Business

Consumer Confidence Hits Five-Year Low Amid Tariff Concerns

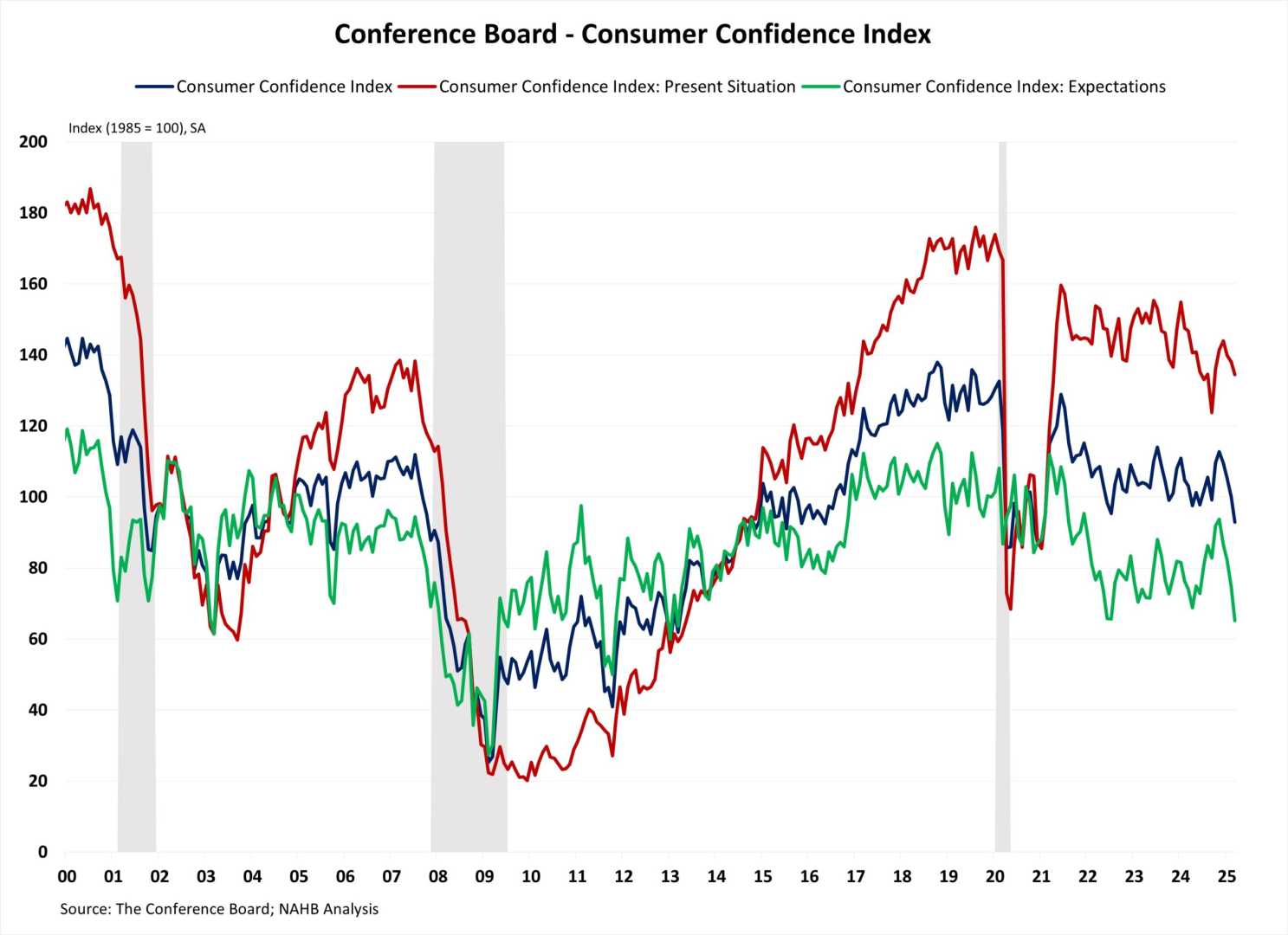

WASHINGTON — Americans’ confidence in the economy has fallen for the fifth consecutive month, reaching its lowest point since May 2020, due to worries about the impact of tariffs on economic growth. The Conference Board reported on Tuesday that its consumer confidence index dropped 7.9 points in April to a total of 86.

This decline brings consumer expectations nearly to the gloom seen in April 2009, when the U.S. was deep in the Great Recession. Almost one-third of consumers surveyed anticipate hiring will slow down in the upcoming months, contributing to the negative outlook.

Consumers’ moods have soured as many expect rising prices attributed to the tariffs enacted by former President Donald Trump. A recent AP-NORC Center survey found that about half of Americans are also concerned about the possibility of a recession.

The measure of short-term expectations for income, business conditions, and the job market fell 12.5 points to 54.4, a stark contrast to the typical recession indicator of below 80.

Analysts say the translation of this pessimistic outlook into consumer spending and hiring patterns will soon be clearer. On Wednesday, the U.S. government is set to report first-quarter economic growth, which is widely expected to show a significant slowdown as consumer spending decreased after a robust holiday shopping season.

Moreover, the Labor Department will release new employment data on Friday, with economists expecting steady job growth despite some predictions of reduced hiring.

The steep drop in consumer confidence is also likely a consequence of volatility in stock and bond markets. While declines were observed across all age groups and income brackets, those earning more than $125,000 and consumers aged 35 to 55 years showed the largest decreases in confidence.

Despite a recent rebound in major U.S. markets, the S&P 500 has still declined 6% this year, and the Dow Jones Industrial Average is down 5%. The tech-heavy Nasdaq has seen a 10% dip in 2025.