Politics

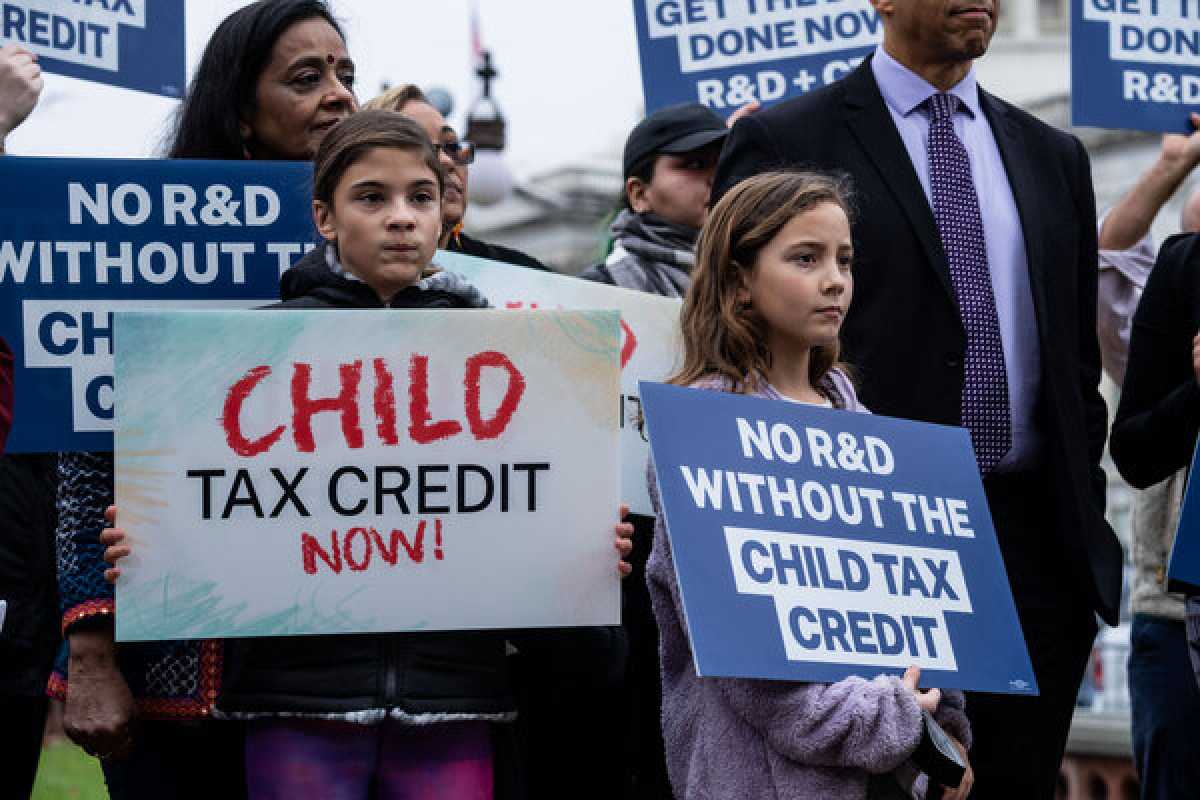

Congressional Negotiators Reach Agreement on Expanding Child Tax Credit

Congressional negotiators have announced a breakthrough in the expansion of the federal child tax credit, a move that could benefit low-income parents. The $80 billion deal, reached by Senate Finance Committee Chairman Ron Wyden (D-Ore.) and House Ways and Means Committee Chairman Jason T. Smith (R-Mo.), aims to make the program more generous, particularly for those in need, starting as early as this year.

Months of negotiations led to this bipartisan agreement, which comes as a positive step towards enhancing the existing child tax credit, a major priority for Democrats. In order to ensure the passage of the bill, Republicans also secured the continuation of several business tax breaks, aligning with their interests.

However, the path to passing a bill remains uncertain, given the potential reluctance of House Republicans to give President [Name] a victory on one of his key domestic economic policy endeavors. The expanded child tax credit was a central element of President [Name]’s 2021 American Rescue Plan.

“Fifteen million kids from low-income families will benefit from this plan, and considering the current challenging political climate, it is a significant achievement to have the opportunity to pass pro-family policies that uplifts so many children,” stated Chairman Wyden.

A notable aspect behind this deal is the substantial bipartisan support for both provisions across parties. The credit was initially expanded in the 2017 tax cut legislation by Republicans, and even some progressive economists advocate for the business provisions.