Business

Streaming Services Shift Focus to Live Sports Amid Subscriber Woes

LOS ANGELES, Feb. 17, 2025 — As competition intensifies, streaming services are pivoting towards live sports and events to combat subscriber cancellations. This strategic shift is creating challenges for traditional television networks and underscores the evolving preferences of modern viewers.

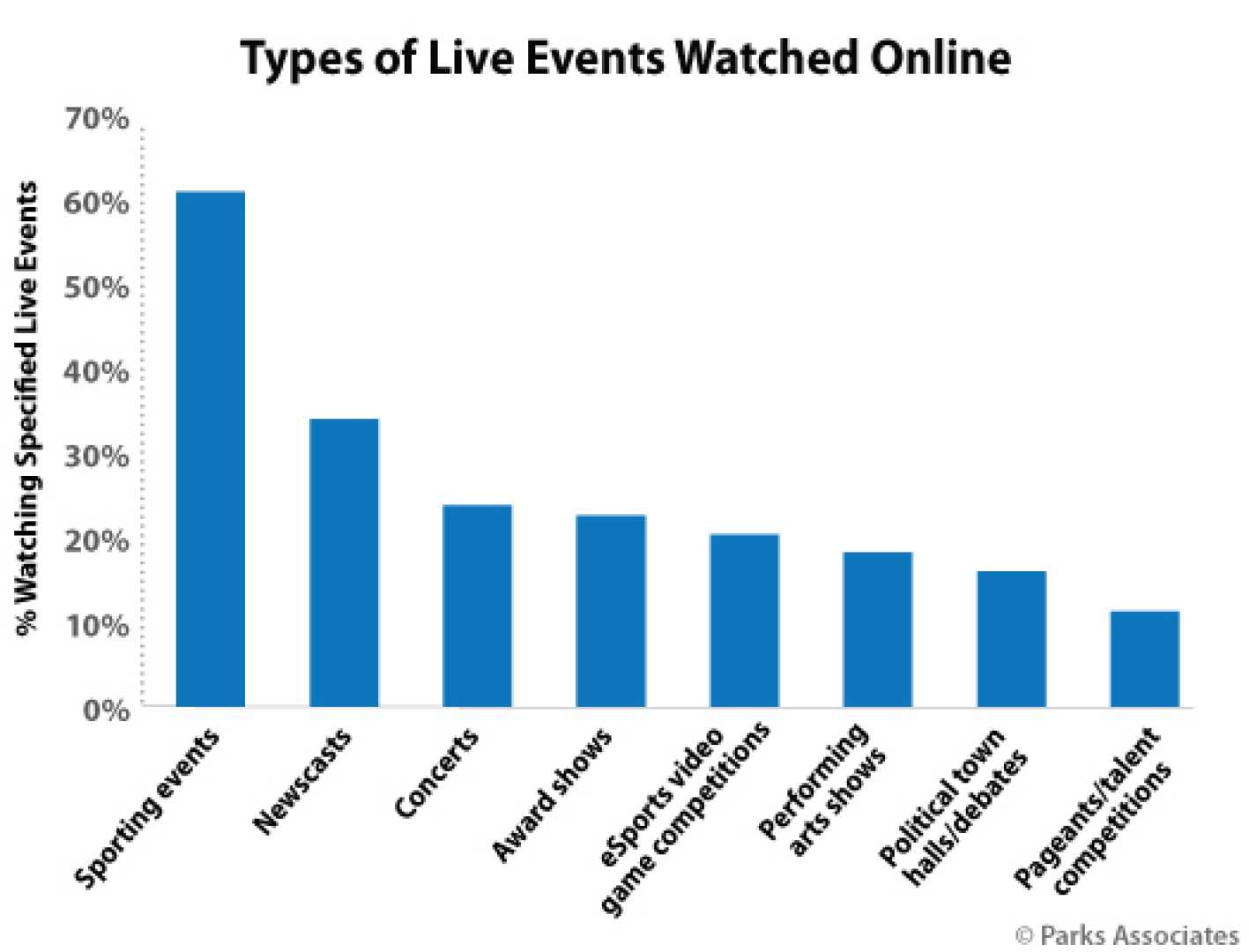

A new trend shows audiences increasingly find it easier to cancel streaming subscriptions than traditional cable services. According to industry sources, gaining and maintaining subscribers hinges on delivering compelling content, particularly in the form of live sports, which have built-in fan bases.

