Business

Mortgage Rates Rise to 6.81% Amid Economic Uncertainty

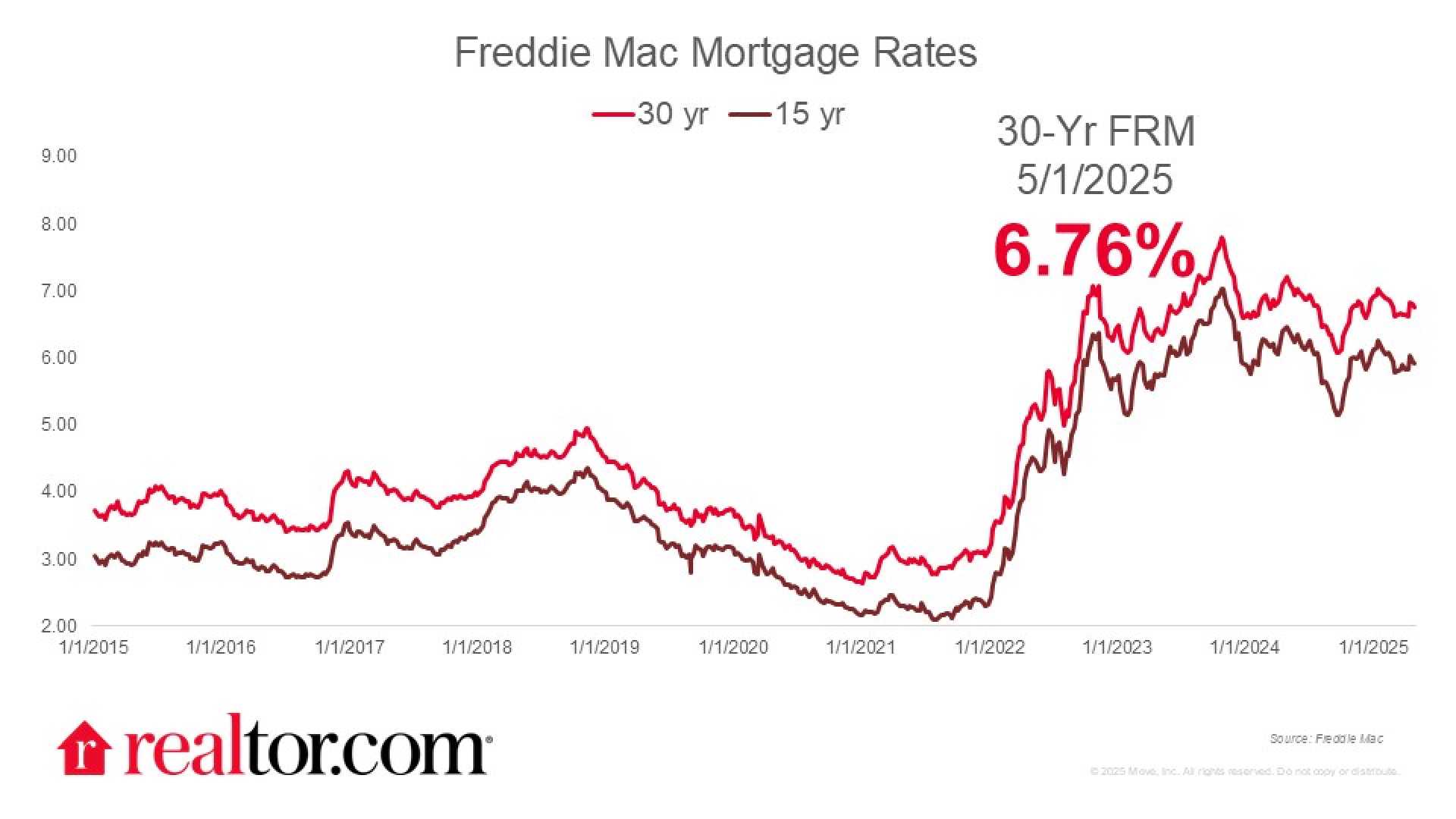

WASHINGTON, D.C. (AP) — Mortgage rates increased this week, with the average 30-year fixed rate climbing to 6.81%, up from 6.76% the previous week, according to Freddie Mac. This marks a shift back into the 6% range after holding steady for several weeks.

The current average for a 15-year fixed mortgage also rose slightly to 5.92% from 5.89%. These changes reflect ongoing economic trends influenced by inflation and Federal Reserve policies.

The increase in mortgage rates comes amidst broader economic uncertainty. Experts point to several factors affecting these rates, including investor appetite for 10-year Treasury bonds. When uncertainty prevails, investors often seek the safety of these bonds, leading to fluctuations that impact mortgage rates.

“Homebuyers would like to see rates come down, but it’s becoming more likely that they will remain in the high 6% range this spring,” said Lisa Sturtevant, chief economist at Bright MLS.

Meanwhile, the national median family income for 2024 is reported at $97,800, and the median price of an existing home sold last month was $403,700, according to the U.S. Department of Housing and Urban Development and the National Association of Realtors. This context adds pressure on potential homebuyers, with the monthly payment on a median home equating to 26% of a typical family’s income.

Experts also noted that despite recent drops in inflation, which eased to 2.3% in April, the Federal Reserve’s cautious stance suggests that mortgage rates may remain elevated. “Markets are now pricing in fewer rate cuts for 2025,” said Samir Dedhia, CEO of One Real Mortgage.

Looking ahead, many predict that rates could remain between 6.5% and 7% due to persistent inflation and market volatility. “If economic conditions worsen, we might see a shift back, but for now, expect gradual moves,” Dedhia added.

The constant changes in mortgage rates demand that potential homebuyers stay informed and proactive about their financing options, suggesting that shopping around for the best rates may still yield favorable outcomes.