Business

Core Inflation Slows to 3.2% in December, Easing Price Pressures

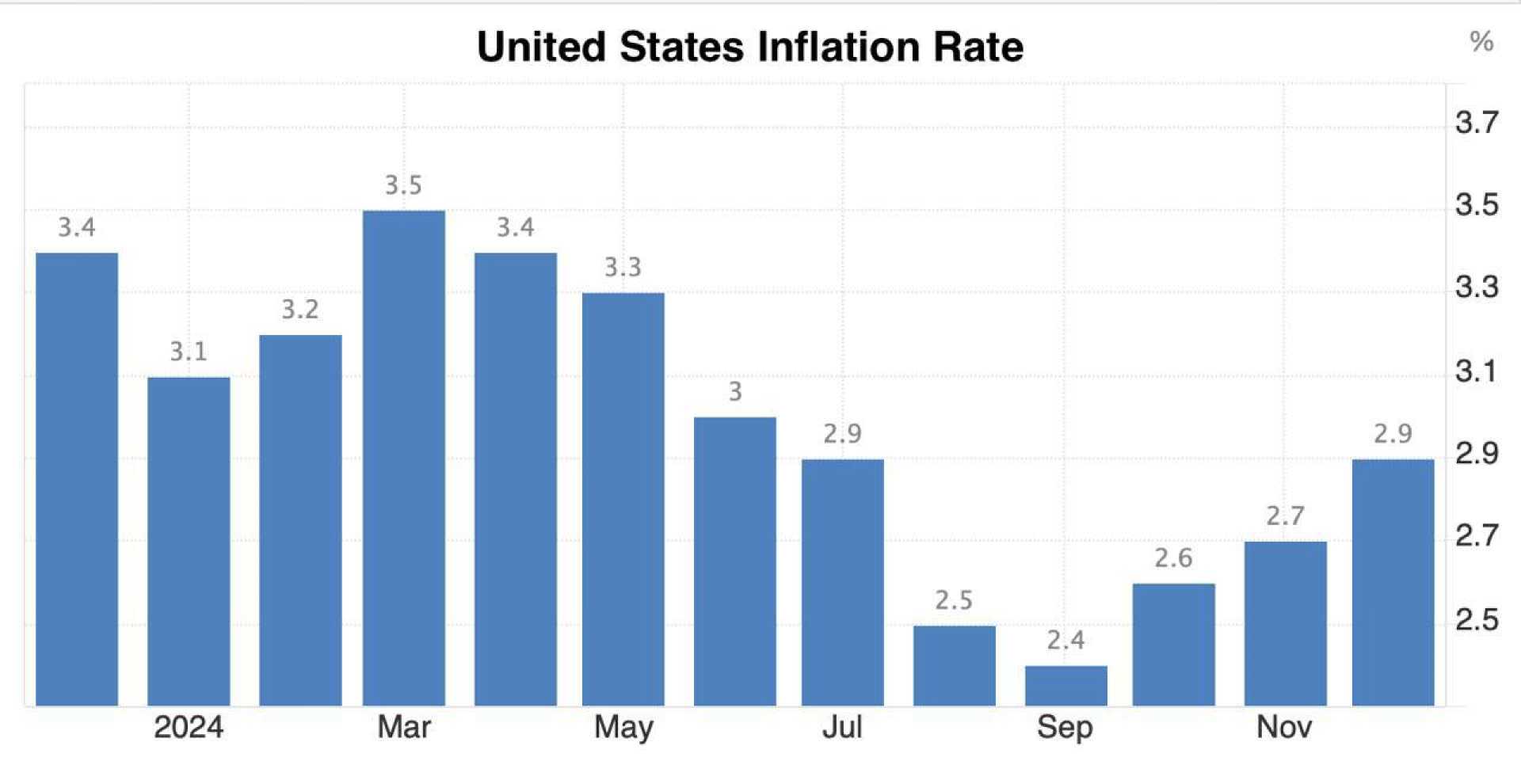

WASHINGTON (AP) — U.S. inflation showed signs of easing in December, with the core consumer price index (CPI) rising 3.2% annually, slightly below expectations, according to data released Wednesday by the Bureau of Labor Statistics. The monthly increase of 0.4% in overall prices, driven largely by energy costs, brought the 12-month inflation rate to 2.9%, matching forecasts.

The core CPI, which excludes volatile food and energy prices, rose 0.2% month-over-month, 0.1 percentage point less than anticipated. Economists had predicted a 3.3% annual core rate, but the actual figure marked a modest improvement from November’s 3.3% reading. Energy prices surged 2.6% in December, with gasoline prices jumping 4.4%, accounting for 40% of the overall CPI increase.

Shelter costs, a significant component of the CPI, rose 0.3% for the month and 4.6% annually, the smallest yearly gain since January 2022. Food prices increased 0.3% monthly and 2.5% year-over-year, while energy prices fell 0.5% annually. Services prices excluding rents rose 4% from a year ago, the slowest pace since February 2024.

“Today’s CPI may help the Fed feel a little more dovish,” said Ellen Zentner, chief economic strategist at Morgan Stanley Wealth Management. “It won’t change expectations for a pause later this month, but it should curb some of the talk about the Fed potentially raising rates.”

Despite the encouraging data, inflation-adjusted hourly earnings fell 0.2% in December, leaving the year-over-year gain at just 1%. Used car and truck prices jumped 1.2%, while new vehicle prices rose 0.5%. Transportation services surged 0.5% monthly and 7.3% annually, and egg prices climbed 3.2%, bringing their annual increase to 36.8%.

“The inflation rate is currently grappling with a ‘last mile’ problem, where progress in reducing price pressures has slowed,” said Sung Won Sohn, a professor at Loyola Marymount University and chief economist at SS Economics. “Key drivers of inflation, including gas, food, vehicles, and shelter, remain persistent challenges.”

The Federal Reserve, which targets a 2% inflation rate, is expected to hold interest rates steady at its upcoming policy meeting. Futures pricing suggests a near certainty of no rate change in January, with markets anticipating potential rate cuts later in the year. The Fed’s preferred inflation gauge, the personal consumption expenditures (PCE) price index, is expected to show a 0.2% monthly increase in December, keeping the annual rate at 2.8%.

The December CPI report follows a stronger-than-expected jobs report, which raised concerns about prolonged inflationary pressures. However, the latest data suggests inflation is not reaccelerating, offering some relief to policymakers and investors.