Business

The Art of Crafting a Compelling Business Pitch: Key Components and Best Practices

In the fast-paced world of entrepreneurship, a well-crafted business pitch is essential for securing investments and driving growth. One often overlooked but crucial element of a successful pitch is the budget outline. This financial roadmap is vital for demonstrating the viability and sustainability of a venture from a financial standpoint.

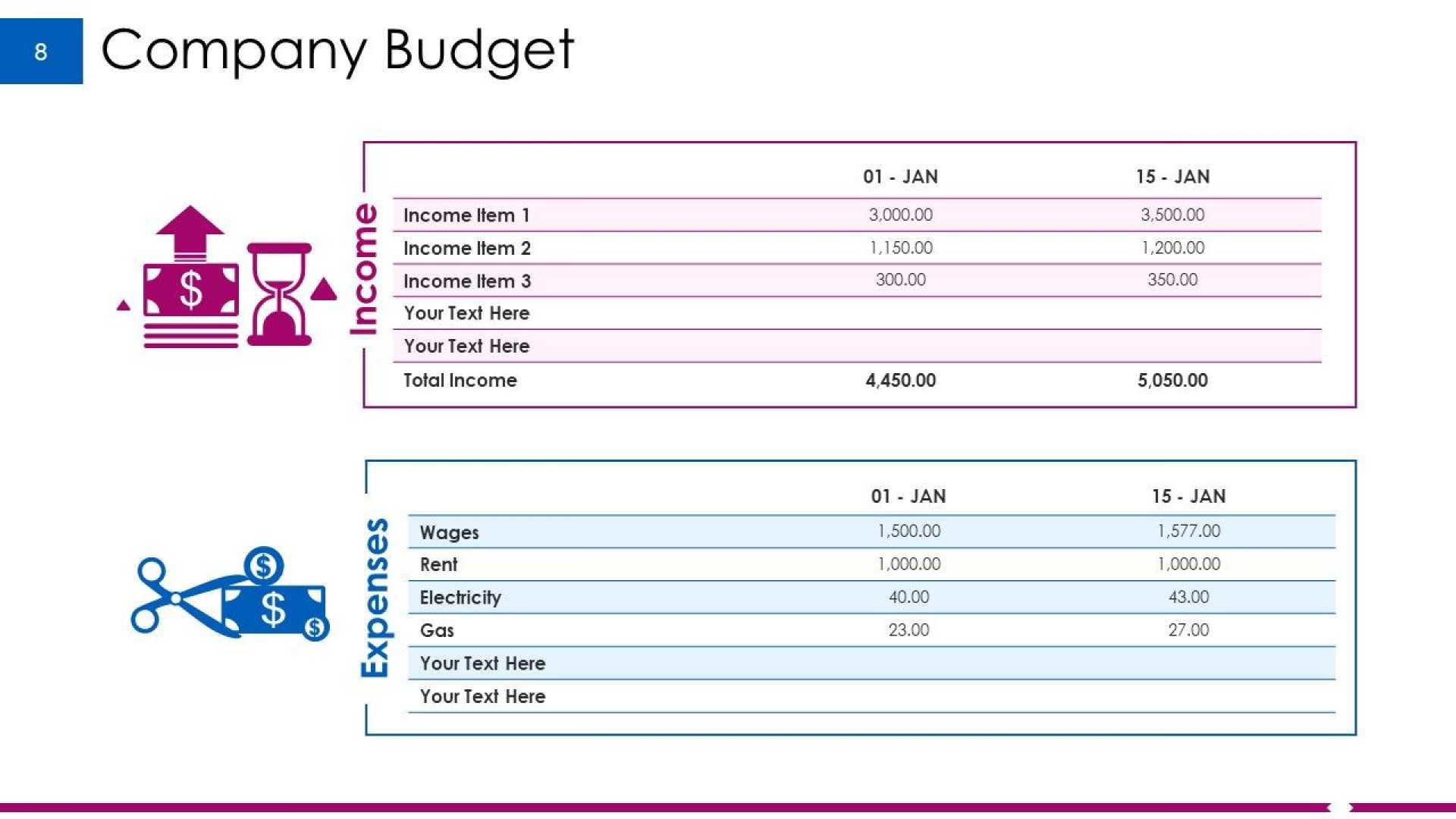

A budget outline serves several critical purposes. First, it provides revenue projections, which are detailed estimates of the income the business expects to generate over a specific period. These projections are typically broken down by product or service lines and help potential investors gauge the potential return on their investment.

Another key component is the expense breakdown, often presented in the form of a profit and loss (P&L) statement. This statement summarizes the revenue, costs, and expenses incurred during a specific period, calculating the net profit or loss and indicating whether the business is financially healthy.

The break-even analysis is also a critical part of the budget outline. It identifies the point at which the business’s total revenue equals its total expenses, helping to determine how much revenue is needed to cover costs and start generating profit.

Capital requirements are another essential aspect, outlining the amount of funding needed to start and sustain the business. This includes initial startup costs and ongoing working capital needs, providing investors with a clear understanding of how their capital will be utilized.

Return on investment (ROI) projections are also vital, as they estimate the potential return that investors can expect from their investment. This demonstrates the entrepreneur’s commitment to providing a lucrative opportunity for investors.

Finally, a budget outline should include contingency plans for unexpected financial challenges. These plans show that the entrepreneur is prepared for the uncertainties of business and can adapt to changing circumstances.

Incorporating a timeline that aligns the budget with the business’s milestones and goals can provide a clear picture of when certain financial targets will be achieved. This comprehensive approach ensures a convincing and efficient presentation of the business plan).