Business

Labor Market Job Growth Revised Down by 911K, Treasury Yields Increase

WASHINGTON, D.C. — The Labor Department reported Tuesday that job growth has been revised down significantly, revealing the economy may be on shakier ground than previously thought. A preliminary report from the Bureau of Labor Statistics (BLS) showed a downward revision of 911,000 jobs for the year prior to March 2025.

This adjustment is one of the largest ever recorded, exceeding Wall Street’s expectations, which estimated a drop between 600,000 and 1 million jobs. The total revision is more than 50% higher than last year’s adjustments, marking the most significant change since the BLS began tracking these numbers in 2002.

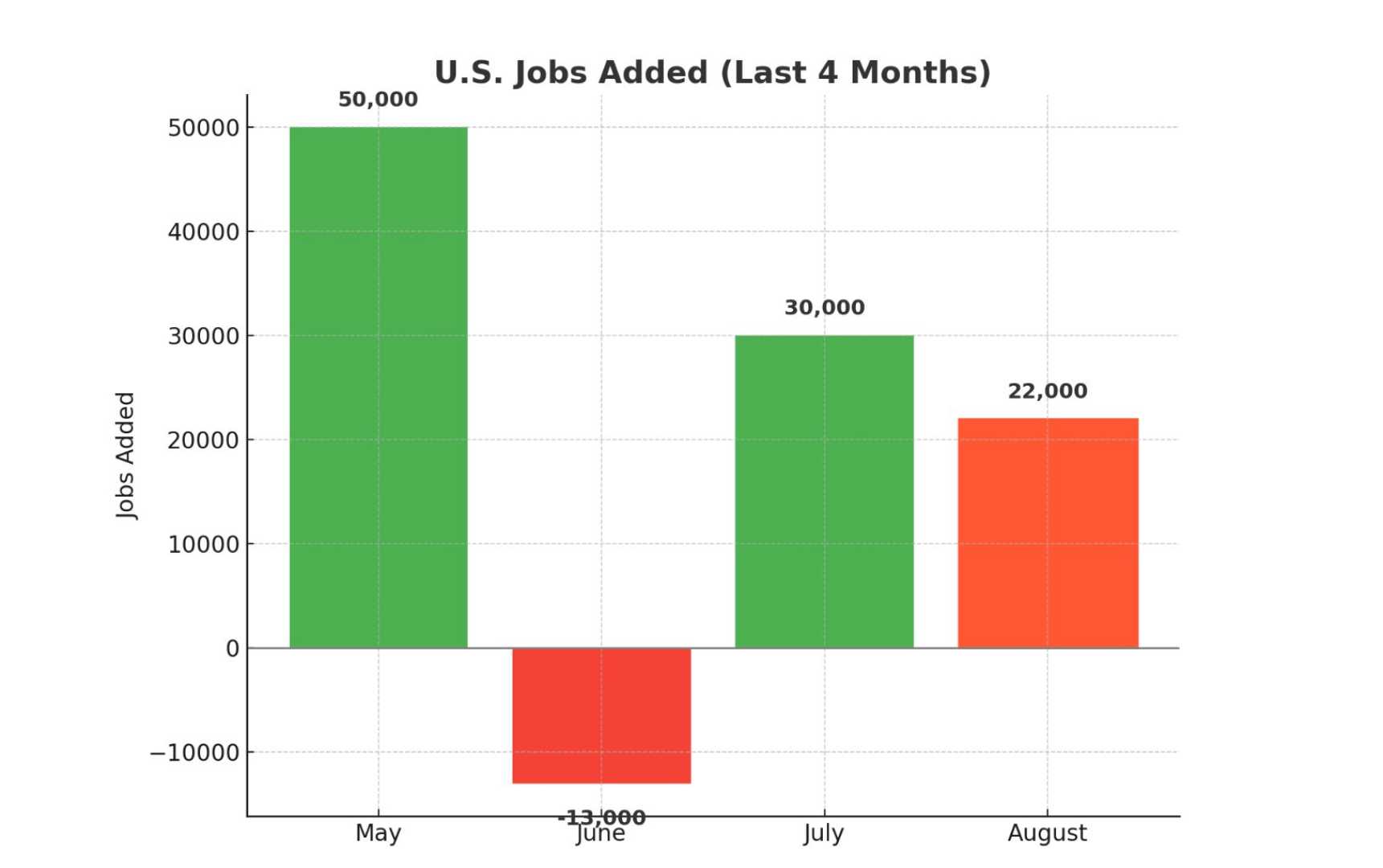

The report suggests that job creation has averaged just 76,000 per month less than earlier reported figures. Oren Klachkin, a market economist at Nationwide Financial, noted that the slower job creation may indicate income growth was also weak before the economic uncertainties emerged in spring 2025.

Many sectors were affected, but the biggest markdowns were seen in leisure and hospitality, which lost 176,000 jobs, professional and business services losing 158,000, and retail trade down by 126,200 jobs. Despite the downward revisions, transportation and warehousing, along with utilities, experienced slight gains.

Treasury yields reacted to the news by erasing early losses and turning higher. The downward adjustments come amid growing scrutiny of the BLS’s data collection practices, following a weak jobs report for July.

After President Joe Biden‘s administration criticized the BLS, former President Donald Trump made headlines by firing the BLS Commissioner and appointing a successor from the Heritage Foundation. Trump stated, “Today, the BLS released the largest downward revision on record proving that President Trump was right: Biden’s economy was a disaster and the BLS is broken,” according to White House press secretary Karoline Leavitt.

The BLS pointed out that these benchmark revisions are distinct from monthly adjustments, which come from ongoing survey data. These annual revisions provide a more complete look at job figures based on comprehensive data sources.

The final benchmark numbers will be released in February 2026, and the implications of these revisions could lead to serious political and economic consequences in the future. Additional signals of a weak labor market could bolster calls for Federal Reserve interest rate cuts.