Business

Hyatt Stock Shows Mixed Signals Amid Hospitality Industry Challenges

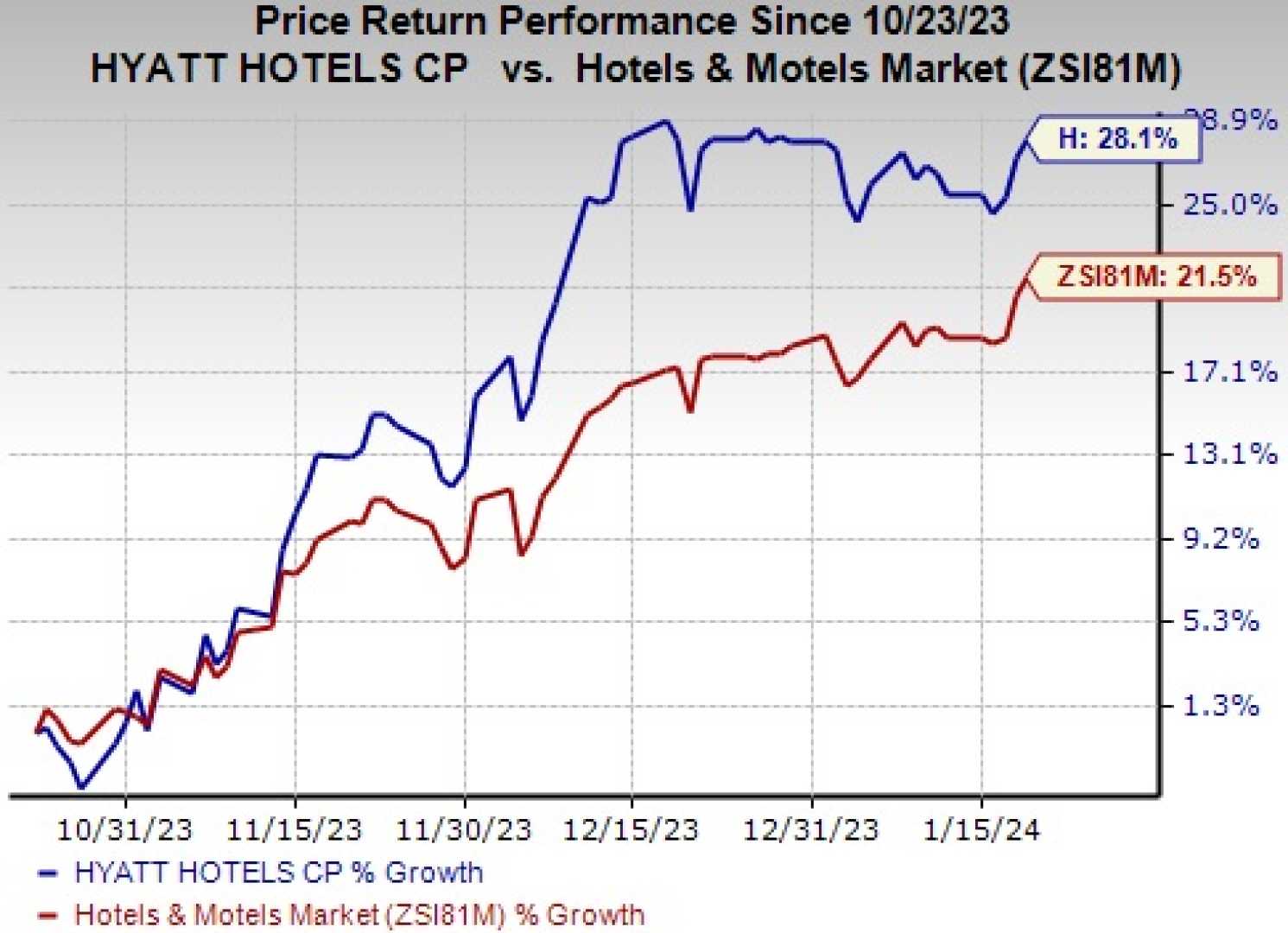

CHICAGO, Ill. — Hyatt Hotels Corporation (NYSE: H) has seen its stock rise nearly 19% since the start of 2024, trailing the S&P 500’s 22% return and lagging behind its peer stock, which gained 24% over the same period. The company’s Q3 2024 earnings report revealed a mixed performance, reflecting broader challenges in the hospitality industry.

Hyatt’s total revenues remained flat year-over-year (y-o-y) at $1.6 billion in Q3 2024. Comparable system-wide all-inclusive resorts experienced a 0.9% decline in Net Package revenue per available room (RevPAR). While the company reported a 3% y-o-y increase in comparable system-wide RevPAR, this growth rate slowed compared to previous quarters, which saw 4.7% growth in Q2 2024 and 5.5% in Q1 2024.

Regional challenges, particularly in Greater China, weighed on performance, but European operations drove growth during the quarter. Hyatt also achieved a net room growth of 4.3%, adding 16 new hotels and 2,589 rooms. The company’s pipeline expanded 10% y-o-y to 135,000 rooms, signaling potential for future growth.

Looking ahead, Hyatt forecasts RevPAR growth of 3.0% to 4.0% and net room growth of 7.75% to 8.25% for FY 2024. Adjusted EBITDA is expected to range between $1.10 billion and $1.12 billion, up from $1.03 billion in FY 2023. Fee-based revenues, a key component of Hyatt’s business model, are projected to reach $1.085 billion to $1.11 billion, representing a 13% increase at the midpoint.

Hyatt’s stock performance over the past four years has been volatile, with returns of 29% in 2021, -6% in 2022, 45% in 2023, and 21% in 2024. In comparison, the Trefis High Quality Portfolio, a collection of 30 stocks, has outperformed the S&P 500 with less volatility.

“Hyatt’s growth strategy is yielding results, particularly in Europe, but challenges in key markets like Greater China remain a concern,” said an industry analyst. “The company’s focus on fee-based revenues and expanding its pipeline positions it well for long-term growth.”

Hyatt’s business model relies heavily on fee-based revenue, licensing, and services, leveraging its brand and intellectual property through partnerships with third-party owners and franchisees. The company aims to derive over 80% of its earnings from fees by 2025.

As the hospitality industry navigates post-pandemic recovery, Hyatt’s ability to adapt to regional challenges and capitalize on growth opportunities will be critical to its future performance.