Business

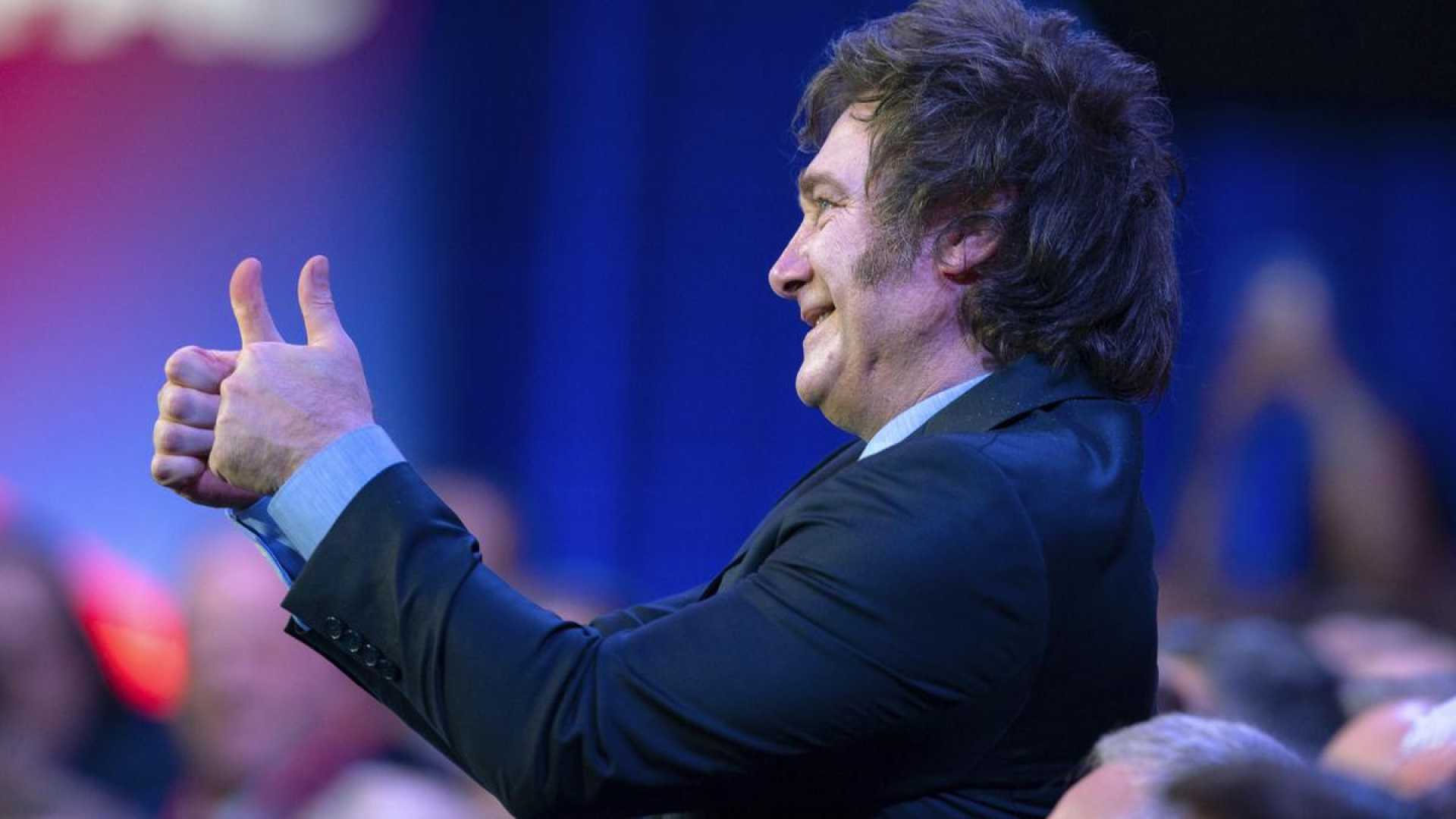

Argentina’s Meme Coin Crisis Sparks Impeachment Calls for President Milei

BUENOS AIRES, Argentina — A sudden collapse in the value of a meme coin has led to calls for impeachment against Argentine President Javier Milei. The crisis unfolded this week after reports revealed that 86% of investors lost approximately $251 million due to the token’s dramatic downturn.

Milei has publicly denied any involvement with the meme coin or its developers and subsequently deleted his original promotional post. Nevertheless, the incident has left many crypto investors frustrated and feeling deceived, drawing parallels to a “rug-pull,” a term used in the industry to describe fraudulent schemes where investors are left with worthless assets.

Experts indicate that scams and fraudulent activities are increasingly common within the meme coin sector. “Everyone’s sick and tired of the meme coins,” said Nic Puckrin, founder of The Coin Bureau. “Sentiment now is probably as low, or probably lower than the FTX collapse,” he added. This sentiment shift comes amid a constant stream of new meme coin launches, often promoted by celebrities, which has led to rampant speculation.

Initially, meme coins emerged as fun community-driven projects. “The initial concept was fun assets that communities could be part of,” Puckrin explained. However, the landscape has dramatically changed, turning into a speculative market attracting more casual investors. “There’s been just a drastic emergence of retail investors who see meme coin trading almost as a new form of gambling,” said Vic Laranja, a content creator.

Market dynamics shifted significantly when Bitcoin exchange-traded funds (ETFs) launched in early 2024, igniting a riskier environment conducive to meme coin trading. Following this, a Solana-based platform called Pump.Fun simplified the minting process, resulting in an explosion of nearly 6 million meme coins by January 2025.

The creation of Pump.Fun did limit some types of scams by standardizing practices. For example, it ensured developers could not mint unlimited tokens, tackling some “honeypot” schemes where investors are unable to sell their holdings. However, it has not eradicated all scams or pump-and-dump schemes that continue to plague the industry.

Adding to this turmoil, allegations were recently brought against one related firm, accused of operating an “evolution of Ponzi and pump-and-dump schemes.” Concerns have also arisen about the content used to promote these tokens. Laranja remarked, “the way that the protocols are set up to launch these meme coins” has exacerbated issues of insider trading and fraudulent behavior.

Additionally, the market’s rapid evolution has prompted reflections on the broader implications of meme coins. Juan Correa, a strategist at BCA Research, noted that their proliferation could detract from investments in more fundamental crypto projects. Puckrin echoed this sentiment, estimating that $6 billion in liquidity has been diverted from the broader crypto ecosystem because of meme coins.

As the meme coin frenzy seemingly continues unabated into 2025, the regulatory path remains murky. The U.S. Securities and Exchange Commission has recently formed a unit aimed at combating cybercrime and blockchain fraud, yet the debate on whether meme coin oversight falls under its jurisdiction persists.

Puckrin emphasized the need for regulatory clarity, stating, “what’s been happening more recently is pure criminality and insider trading.” Despite the current disillusionment, Laranja holds an optimistic view for the future of cryptocurrency. “I think there’s a beautiful future ahead of us, but we need clarity first,” he added, as investor sentiment falters amidst growing uncertainty.