Business

Bank of Japan Raises Interest Rates to 17-Year High Amid Inflation Push

TOKYO, Japan — The Bank of Japan (BOJ) on Friday raised interest rates to their highest level since the 2008 global financial crisis, signaling confidence that rising wages will help sustain inflation around its 2% target. The decision, the first rate hike since July 2023, comes amid heightened global economic uncertainty following the inauguration of U.S. President Donald Trump and his potential tariff policies.

The central bank increased its short-term policy rate from 0.25% to 0.5% in an 8-1 vote, with board member Toyoaki Nakamura dissenting. This marks the highest rate Japan has seen in 17 years. The BOJ stated that the likelihood of achieving its inflation outlook has improved, citing steady wage increases in this year’s annual wage negotiations as a key factor.

“The likelihood of achieving the BOJ’s outlook has been rising,” the central bank said in a statement. “Many firms have indicated they will continue to raise wages steadily.”

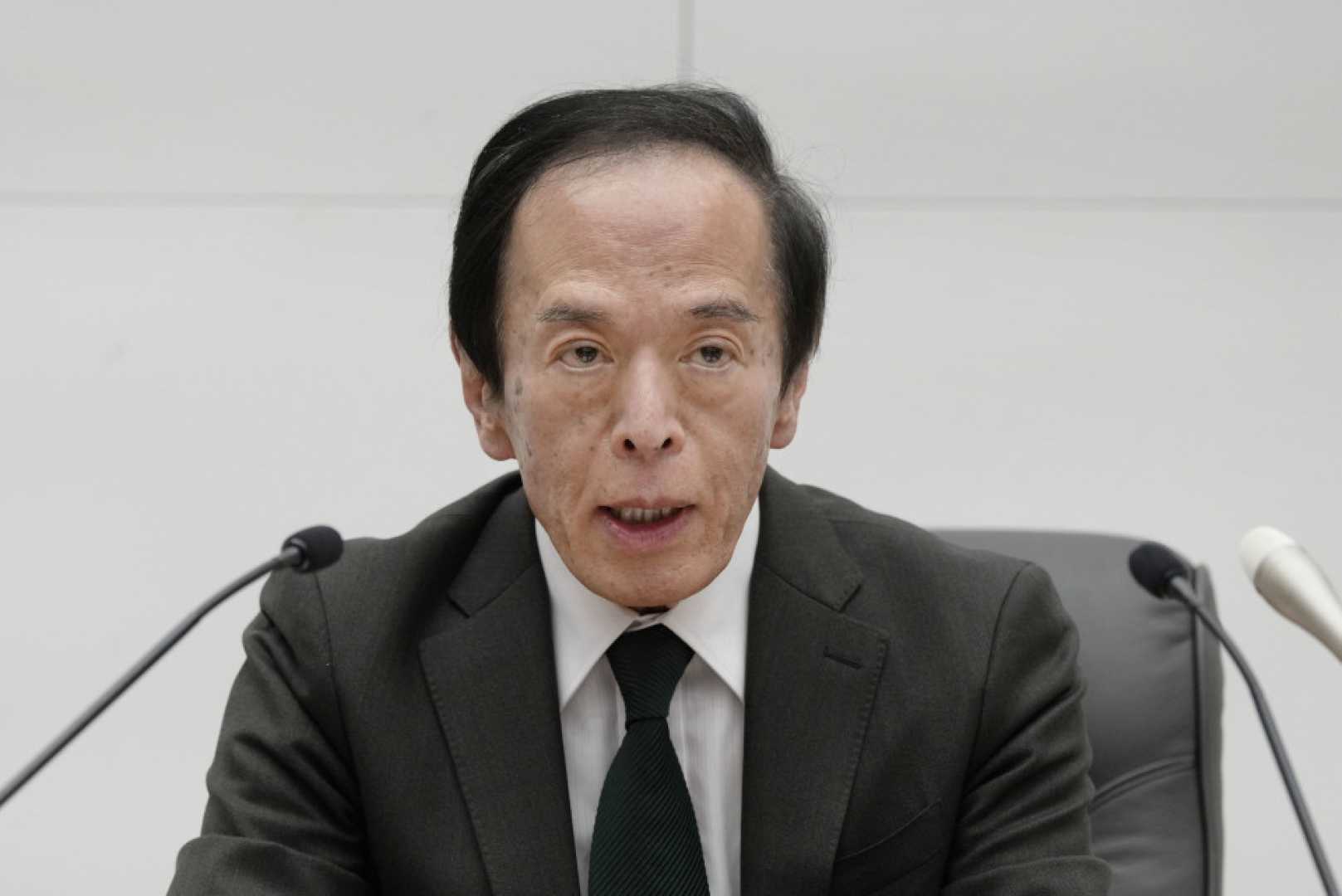

The move reflects the BOJ’s commitment to gradually raising interest rates to around 1%, a level analysts believe will neither cool nor overheat Japan’s economy. Attention now turns to BOJ Governor Kazuo Ueda‘s post-meeting briefing, where he may provide insights into the timing and pace of future rate hikes.

In a quarterly outlook report, the BOJ raised its inflation forecasts, citing growing prospects that Japan is on track to sustainably meet its 2% inflation target. Recent data showed Japan’s inflation accelerated to its fastest annual pace in 16 months in December, driven by rising fuel and food prices.

Since taking office in April 2023, Ueda has dismantled his predecessor’s radical stimulus program and pushed short-term interest rates to 0.25% in July. BOJ policymakers have emphasized that further rate hikes will depend on Japan’s progress in achieving a cycle where rising inflation boosts wages and consumption, enabling firms to pass on higher costs.

The decision underscores the BOJ’s cautious approach to monetary policy amid global economic volatility and domestic inflationary pressures.