Business

Circuit Breakers: Emergency Measures to Prevent Stock Market Panic

NEW YORK, N.Y. — In response to extreme market volatility, financial exchanges employ a mechanism known as circuit breakers to temporarily suspend trading. This emergency measure is designed to prevent panic-selling during significant market downturns. For example, just moments after opening on March 9, 2020, the S&P 500 index fell 7%, triggering the first circuit breaker of the day.

Circuit breakers act as a regulatory safeguard, providing investors with a crucial cooling-off period when markets decline sharply. Established after the stock market crash of 1987, also known as Black Monday, these mechanisms halt trading when the market or individual securities drop past specific thresholds. They interrupt what could devolve into chaos, giving traders a moment to assess information and avoid irrational decisions.

“Circuit breakers offer a vital tool to curtail cascading sell-offs that can worsen market conditions,” said financial analyst Lisa Tran. “Their role is increasingly critical in a time marked by rapid market changes.”

For instance, on March 9, 2020, the S&P 500’s 7% dive less than an hour after market open set off a chain of halts. Federal regulators instituted these safeguards to restore order in tumultuous market environments. Since their introduction, researchers have noted that circuit breakers tend to reduce panic and provide necessary stabilization.

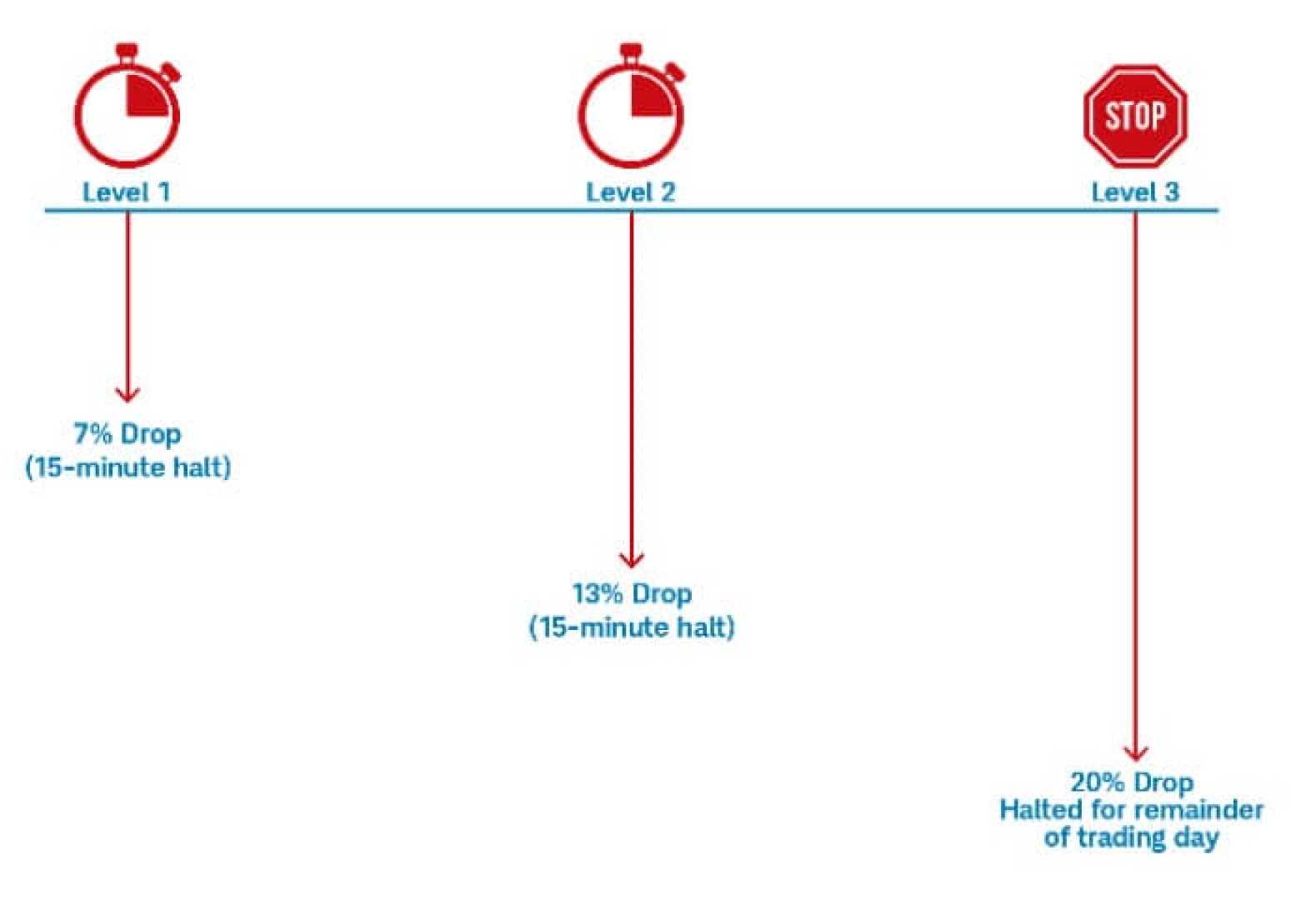

There are three levels of market-wide circuit breakers based on the decline of the S&P 500: a Level 1 decline of 7% triggers a 15-minute halt, Level 2 at 13% triggers an additional 15-minute halt, and Level 3 at 20% results in the cessation of trading for the remainder of the day. This approach allows traders to digest information without making hasty decisions.

Circuit breakers do not only apply to the broad market; individual stocks can also have their own trading halts. For instance, if an individual security moves outside predetermine price bands within five minutes, trading may be paused for five minutes.

Initially introduced on a market-wide basis after the catastrophic 1987 crash, the system received a significant revamping after a brief but severe market plunge referred to as the Flash Crash in 2010. In that event, the Dow Jones Industrial Average lost nearly 1,000 points in just 10 minutes before retaliating, igniting discussions among regulators about the effectiveness of existing structures.

Regulatory bodies have continuously monitored the efficacy of these breakers, as critics have raised concerns regarding unexpected consequences. Some argue that the existence of circuit breakers can lead to a magnet effect that encourages traders to accelerate selling when approaching a threshold, thus ironically undermining their intended stabilizing function.

“The fundamental idea is to help stabilize the market,” said economist Eric Fenton. “But the implementation can create paradoxical outcomes where traders might actually push prices toward the trigger point.”

Despite the critiques, supporters argue that circuit breakers have largely succeeded in maintaining order within stock exchanges. Notable absences of severe market failures since their implementation suggest they effectively mitigate risk and promote stability during crises.

On August 5, 2024, the Japanese Nikkei index experienced a significant decline of 12% in a single day, sparking sell-offs across global markets. Notably, the S&P 500 responded with a more modest drop of 3%, insufficient to trigger circuit breakers. It reflects modern markets’ increased robustness since the introduction of these financial fail-safes.

“Market dynamics today are far more controlled thanks to these mechanisms,” added financial educator Naomi Lu. “It allows us to pause and think rather than just react in panic mode.”

While circuit breakers are far from perfect, they represent a crucial component of modern financial trading, balancing the tension between market responsiveness and stability.