Business

Super Micro Computer Faces Stock Turmoil Despite Optimistic Forecasts

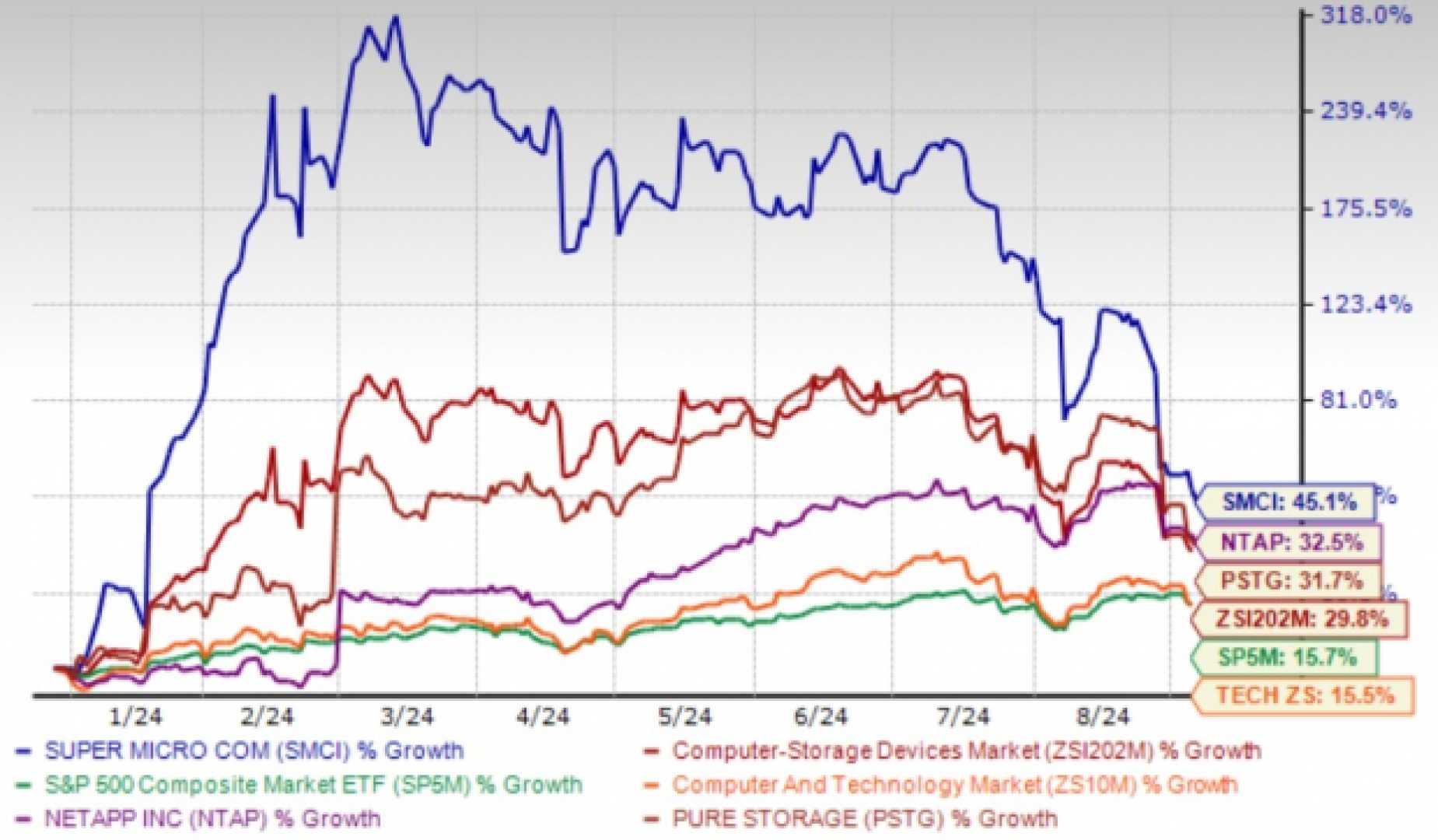

SAN JOSE, Calif. – Super Micro Computer Inc. is experiencing stock volatility, having sharply descended from its 52-week highs. As the company grapples with regulatory challenges, it recently provided optimistic preliminary second-quarter results along with a robust outlook for fiscal 2026. The developments have reignited interest among investors looking for opportunities in a high-growth, AI-centric market.

