Business

US Jobless Claims Decline as Markets Await Inflation Data

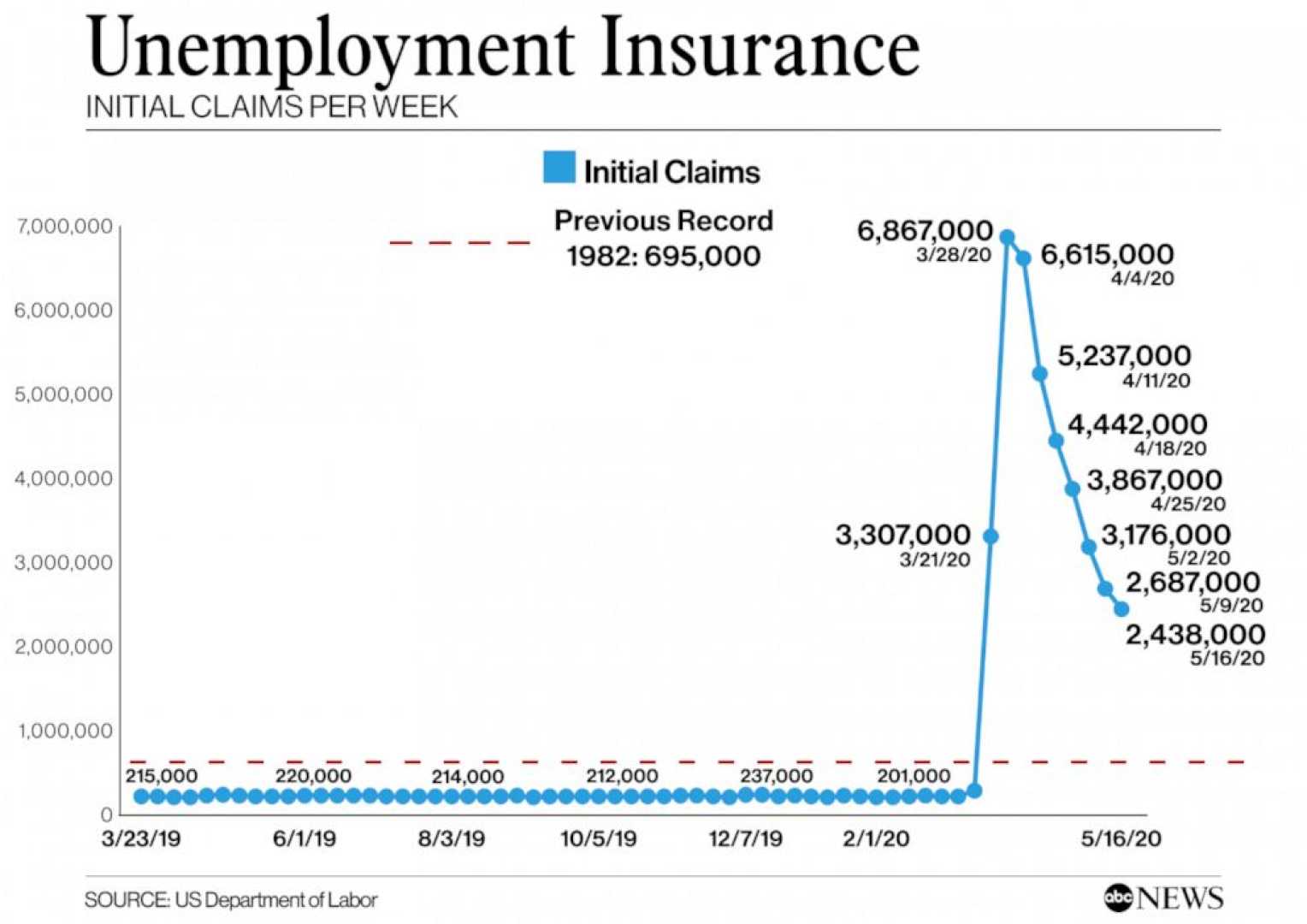

WASHINGTON (AP) — The number of Americans filing for unemployment benefits fell last week to the lowest level in three months, signaling a strong U.S. labor market despite ongoing concerns about tariffs. According to the Labor Department, initial jobless claims for the week ending July 12 decreased by 7,000 to 221,000, marking the fifth consecutive weekly decline and the lowest figure since mid-April. Analysts had anticipated claims to reach 232,000.

The jobless claims reflect layoffs and are viewed as an economic indicator. Earlier in July, the Labor Department reported significant job gains for June, further demonstrating the resilience of the American workforce. That report showed the unemployment rate decreased to 4.1%, down from 4.2% in May, despite predictions that it would rise to 4.3%.

While the job market appears healthy, it faces challenges due to President Donald Trump’s tariffs, which could increase prices for consumers and businesses. Economists warn that these import duties may hamper economic efficiency and provoke retaliatory tariffs from other nations. If unresolved, the tariffs could hinder job growth and lead to inflation.

The deadline for many of Trump’s proposed tariffs has been postponed to August 1. If no agreements are made with other countries, these tariffs could slow economic growth. Major corporations, including recruiting firm Recruit Holdings and Intel Corp., have recently announced job cuts, reflecting the uncertain economic climate.

In addition to the jobless claims data, the four-week moving average, a smoother measure of claims, decreased by 6,250 to 229,500, the lowest since early May. While the total number of Americans receiving unemployment benefits rose slightly by 2,000 to 1.96 million, this metric remains stable.

These developments come as the Federal Reserve considers adjustments to monetary policy. Economists emphasize that the upcoming inflation data, expected Tuesday, will play a crucial role in determining future Fed decisions.