Business

Consumer Sentiment Plummets Amid Rising Inflation Fears

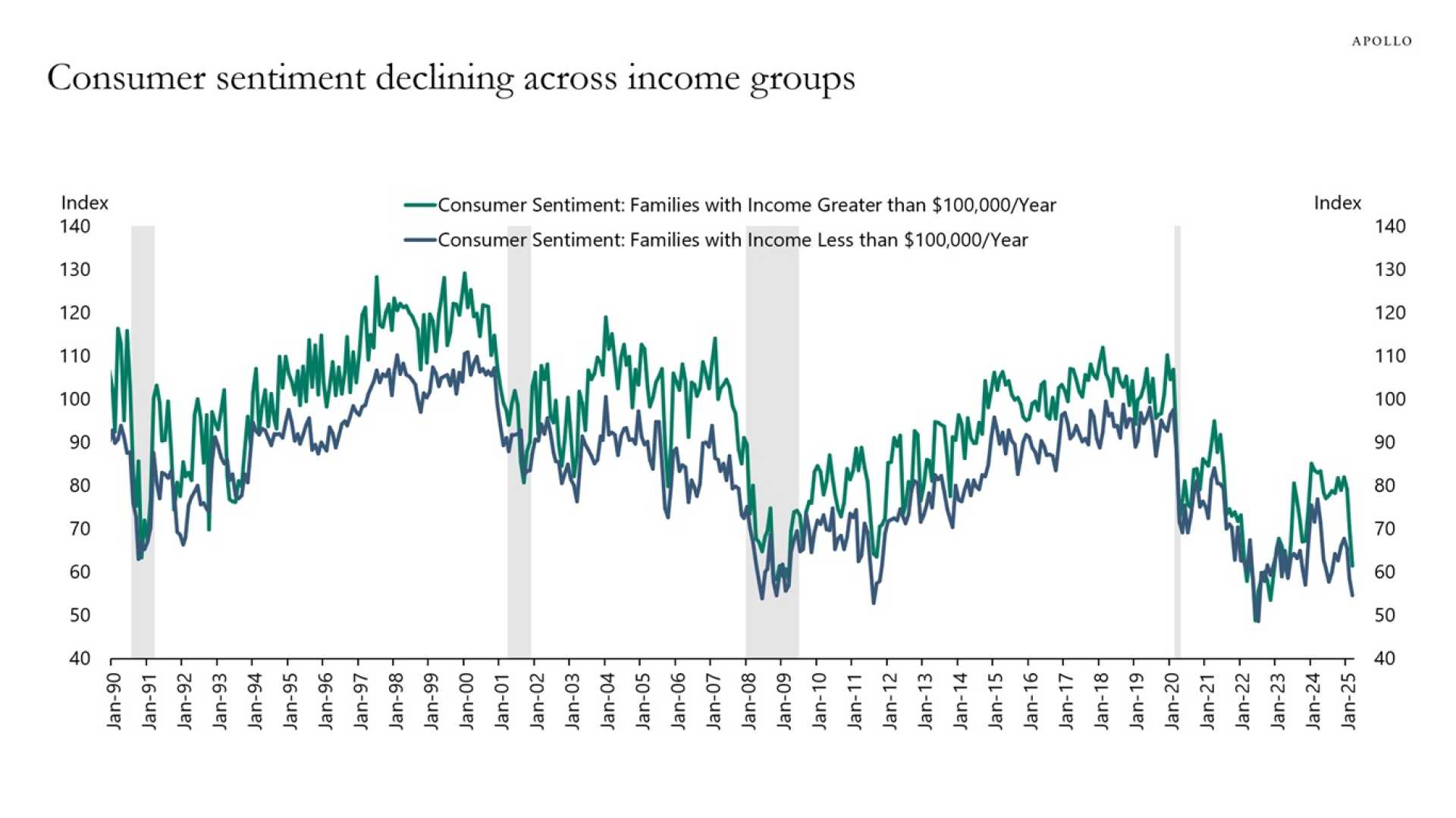

BAYONNE, New Jersey — Consumer sentiment in the United States declined sharply in April, as worries over inflation reached a peak not seen since 1981, according to a report released Friday by the University of Michigan.

n

The mid-month survey revealed a consumer sentiment index of 50.8, down from 57.0 in March and significantly below the Dow Jones consensus estimate of 54.6. This drop represents a 10.9% decline from the previous month and marks a staggering 34.2% decrease compared to the same period a year ago.

n

As prospects for the economy dimmed, inflation fears intensified. The survey indicated that respondents expect inflation to rise to 6.7% over the next year, the highest projection since November 1981 and a substantial increase from 5% in March. Additionally, expectations for inflation over the next five years rose to 4.4%, marking a 0.3 percentage point increase from March, the highest since June 1991.

n

Joanne Hsu, the survey director, noted that declines in sentiment were consistent across all demographics, including age, income, and political affiliation. “Consumers report multiple warning signs that raise the risk of recession: expectations for business conditions, personal finances, incomes, inflation, and labor markets all continued to deteriorate this month,” she stated.

n

The current economic conditions index decreased to 56.5, an 11.4% drop from March, while the expectations measure also fell to 47.2, declining by 10.3%. On an annual basis, these figures dropped 28.5% and 37.9%, respectively, indicating widespread concern among consumers.

n

Worries about unemployment surged, reaching levels not seen since 2009. This bleak survey comes as President Donald Trump’s trade tariffs are believed to contribute to rising inflation and could potentially slow economic growth. Many Wall Street analysts are bracing for the possibility of a recession in the upcoming year.

n

While these survey results contrast with market-based expectations that suggest low inflationary fears, Federal Reserve officials have voiced concerns that deteriorating consumer expectations could become a self-fulfilling prophecy if behavior changes accordingly. Recent data indicates that inflationary pressures might be easing.

n

The survey was conducted from March 25 to April 8, concluding just before Trump announced a temporary halt on aggressive tariff measures against several U.S. trading partners.

n

As the market digests this information, investors are reacting to volatility driven by escalating U.S.-China trade tensions. On April 11, U.S. futures exhibited wild swings following China’s announcement that it would impose further tariffs on American goods, increasing rates to 125% effective April 12.

n

The U.S. stock market exhibited mixed results, with the Dow Jones Industrial Average fluctuating significantly as market participants weighed the implications of the ongoing tariff situation and its effects on the economy. The performance of key bank stocks, including JPMorgan Chase and Wells Fargo, also contributed to market volatility as traders reacted to first-quarter earnings amid these economic conditions.