One of the primary concerns impacting Super Micro’s stock, denoted by ticker SMCI, is its delayed annual report filing. However, CEO Charles Liang addressed investor anxieties head-on on February 11, asserting that the company intends to file its 10-K report for fiscal 2024 and the 10-Q reports for the first two quarters of fiscal 2025 by the February 25 deadline—a key date to avoid potential delisting by Nasdaq. The announcement brought some relief to investors, who had been wary due to the filing delays.

In addition to resolving reporting issues, Super Micro released a robust revenue forecast that anticipates generating $40 billion in revenue for fiscal 2026, significantly outstripping analysts’ predictions. This optimistic projection contributed to a nearly 7% increase in shares during morning trading on February 12.

Despite the upbeat long-term forecast, Super Micro adjusted its revenue guidance downward for fiscal 2025, now estimating a range of $23.5 billion to $25 billion, down from an earlier estimate of $26 billion to $30 billion. Analysts had anticipated revenue of $24.2 billion. The company’s preliminary revenue outlook for Q2 stands between $5.6 billion and $5.7 billion, reflecting a 54% year-over-year increase but falling short of Wall Street expectations.

Furthermore, Super Micro reported anticipated adjusted earnings per share (EPS) of $0.58 to $0.60 for Q2, slightly ahead of last year’s $0.56 but lower than analysts’ expectations of $0.54. The company indicated that margins have faced pressure from various factors, including ongoing efforts to enhance R&D, shifts in product mix, and the ramifications of the delayed 10-K filing.

While the 10-K delay has strained cash flow and influenced market sentiment negatively, Super Micro’s performance has remained robust, largely driven by consistent demand for artificial intelligence (AI)-related products.

Super Micro is positioning itself at the forefront of the AI and cloud storage solutions sector, capitalizing on strong demand for its advanced air-cooled and Direct Liquid Cooling (DLC) AI GPU platforms. AI-related platforms constituted over 70% of Super Micro’s Q2 revenue, indicating AI’s escalating significance in enterprise and cloud computing environments.

With the recent shipment of Nvidia Blackwell products and increased volumes of both air-cooled and liquid-cooled NVIDIA B200 HGX systems, Super Micro is poised to take advantage of growing demand for AI infrastructure. The company has also prepared its NVIDIA GB200 racks, positioning itself as a leader in AI technology.

As Super Micro expands its range of system-building blocks, it aims to deliver upgraded, high-density, and energy-efficient AI solutions. Rising demand from enterprises, cloud service providers, hyperscalers, and government entities further underpins its growth trajectory.

The company is strategically positioned to tap into the burgeoning market for liquid-cooled data center infrastructure, forecasting that over 30% of new data centers globally will adopt liquid-cooling within the coming year, in response to the rapid growth of AI computing. Its long-term investments in DLC technology provide a sustainable competitive edge against its rivals.

Additionally, Super Micro’s DataCenter Building Block Solution (DCBBS) accelerates data center construction and modernization, enhancing its role in the evolving landscape of AI-driven computing.

Investors face a complicated landscape with Super Micro. While the company’s aspirations are promising, its stock remains a high-risk, high-reward investment. Challenges related to regulatory uncertainties and profit margins could stifle its short-term performance. Analysts maintain a cautious outlook, recommending a “Hold” consensus on the stock. Given SMCI’s significant volatility, risk-tolerant investors may find it worth navigating short-term fluctuations for potential long-term gains.

On the date of publication, Amit Singh did not hold positions in any of the securities mentioned in this article. All information and data presented are purely for informational purposes. For more details, please review the Barchart Disclosure Policy.