Business

BlackRock CEO Pushes for Tokenization of Stocks and Bonds

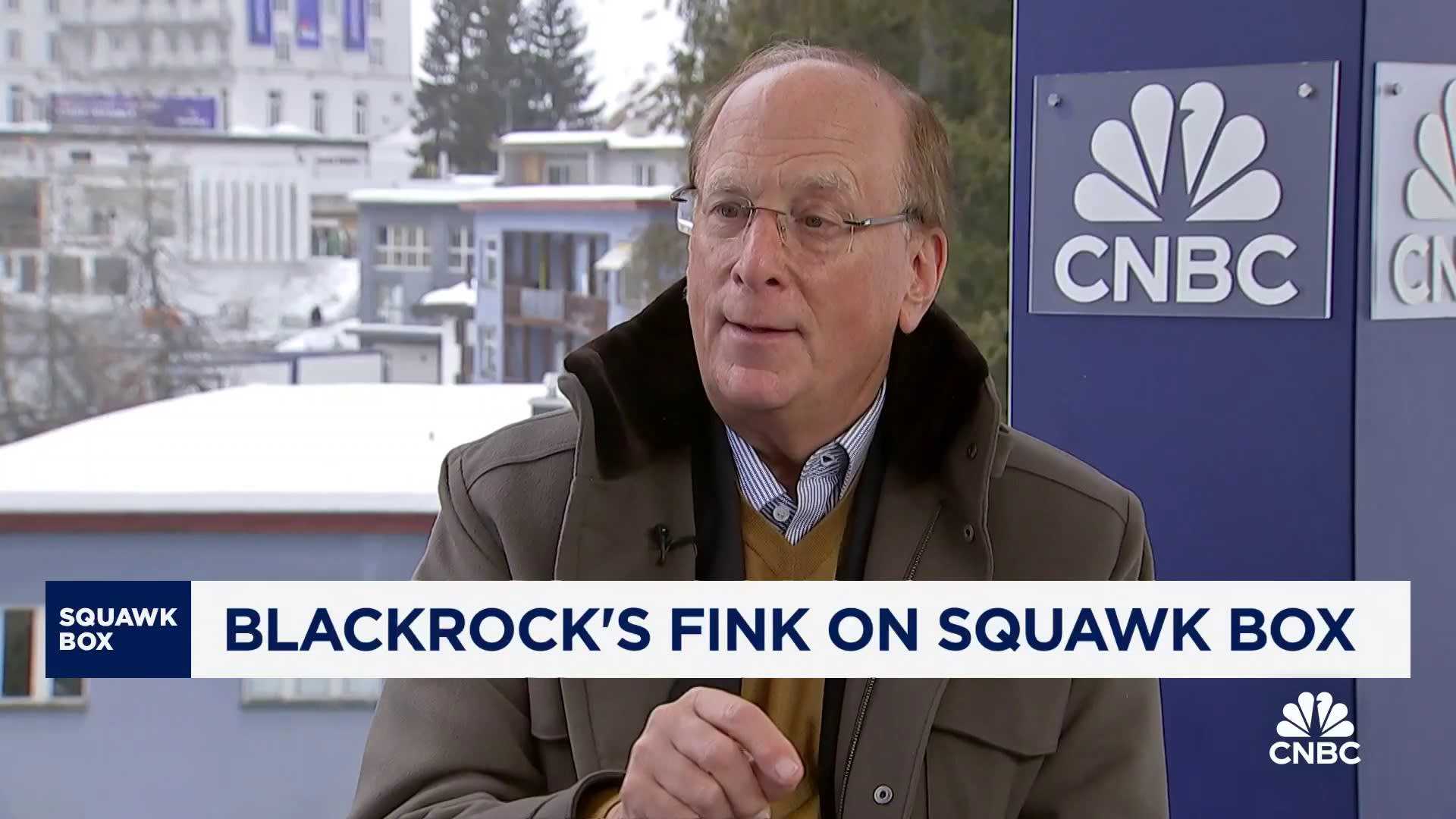

DAVOS, Switzerland — Larry Fink, CEO of BlackRock, has called for the tokenization of stocks and bonds, a move that could revolutionize the financial markets by converting traditional assets into digital tokens on blockchain networks. Fink made the remarks during an interview at the World Economic Forum in Davos, emphasizing the potential to democratize investing.

“If we can tokenize bonds and stocks… it will democratize investing in ways we can’t imagine,” Fink said in a Bloomberg interview. The proposal aims to make financial markets more accessible to a broader range of investors, though it hinges on regulatory approval from bodies like the U.S. Securities and Exchange Commission (SEC).

Tokenization, the process of converting physical or financial assets into digital tokens, has gained traction in recent years as blockchain technology evolves. Proponents argue it could streamline transactions, reduce costs, and increase transparency. However, the initiative faces significant hurdles, including regulatory scrutiny and market adaptation.

Fink’s comments come as BlackRock, the world’s largest asset manager, continues to explore innovative financial technologies. The firm has already made strides in digital assets, including the launch of a spot Bitcoin ETF earlier this year. Tokenizing traditional assets like stocks and bonds would mark a significant expansion of blockchain’s role in finance.

Despite the potential benefits, experts caution that widespread adoption of tokenization will require robust regulatory frameworks. “The SEC and other regulators will need to ensure investor protection and market stability,” said Jane Smith, a financial analyst at Bloomberg Intelligence. “This is a transformative idea, but it won’t happen overnight.”

Fink’s advocacy for tokenization reflects a broader trend in the financial industry, where major players are increasingly exploring blockchain-based solutions. While the technology promises to enhance efficiency and accessibility, its implementation will depend on collaboration between regulators, financial institutions, and technology providers.

As the conversation around asset tokenization gains momentum, stakeholders are closely watching how regulators respond. For now, Fink’s vision remains aspirational, but it underscores the growing interest in leveraging blockchain to reshape the future of finance.