Business

DTE Energy Analysts Issue New Ratings Amid Market Fluctuations

DETROIT, Mich. — Analysts are closely monitoring DTE Energy, which has experienced a shift in ratings as investors navigate a volatile energy landscape. In the past three months, four analysts have published new assessments on DTE, revealing an even mix of bullish and indifferent perspectives.

According to recent data, one analyst maintained a bullish outlook while two analysts remained indifferent. Over the last month, there were no bearish ratings noted, showcasing a cautious optimism from financial experts as they evaluate the company’s stock performance.

The recent ratings have culminated in a positive revision of the 12-month price targets. The average target now stands at $138.25, with estimates varying from $135.00 to $147.00. This average marks a 3.95% increase from the prior target of $133.00, indicating an encouraging sign for investors.

Notable analyst adjustments include Shahriar Pourreza from Guggenheim, who raised their rating to Buy, increasing the price target from $139.00 to $147.00. David Arcaro of Morgan Stanley upgraded their rating to Overweight, with the price target shifting from $131.00 to $136.00. Meanwhile, Nicholas Campanella of Barclays lowered his rating to Equal-Weight, adjusting the target from $137.00 to $135.00, while James Thalacker from BMO Capital also increased his assessment to Market Perform, raising the price target from $125.00 to $135.00.

DTE Energy operates two regulated utilities, DTE Electric and DTE Gas, providing services to approximately 2.3 million customers in southeastern Michigan and 1.3 million customers statewide. The company generates 90% of its earnings from these utility operations, underscoring their significance to its financial health.

Financial metrics paint a multifaceted picture of DTE Energy’s performance. The company reported a revenue growth rate of 1.24% for the three months ending December 31, 2024. While this marks positive growth, it lags behind peers in the utility sector. The net margin as of now is 8.5%, signaling challenges in profitability. Conversely, the return on equity (ROE) is commendable at 2.51%, exceeding industry benchmarks. However, a return on assets (ROA) of 0.59% suggests inefficiencies in capitalizing on assets, and the debt-to-equity ratio stands at a concerning 1.99, raising concerns regarding the management of debt levels.

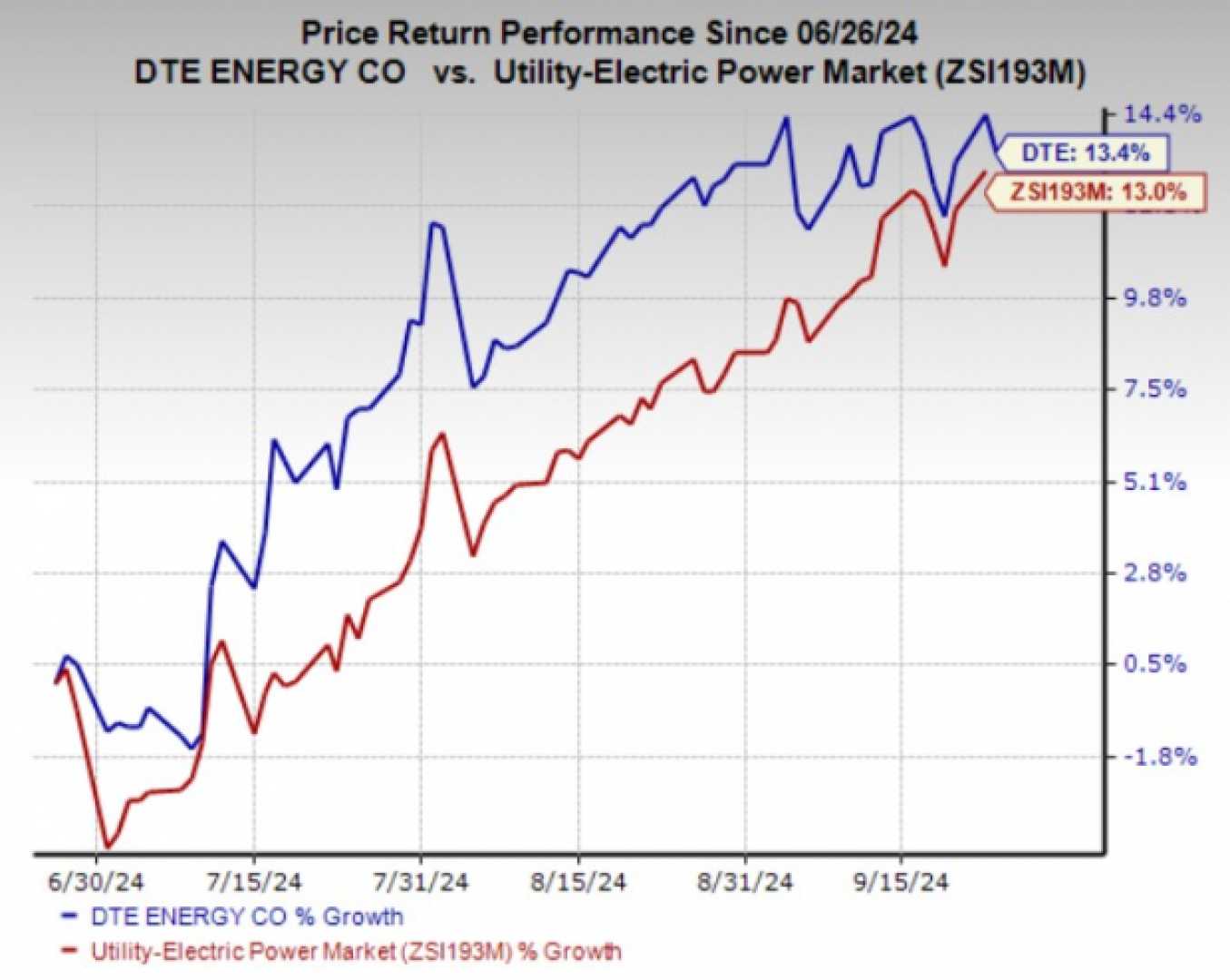

In light of recent trends, DTE shares have risen to a 52-week high of $137.03, highlighting a robust growth trajectory despite market fluctuations. In the past three months, the stock has experienced a 14% increase, outperforming the Nasdaq Composite, which saw a 9.6% decline during the same period. Furthermore, shares have climbed 13.4% year-to-date and have exhibited a 24.5% increase over the past year.

Following its fourth-quarter results released on February 13, 2025, which reported operating earnings per share (EPS) of $1.51—surpassing expectations of $1.46—DTE shares rose more than 2%. Looking ahead, the company projects its full-year operating EPS to fall between $7.09 and $7.23, further supporting a positive outlook.

In its commitment to sustainability, DTE Energy has invested in expanding its renewable energy portfolio, adding 2,300 megawatts of renewable energy capacity. The company is also developing a 220 megawatt battery storage facility, reflecting its strategy to enhance its energy offerings and adapt to the evolving market landscape.

Analysts currently hold a consensus rating of “Moderate Buy” on DTE Energy, with a mean price target of $139.87, suggesting a potential upside of 2.1% from current levels. Despite the challenges posed by profitability metrics and debt management, DTE Energy’s proactive initiatives in sustainability may bolster its position in the energy sector.

As market conditions continue to evolve, investors should closely monitor DTE Energy’s developments and analyst ratings to make informed investment decisions going forward.