Business

Federal Reserve Chair Faces Pressure Amid Tariff Uncertainty

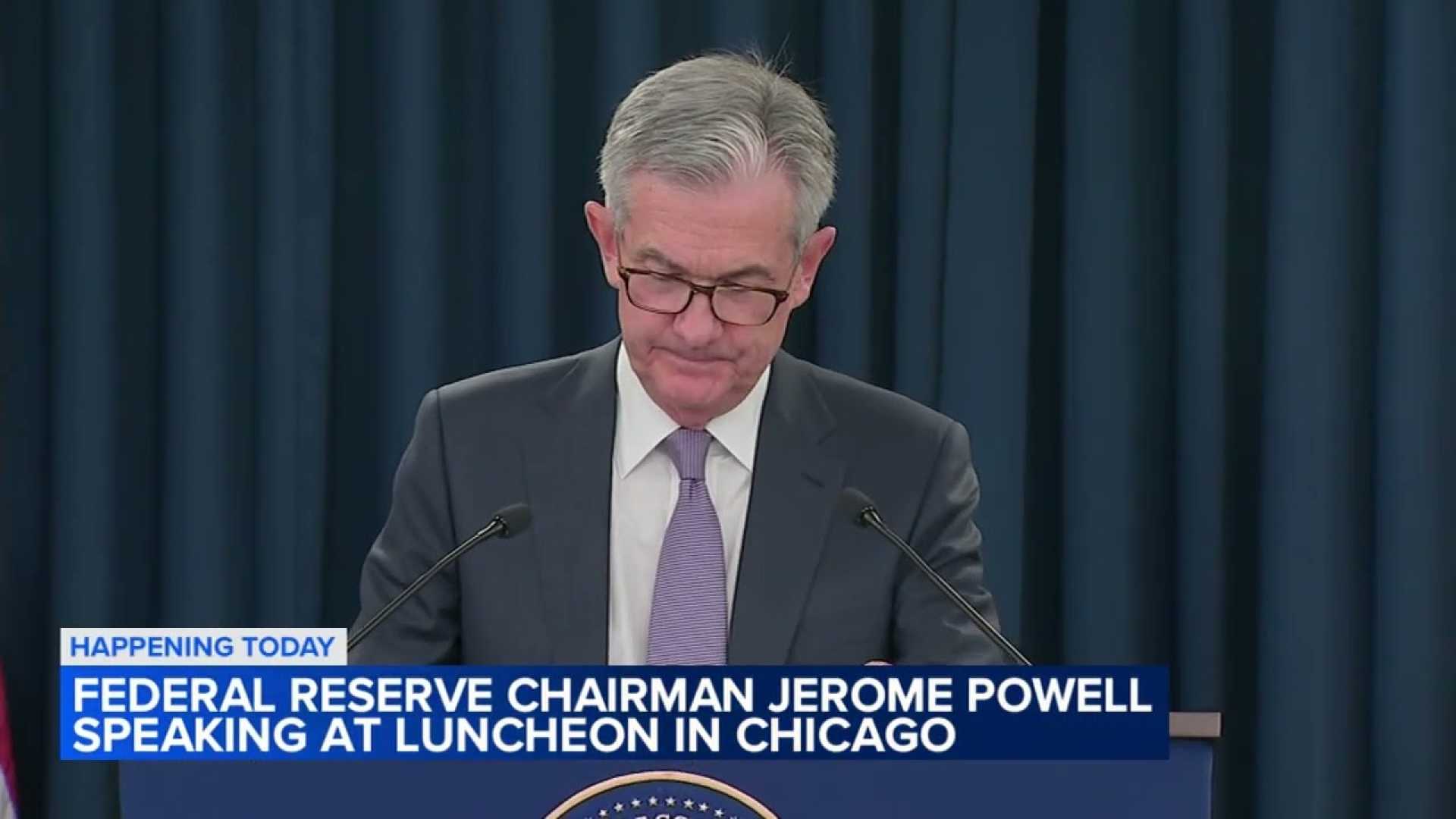

NEW YORK (AP) — Federal Reserve Chairman Jerome Powell will address the economy Wednesday at 1:30 p.m. EDT during a moderated discussion at the Economic Club of Chicago. This marks his second public engagement since President Donald Trump introduced sweeping tariffs on U.S. imports earlier this month.

On April 2, Trump unveiled expansive tariffs, and later, on April 9, he announced a temporary 90-day suspension on some tariffs for select trading partners. At a press conference on Monday, Trump indicated he might consider pausing tariffs related to the auto industry amid heightened inflation fears and market volatility.

These moves have left the economic outlook in flux, with Fed officials grappling over whether to maintain a cautious policy approach or initiate immediate measures in response to rising recession fears. With the Fed typically relying on concrete economic data, the recent uncertainty has provoked a shift in focus toward surveys and sentiment data from consumers and businesses.

Investors are anticipating Powell’s comments for signals on how the Federal Reserve plans to respond to softer economic indicators, particularly ahead of the May 6-7 meeting of the Federal Open Market Committee. “Key phrases like ‘wait and see’ or any mention of inflation may rattle markets,” said financial analyst Mark Williams.

Inflation expectations surged recently, with median expectations for the year climbing from 3.1% in February to 3.6% in March, according to the Federal Reserve Bank of New York‘s April 14 report. Despite these shifts, long-term inflation expectations appear to remain stable, suggesting some resilience in consumer outlook.

Meanwhile, reports from the Society for Advancing Business Editing and Writing noted that the effects of tariff increases are expected to lead to “higher inflation and slower growth,” exerting pressure on the consumer economy.

April retail sales reflected a spending spike as consumers rushed to purchase big-ticket items, particularly vehicles, ahead of impending price increases tied to tariffs. March saw a 1.4% rise in retail sales, rebounding from a 0.2% rise in February, as car dealers saw a 5.3% increase in sales. “Consumers are clearing store shelves and picking up bargains while they can,” explained Christopher Rupkey, chief economist at FWDBonds LLC.

However, the data reflects a spike driven by caution rather than sustainability, with analysts warning that continued tariff effects could dampen economic activity in the upcoming quarters.

“With tariffs taking their toll, price-sensitive consumers are likely to tighten their spending soon,” said Lydia Boussour, senior economist with EY. Recent sentiment indicators show worsening consumer confidence, as shoppers express anxiety over potential job losses and rising costs. In response, many retailers have halted shipments from China and are pausing orders while the tariff landscape remains fluid.

The U.S. has imposed an average tariff of 10% on most countries, with significantly higher levies on China, reaching up to 145%. Tariffs on goods from Canada and Mexico also climbing to 25%. In response, China has retaliated with a 125% tariff on U.S. goods.

Despite a press release detailing temporary tariff exemptions for electronics like smartphones and laptops, analysts remain skeptical about the longevity of these measures.

“Companies are raising prices across the board in anticipation of increased tariffs, which haven’t even fully absorbed into the supply chain yet,” said Ryan Petersen, CEO of logistics company Flexport. “Uncertainty remains a major hurdle for businesses trying to plan investments.”

Greater flexibility in navigating tariff challenges seems likely for major retailers compared to smaller companies, which lack the leverage to absorb additional costs. The upcoming weeks and Powell’s remarks may pivot the course of economic strategy, lending insight into a highly volatile landscape.