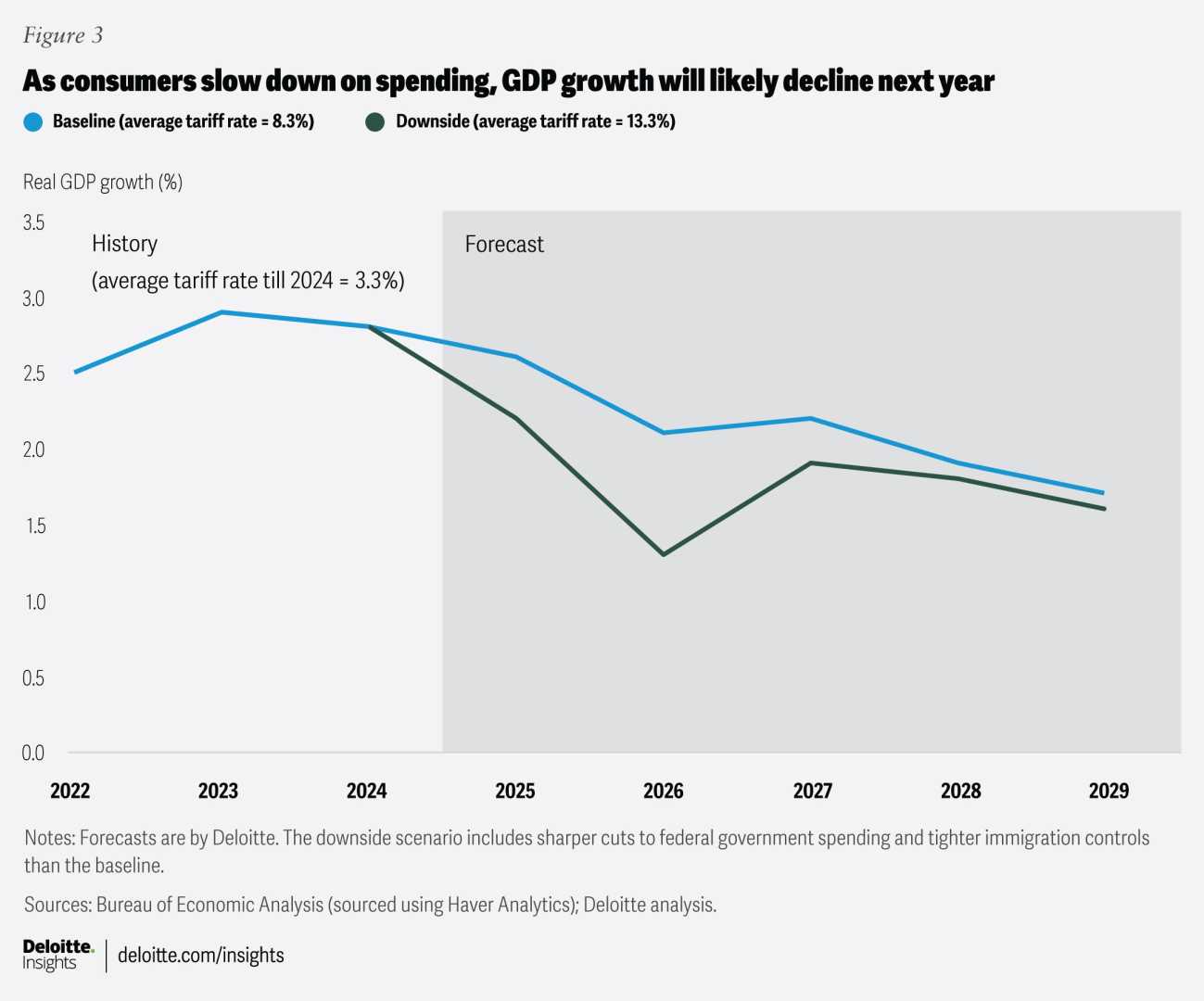

Washington, D.C. — The International Monetary Fund (IMF) has announced a significant downgrade in the United States’ economic growth forecast, primarily due to the ongoing impact of President Donald Trump’s tariffs. The IMF predicts that the U.S. economy will grow by 1.8% this year, a sharp decrease from its earlier projection of 2.7%.

The IMF warned that heightened uncertainty in global markets could lead to what it describes as a “significant slowdown.” The organization also placed the chances of a recession in the U.S. at 40%, marking the largest downgrade among advanced economies.

The tariff situation has rippled through to other nations, leading to reduced growth expectations for Canada, Japan, the United Kingdom, Germany, France, and Italy. However, the White House remained silent on the IMF’s grim outlook, with Press Secretary Karoline Leavitt focusing instead on ongoing trade discussions. “We have 18 proposals for trade deals on the table,” Leavitt stated.

American citizens are divided regarding the tariffs’ impact. Retailer Marc Bowker, who owns Alter Ego Comics in Lima, Ohio, expressed concern over rising costs. Bowker noted that he has received “tariff emails” from manufacturers indicating price increases between 14% and 35%. “Small retailers like me can’t absorb all of these tariff fees. At the end of the day, the tariff is a consumer tax,” Bowker said.

Adding further to the economic strain, electric car manufacturer Tesla reported a drop in revenue, falling short of its targets by approximately $2 billion. Tesla CEO Elon Musk has been critical of the tariffs, stating, “The cost impact of the levies is not trivial,” as he calls for zero tariffs between the U.S. and Europe.

Meanwhile, Treasury Secretary Scott Bessent emphasized the importance of maintaining trade relations with China, noting that negotiations have not yet commenced. Bessent commented, “No one thinks the current status quo is sustainable,” in reference to U.S.-China tariffs. He expressed optimism over potential future agreements that might rebalance trade.

As the markets closed for the day, major indexes saw an uptick, partly fueled by optimism around trade discussions and the absence of immediate threats to Federal Reserve Chair Jerome Powell’s leadership. This turn comes amidst ongoing tariffs issues impacting various sectors and consumer prices, which remain a focal point in the economic landscape.