Business

S&P 500 Expected to See Significant Slowdown in Gains Over Next Decade, Goldman Strategists Warn

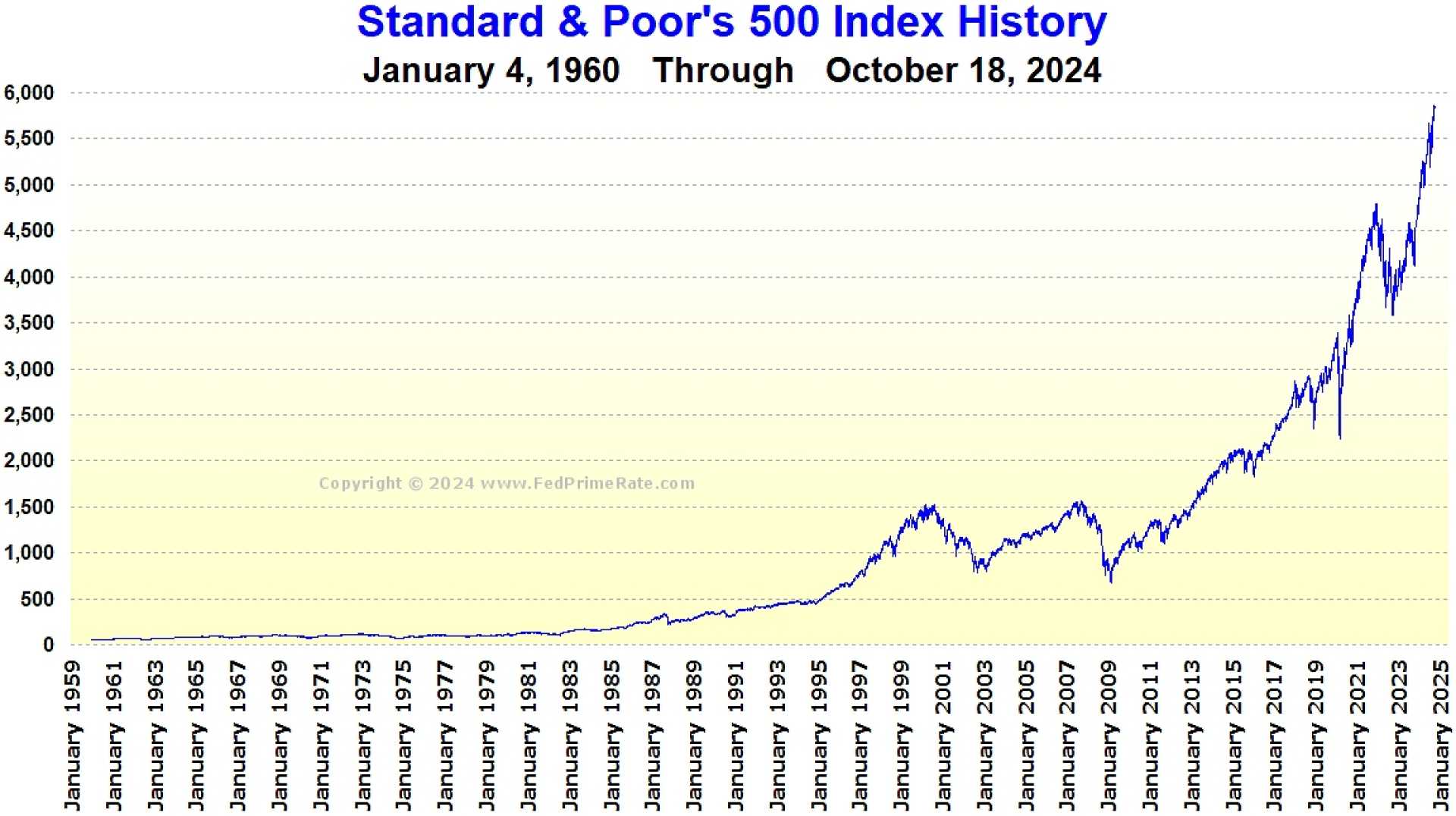

The S&P 500 Index, which has been on a remarkable run, hitting 47 record highs in 2024 and advancing 23% year to date, is expected to experience a significant slowdown in its gains over the next decade, according to Goldman Sachs strategists. In a recent analysis, strategists including David Kostin predicted that the S&P 500 will post an annualized nominal total return of just 3% over the next 10 years. This is a stark contrast to the 13% annualized return seen in the last decade and the long-term average of 11%.

The current momentum of the S&P 500, driven by factors such as excitement over artificial intelligence stocks, falling interest rates, and potential holiday spending stimulus, may not be sustainable. Investors are increasingly looking to other assets, including bonds, for better returns. The index’s recent performance has been robust, with the S&P 500 climbing higher for six consecutive weeks and reaching a new record high on October 18.

Historical data suggests that the S&P 500 tends to perform well after reaching record highs. Since 1988, the index has closed at an all-time high about 6.6% of the time, and nearly one-third of these record highs have been followed by continued upward momentum with the index not falling more than 5% from that level. However, this historical performance does not guarantee future results, and investors should be cautious of the current elevated valuations.

The S&P 500 currently trades at 21.9 times forward earnings, which is a premium to the five-year average of 19.5 times forward earnings. This high valuation indicates that many stocks are expensive by historical standards, posing a risk of a sharp decline if earnings growth does not meet expectations. Analysts forecast strong earnings growth, particularly in the technology sector driven by demand for artificial intelligence products, but the market may have already priced in this potential upside.