Business

Bitcoin’s Potential Surge Amidst US Election and Economic Indicators

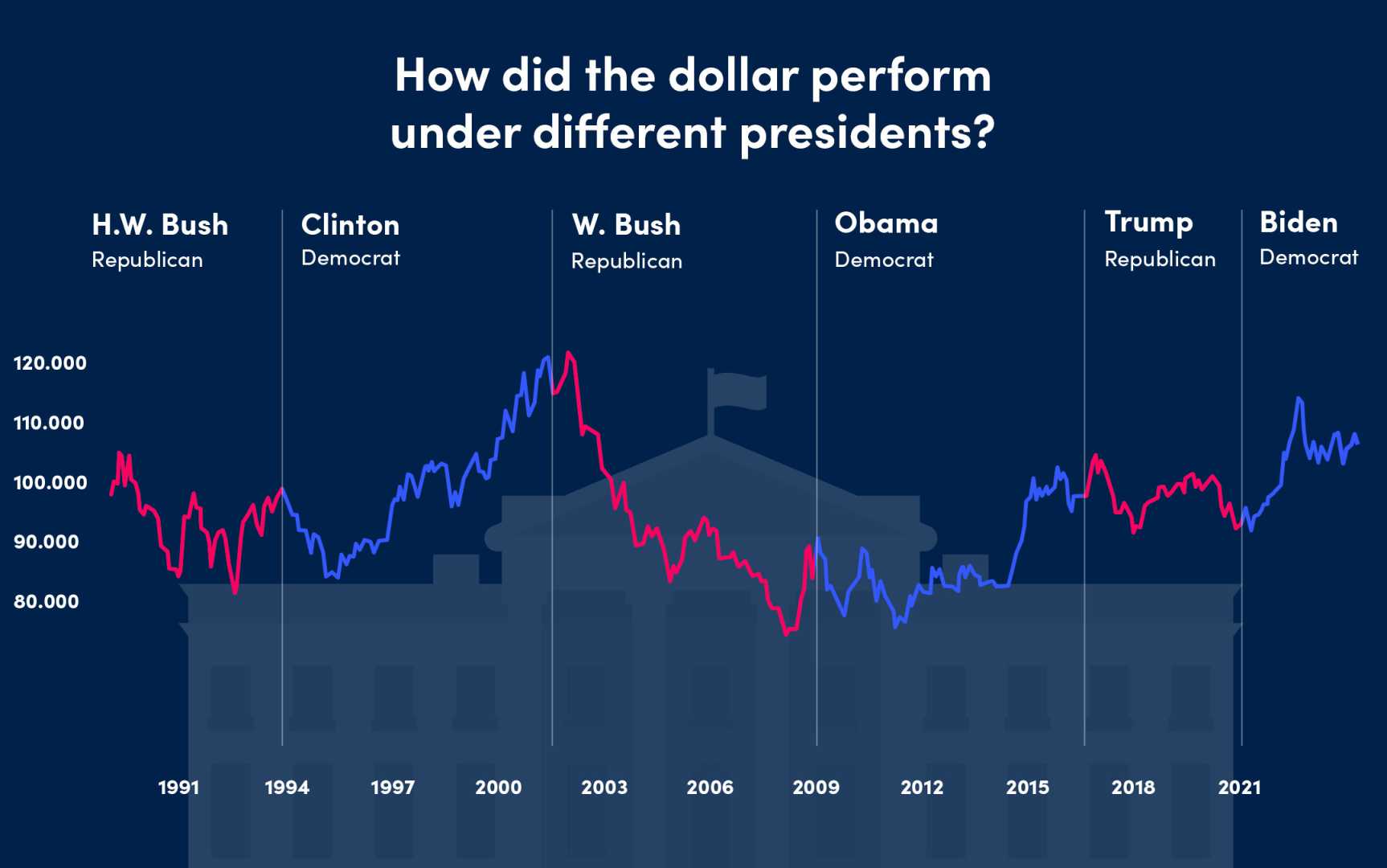

As the US presidential election approaches, analysts and investors are closely watching the potential impact on Bitcoin‘s price. According to Matthew Sigel, head of digital assets research at VanEck, the current setup for Bitcoin is very bullish heading into the election. Sigel highlighted on CNBC‘s ‘Squawk Box‘ that the combination of a potential Republican victory, which could be more favorable to cryptocurrencies, and anticipated interest rate reductions by the Federal Reserve, could drive Bitcoin’s price upward.

Historical data suggests that Bitcoin has often reached new all-time highs during previous US election cycles. A recent analysis using AI and historical data predicts that Bitcoin could break its all-time high within 5-12 days after the 2024 election, with an average of around 8 days. This prediction is based on cyclical patterns observed in previous election seasons.

However, economic indicators such as the copper-to-gold ratio are raising cautionary signals. The copper-to-gold ratio, which is seen as a barometer for global economic conditions and investor risk tolerance, has been declining. This downward trend, particularly since China‘s stimulus announcements, suggests potential economic weakness and could impact risk assets like Bitcoin. Historically, Bitcoin’s most successful years have coincided with copper outperforming gold, which is not the current scenario.

Despite these economic concerns, many analysts remain optimistic about Bitcoin’s short-term and long-term prospects. Standard Chartered has predicted that Bitcoin could reach fresh all-time highs by the end of the year, regardless of the election outcome. In a scenario where Donald Trump wins, some predictions suggest Bitcoin could rise to $125,000, while a victory for Kamala Harris might still see Bitcoin reach around $75,000.

The institutional support for Bitcoin is also a positive factor. Major institutions like BlackRock have been aggressively buying Bitcoin, with BlackRock’s Bitcoin ETF now holding over 400,000 Bitcoins. This institutional buying activity is seen as a bullish sign for the cryptocurrency).