Examples of this approach include Amazon‘s acquisition of Thursday Night Football and Netflix‘s addition of WWE programming, both of which cater to established sports audiences. Reports indicate Netflix is actively pursuing rights to major sports events, including UFC, enhancing its portfolio to attract wider viewership.

PWC‘s recent prediction highlights the significance of this shift: over 90 million U.S. viewers are expected to stream sports events monthly by 2025, a steep increase from 57 million in 2021. IndexBox data indicates this growing audience presents a profitable opportunity for platforms like Netflix and Amazon to broaden their market share.

While pursuing sports content, streaming services must also respond to Wall Street’s demand for consistent subscriber growth. The preference for online streaming over traditional television continues to rise, pushing platforms to secure more substantial portions of the digital market.

According to Horizon Sports and Experiences co-CEO David Levy, many viewers still favor large screen experiences. In response, traditional networks such as NBC are exploring cross-platform opportunities through simulcasting, merging traditional and digital viewing habits.

Despite these industry shifts, experts believe Netflix remains a dominant force in the streaming realm. Jeff Wlodarczak, an analyst with investment firm Pivotal Research Group, pointed to Netflix’s strong performance as evidence of its sustained leadership in the market.

“The competition is intensifying, but Netflix’s proven track record keeps it ahead,” Wlodarczak commented.

In the past, streaming services focused heavily on original content to entice subscribers. However, with profitability becoming increasingly elusive, companies are now tightening their budgets. A report from Ampere Analysis forecasts streaming service programming budgets will see only a modest increase of 0.4 percent in 2025, totaling $248 billion. This marks a slow-down in growth compared to previous years.

The emphasis on original scripted programming is also set to decrease, projected to account for only 35 percent of budgets in 2025, down from 45 percent three years prior. Amazon is reportedly scaling back on film and TV projects, prioritizing live events instead, which generate substantial revenue through advertising and large audiences.

Amazon officials, however, disputed these claims, stating the company’s number of projects has grown steadily and is expected to continue doing so. Meanwhile, competitor Disney is also re-evaluating its content spending, eyeing efficiency in its major $23 billion budget for 2025, which includes theatrical releases and programming for its various networks.

The streaming landscape is becoming increasingly competitive, with many services facing budget cuts and layoffs as profitability becomes a key focus. According to Dan Green, director at Carnegie Mellon University, the industry landscape is shifting, leading to a heightened scrutiny of content budgets across platforms.

Peacock, for instance, has seen its major differentiator come from live events rather than original series, marking a significant change in strategy. Smaller streaming platforms are expected to follow suit, tightening their budgets and focusing on sports rights to remain competitive.

Current data suggests a general decline in new drama series ordered by streaming services, with Luminate‘s findings indicating a drop in the number of total series and episodes. The report also states that animated series are witnessing a significant decrease in volume, highlighting a shift in content strategy.

The current evolution of the streaming market indicates a potential reduction in the diversity of programming available to subscribers. Experts, including Carnegie Mellon’s Green, suggest tighter budgets could lead to a lack of diverse storytelling from new creators, potentially favoring established names with proven track records.

Elizabeth Parks, president and CMO at Parks Associates, warned that the shift toward maximizing content value could lead to a less compelling viewer experience, with many platforms moving toward greater reliance on established franchises over original materials.

As streaming services increasingly integrate live events and conventional narratives into their portfolios, viewers may find themselves encountering more familiar landscapes reminiscent of traditional TV. The demand for unique content and diverse storytelling may hinge on effective content investment in the years to come.