Business

D-Wave Quantum Sees Dramatic Stock Surge Amid Industry Optimism

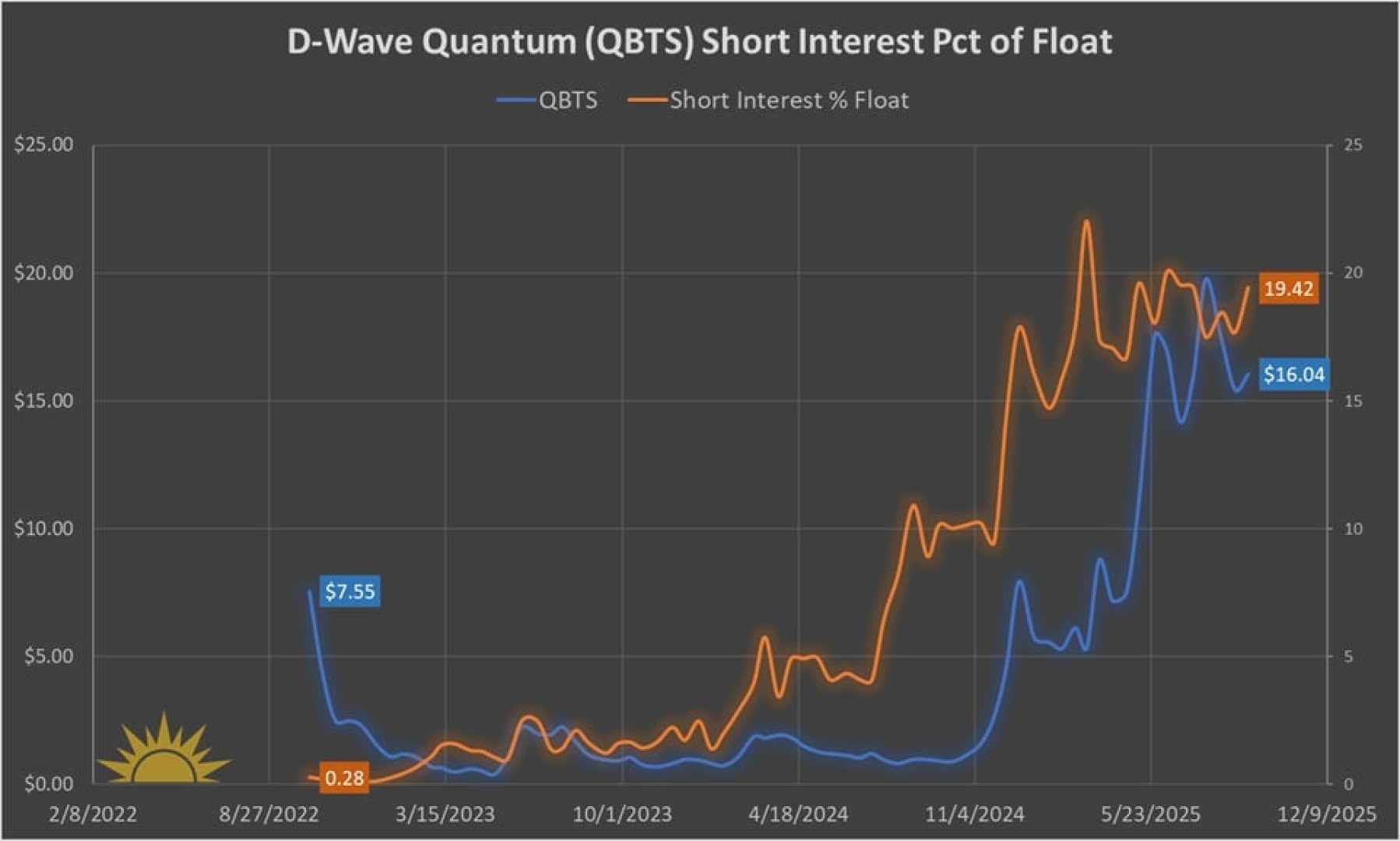

NEW YORK, NY — October 22, 2025 — D-Wave Quantum has captured the attention of investors after experiencing a remarkable stock price increase of 3,500% over the past year. This surge follows rising optimism surrounding quantum computing as a viable industry.

D-Wave focuses on a unique approach to quantum computing known as quantum annealing, which aims to tackle optimization problems efficiently. Despite its successes, the company is still far from profitability, with a reported operating loss of $26.5 million in the second quarter, even as its revenues rose by 42% to $3.1 million compared to last year.

Investors are weighing the potential risk of purchasing stocks at this elevated price level. While some regard the surge as a sign of the future of quantum technology, others advise caution, especially as D-Wave’s price-to-sales ratio sits at a staggering 336, far above the S&P 500 average of 3.35.

Moreover, according to reports from Silicon Valley Bank, most successful start-ups are typically acquired rather than making public offerings. D-Wave managed to raise $400 million in June through stock sales, which they plan to use for corporate needs and potential acquisitions. However, the dilution of shares can diminish ownership stakes for existing shareholders, potentially deterring future investment.

The current market capitalization for D-Wave Quantum stands at about $10 billion. The lofty valuation raises concerns for potential investors, as many feel the easy returns may have already been realized. The company’s price-to-book ratio of 15.9x also paints a picture of overvaluation compared to the industry average of 4x.

Despite these challenges, analysts continue to view D-Wave’s technology as innovative. However, investors are advised to remain cautious and might seek better entry points before engaging with D-Wave stock, given the ongoing debate on its high market valuation.