Business

Cryptocurrency Prices Plunge Amid Economic Woes and Trade War Fears

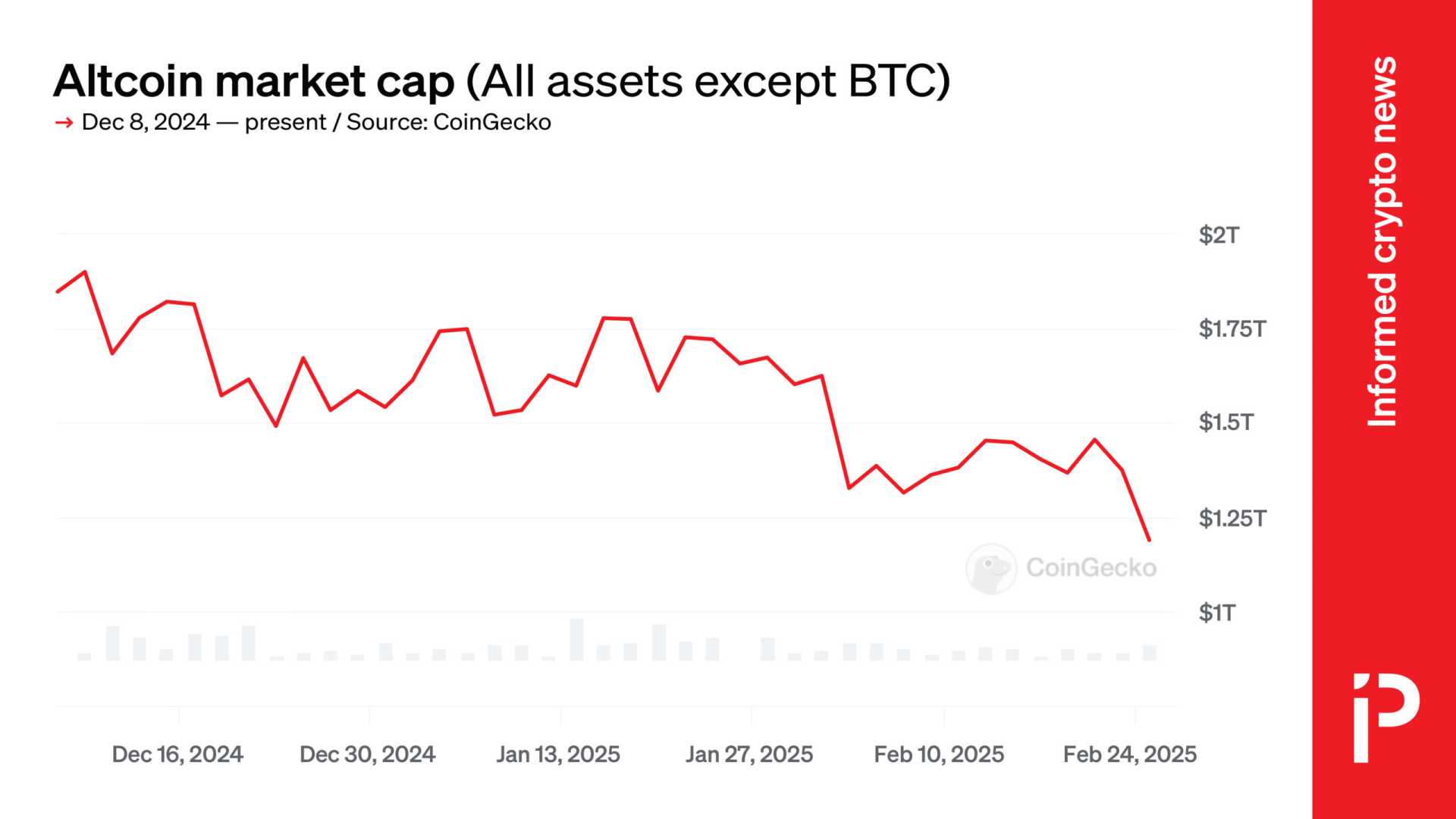

NEW YORK, NY — Cryptocurrency markets faced severe sell-offs on Tuesday, February 25, 2025, driven primarily by economic concerns and possible trade war ramifications. Bitcoin, Ethereum, and Dogecoin witnessed substantial price drops, gripping investors with anxiety over declining valuations across the sector.

Bitcoin, the leader in the crypto market, fell by 9.02%, trading at $79,717.09, while Ethereum dropped 11.43% and Dogecoin slid 12.98% as of the latest update. The downturn comes as consumer confidence diminishes, indicated by a significant drop in the Conference Board‘s Consumer Confidence Index from 105.3 in January to 98.3 this month, marking its steepest decline since August 2021.

“The fear of a trade war has placed pressure on markets, particularly in the crypto space, where price movements are closely tied to economic sentiment,” said Alex Kuptsikevich, chief market analyst at FxPro. “Investors are understandably cautious about entering a sector characterized by volatility amidst uncertain economic conditions.”

The correlation between cryptocurrency prices and stock market performance is becoming increasingly evident. Growth stocks have also been hit hard, with the overall market responding negatively to impending tariffs on imports from Canada and Mexico set to come into effect next month. This uncertainty only adds to the already precarious market landscape.

Short-term expectations for the job market, income, and business conditions have also taken a hit, reflecting a growing apprehension among consumers and investors. With tariffs planned to mirror duties previously imposed on U.S. goods by other nations, analysts warn that the market could face further strain as trading resumes.

The cryptocurrency boom that began post-election in November has now hit a wall, with new regulatory approaches by the Securities and Exchange Commission failing to provide the anticipated boost to investor confidence. “Currently, it seems the industry is shifting towards stablecoins, which offer practical usability advantages,” noted Damian, a business intelligence analyst with Finance Magnates. “This reflects a fundamental shift away from traditional cryptocurrencies like Bitcoin and Ethereum.”

As the crypto market experiences lingering downturns and sentiment turns bearish, many investors are seeking refuge in safer assets, reflecting a cautious approach to trading. Although some analysts suggest long-term recovery is still possible, the immediate future for cryptocurrencies, especially meme coins like Dogecoin, looks bleak.

Technical analysis shows that Dogecoin’s recent performance has dipped below crucial support levels, prompting fears of further depreciation. The primary indicators suggest that if it closes below $0.2418, the cryptocurrency may spiral toward the psychological threshold of $0.20.

“Traders and investors are advised to adopt a wait-and-see strategy until market conditions stabilize,” emphasized Tim Urbanowicz, chief investment strategist at Innovator Capital Management. “Consumer confidence plays a pivotal role, and if the economy continues on this path toward recession, the repercussions on crypto markets could be severe.”

Future projections vary widely among analysts. Some predict Dogecoin could rally to $1.07 in 2025, while others remain more conservative with targets as low as $0.12. The schism reflects the uncertainty surrounding market adoption and regulation impacts as legislative changes loom on the horizon.