Business

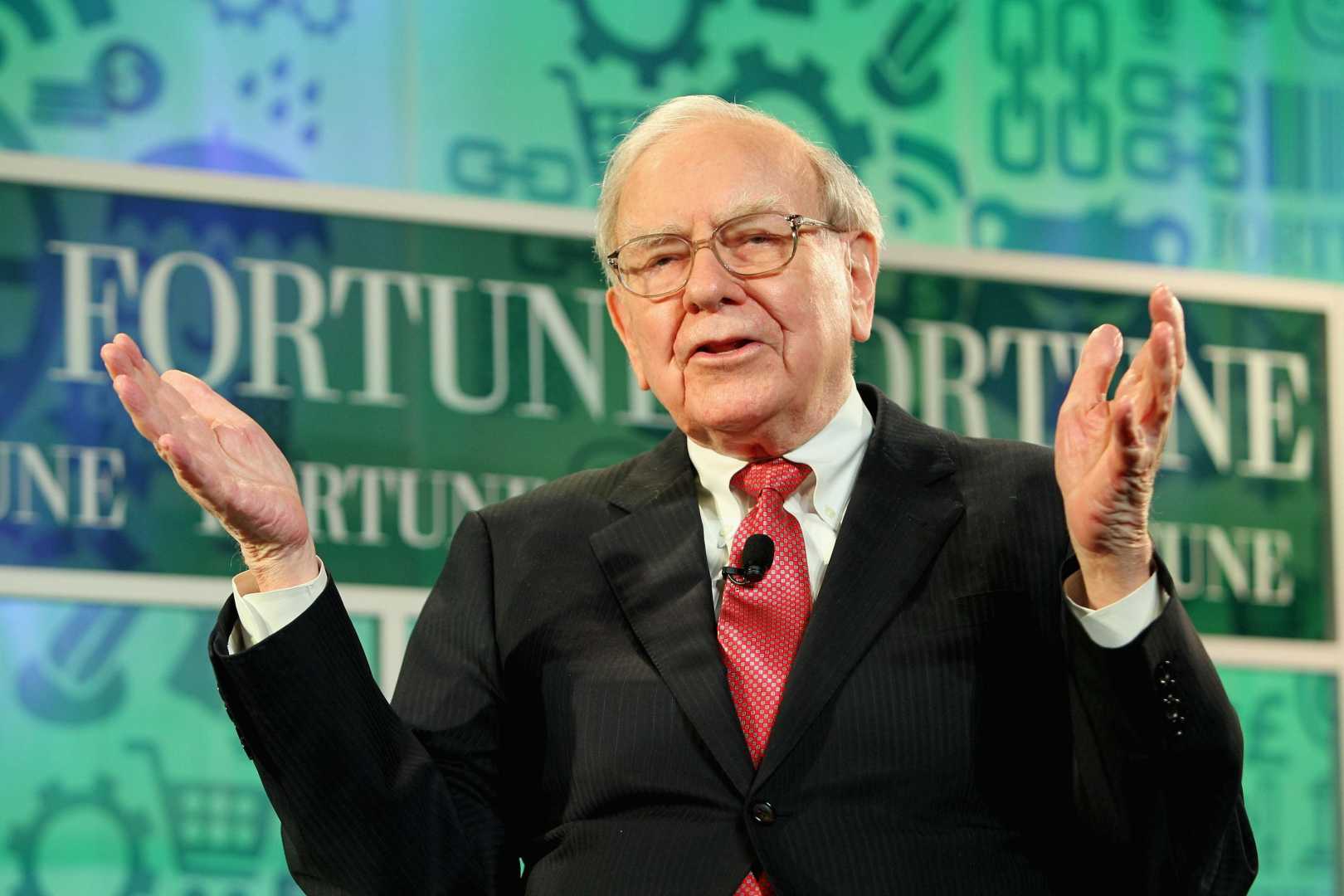

Warren Buffett Plans Increased Charitable Giving Ahead of CEO Transition

Omaha, Nebraska – Warren Buffett, the renowned investor and CEO of Berkshire Hathaway, announced plans to increase the pace of donating his $149 billion estate to his children’s foundations. This strategy, detailed in a letter released on Thanksgiving, aims to ensure his wealth is distributed before alternate trustees take over.

Buffett, who is 95, will pass the reins to Greg Abel, 63, starting in January 2026. In his letter, Buffett expressed a desire to maintain a significant amount of ‘A’ shares until shareholders grow comfortable with Abel. He emphasized that his children fully support Abel’s leadership, alongside Berkshire’s directors.

At the end of the second quarter, Buffett owned approximately $149 billion in Berkshire, making him the largest shareholder. He converted 1,800 of his A shares into 2.7 million B shares, which were donated to four family foundations: The Susan Thompson Buffett Foundation, The Sherwood Foundation, The Howard G. Buffett Foundation, and the NoVo Foundation.

Buffett clarified that his increased giving does not reflect any lack of confidence in Berkshire’s future success. The letter marks his first major communication since the CEO announcement, signaling the end of a prolific six-decade career.

In a personal update, Buffett shared insights about his health, stating, “To my surprise, I generally feel good. Though I move slowly and read with increasing difficulty, I am at the office five days a week where I work with wonderful people.” He has contributed greatly to Berkshire’s transformation from a struggling textile mill to a $1 trillion conglomerate.

Buffett reaffirmed Berkshire’s resilience, indicating it can weather economic downturns better than other companies. With a record $381.6 billion in cash by the end of September, Berkshire maintains a strong financial position.

Despite acknowledging challenges, Buffett emphasized the durability of the company’s underlying businesses. He also mentioned a caution in investments, marking a trend of selling equities for 12 consecutive quarters.

While Berkshire’s stock has shown a 10% increase in 2025, it has underperformed compared to the S&P 500 amid a tech-driven market surge. Buffett urged shareholders not to despair during fluctuating stock prices, assuring them that both the company and America would rebound.