Business

Will Mortgage Rates Drop Below 6% in 2025? Experts Weigh In

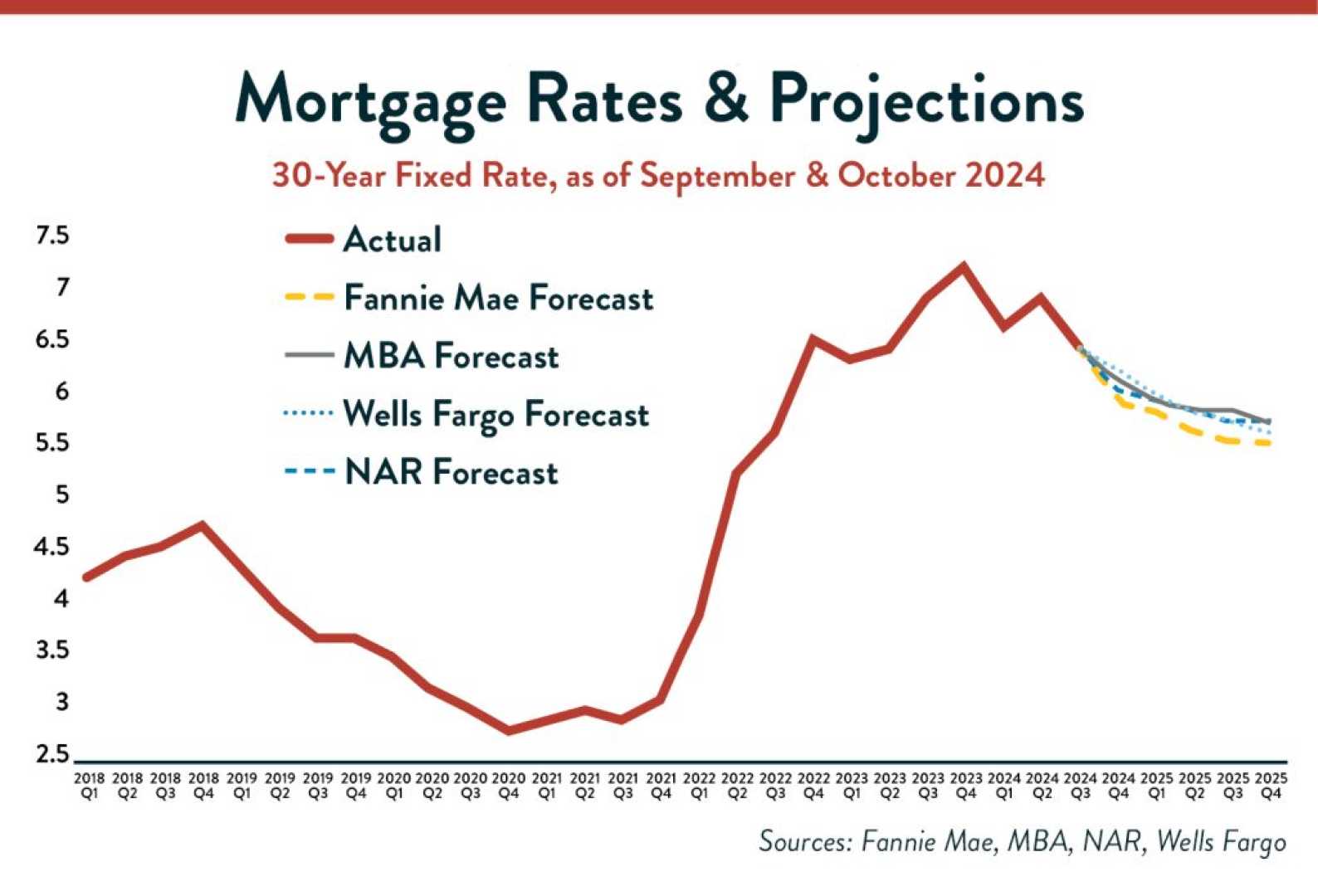

WASHINGTON, D.C. — As the U.S. economy sends mixed signals in early 2024, prospective homebuyers are left wondering whether mortgage rates will finally drop below 6% this year. Inflation has cooled from its 2023 peak but remains above the Federal Reserve‘s 2% target, while interest rates hover between 6% and 7%, forcing many to delay homebuying plans.

Industry experts offer varying predictions on whether mortgage rates will decline. Chris Heller, president of Movoto.com, believes a gradual drop below 6% is possible but cautions it won’t happen overnight. “For rates to fall below 6%, inflation would need to show sustained moderation, prompting the Federal Reserve to ease monetary policy,” Heller said.

However, Emanuel Santa-Donato, senior vice president and chief market analyst at Tomo Mortgage, argues that historical patterns make it unlikely for rates to dip below 6% in 2024. “The U.S. economy has proven resilient despite restrictive monetary policy,” Santa-Donato noted, adding that potential tax cuts under the incoming administration could further reduce the likelihood of significant rate cuts.

Steven Parangi, a licensed mortgage loan originator and owner of Alpine Mortgage Services, offers a middle-ground perspective. “While I’d love to say rates will drop below 6% in 2025, I think it’s a moderate probability and not a certainty,” Parangi said. His view aligns with the Mortgage Bankers Association’s forecast, which predicts rates will remain between 6% and 7% throughout the year.

Several factors could influence mortgage rates in the coming months. A slowing economy might push rates lower, but Parangi warns this isn’t guaranteed. “A mild recession would push rates down as the Fed tries to stimulate growth,” he said. “But it isn’t always good for mortgage rates if it brings market instability or more inflation.”

Supply chain disruptions, global tensions, and a strong job market could also play a role. While robust employment numbers are positive for the economy, they might convince the Fed to keep rates elevated longer. Additionally, persistent inflation remains a key risk. “If inflation doesn’t get under control, the Fed will be forced to keep rates high to prevent inflation from spiking again,” Parangi explained.

Experts advise homebuyers to focus on factors within their control rather than waiting for rate drops. “What matters is finding a home you love at a fair price with an affordable payment,” Heller said. Parangi recommends checking local home inventory, reviewing finances, and considering job security and long-term plans before making a decision.

For those ready to buy, shopping around for rates and loan programs is crucial. “Be prepared to act quickly when the right opportunity comes,” Parangi advised. Building a network of professionals, including local lenders and real estate agents, can also help buyers move swiftly when the time is right.

Ultimately, experts agree that preparation is key to navigating the housing market. “Your success depends more on preparation than prediction,” Heller said. Whether rates drop below 6% or not, taking proactive steps now can position buyers for success in 2025 and beyond.