Business

Mortgage Rates Surge Amid Ongoing Trade War Uncertainty

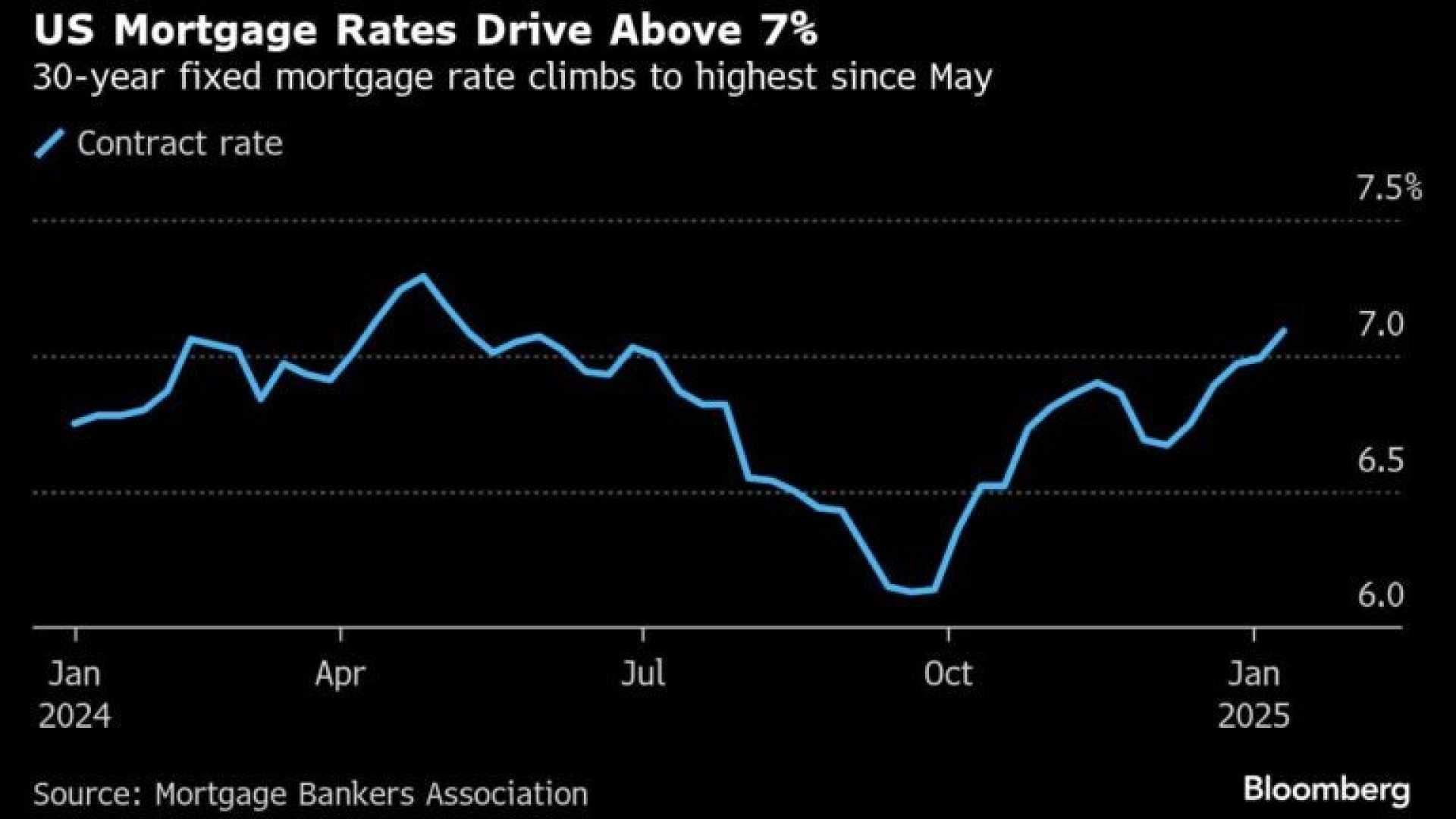

HERKULES, California — The ongoing trade war is sending shockwaves through the housing market as mortgage rates hit a significant milestone this week. According to Freddie Mac, the average rate for a standard 30-year fixed mortgage rose to 6.83% for the week ending April 17, up from 6.62% just a week earlier.

This spike marks the largest one-week increase in mortgage rates in nearly a year, and it follows a period of steadily declining rates since March. The change in rates is linked to President Donald Trump‘s tariffs and heightened trade tensions with China, which have created volatility in the bond market and led to a sell-off in U.S. bonds last week.

Mortgage rates typically align with the benchmark U.S. 10-year Treasury yield, which surged as high as 4.5% before slightly tapering to around 4.3% on Thursday. Still, the average mortgage rate remains below the 7% threshold recorded at this time last year.

“At this time last year, rates reached 7.1% while purchase application demand was 13% lower than it is today, a clear sign that this year’s spring homebuying season is off to a stronger start,” said Sam Khater, Freddie Mac’s chief economist.

In Bankrate‘s latest survey, the 30-year fixed mortgage rate averaged 6.88%, an increase from 6.83% the previous week. The data further highlights the rising cost of borrowing, with rates for different loan types such as 15-year fixed and 5/1 adjustable-rate mortgages also on the upswing.

The national median family income for 2024 was reported at $97,800 by the U.S. Department of Housing and Urban Development. Meanwhile, the National Association of Realtors noted that the median price of existing homes sold in February 2025 was $398,400. For families making this median income, a 20% down payment on a home at the current interest rate translates to a monthly mortgage payment of about $2,095, which accounts for 26% of the typical family’s monthly earnings.

Despite fluctuating mortgage rates, housing experts maintain that rates are likely to move steadily rather than dramatically. “While rates are up in this week’s report, the trend may be softening, presenting opportunities for those who are ready,” said Samir Dedhia, CEO of One Real Mortgage.

“Homebuyers and homeowners exploring refinancing should stay closely connected to market movements and consult with mortgage professionals to make informed decisions in a rapidly shifting rate environment,” Dedhia emphasized.