Business

Costco Beats Q1 Earnings and Revenue Estimates, Posts Strong Fiscal 2025 First Quarter Results

Costco Wholesale Corporation (COST) has reported strong results for the first quarter of its fiscal year 2025, exceeding both earnings and revenue estimates. The company announced quarterly earnings of $3.82 per share, surpassing the Zacks Consensus Estimate of $3.79 per share. This represents an earnings surprise of 0.79% and marks the fourth consecutive quarter where Costco has beaten consensus EPS estimates.

Revenue for the quarter ended November 2024 was $62.15 billion, which also surpassed the Zacks Consensus Estimate by 0.17%. This figure is up from $57.8 billion in the same period last year, reflecting a 7.5% increase in net sales to $60.99 billion.

The company’s performance was driven by positive comparable sales growth across all regions, including the U.S. (5.2%), Canada (5.8%), and Other International (4.7%), with an overall adjusted total company growth of 7.1%. Additionally, e-commerce sales saw a robust growth of 13.0%.

Costco’s net income rose to $1,798 million ($4.04 per diluted share) from $1,589 million ($3.58 per diluted share) in the previous year, including a tax benefit related to stock-based compensation. The company currently operates 897 warehouses globally and maintains e-commerce operations in 8 markets.

The strong earnings report has been reflected in the stock’s performance, with Costco shares adding about 50.7% since the beginning of the year, outpacing the S&P 500’s gain of 27.6%. The stock traded up $2.50 during mid-day trading on Thursday, reaching $997.19.

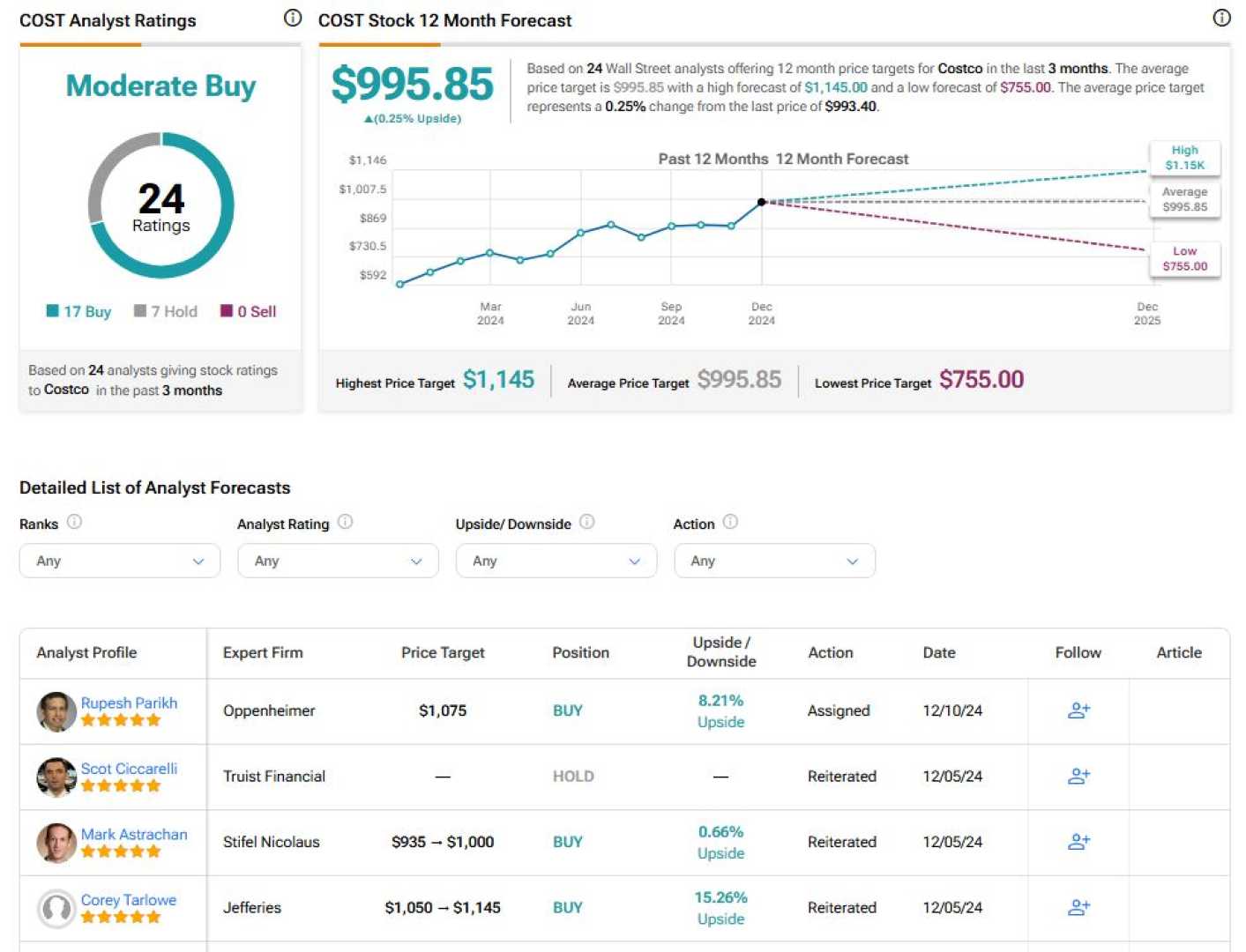

Analysts have generally maintained a positive outlook on Costco, with several firms raising their price targets. For example, Jefferies Financial Group lifted their price objective from $1,050.00 to $1,145.00, and BMO Capital Markets raised their target from $980.00 to $1,075.00, both maintaining a “buy” or “outperform” rating.