Business

Energy Stocks Offer High Yields and Value as S&P 500 Nears Record High

HOUSTON, Texas – As the S&P 500 inches closer to a record high, energy stocks like ConocoPhillips, Kinder Morgan, and Phillips 66 are emerging as attractive options for value and passive-income investors. With inexpensive valuations and yields exceeding 3%, these companies are poised to deliver strong returns in 2025.

ConocoPhillips, the largest U.S.-based independent exploration and production company, has seen significant growth in recent years. The company completed its acquisition of Marathon Oil in November 2024, marking 2025 as the first full year of results post-acquisition. ConocoPhillips boasts a highly efficient production portfolio, with a breakeven free cash flow (FCF) in the low $40s per barrel of oil equivalent (boe). The company currently offers a solid yield of 3.1% and expects dividend growth to outpace the S&P 500 average. A $1,000 investment in ConocoPhillips could generate approximately $31 in passive income in 2025.

Kinder Morgan, a midstream energy company, has surged in value due to growing earnings and a shift in investor sentiment. The company operates critical infrastructure, including pipelines and storage facilities, connecting hydrocarbon production to processing and distribution. With a yield of 4.1%, a $1,000 investment in Kinder Morgan could yield about $41 in passive income this year. The stock remains undervalued, with a price-to-earnings (P/E) ratio of 24.4 and a price-to-FCF ratio of 15.7.

Phillips 66, a downstream and midstream energy company, focuses on refining crude oil into products like gasoline and aviation fuel. Despite industry challenges, Phillips 66 maintains a strong dividend yield of 4%, with a $1,000 investment expected to generate $40 in passive income in 2025. The company’s P/E ratio of 14.8 and forward P/E of 12.4 make it an affordable option for investors.

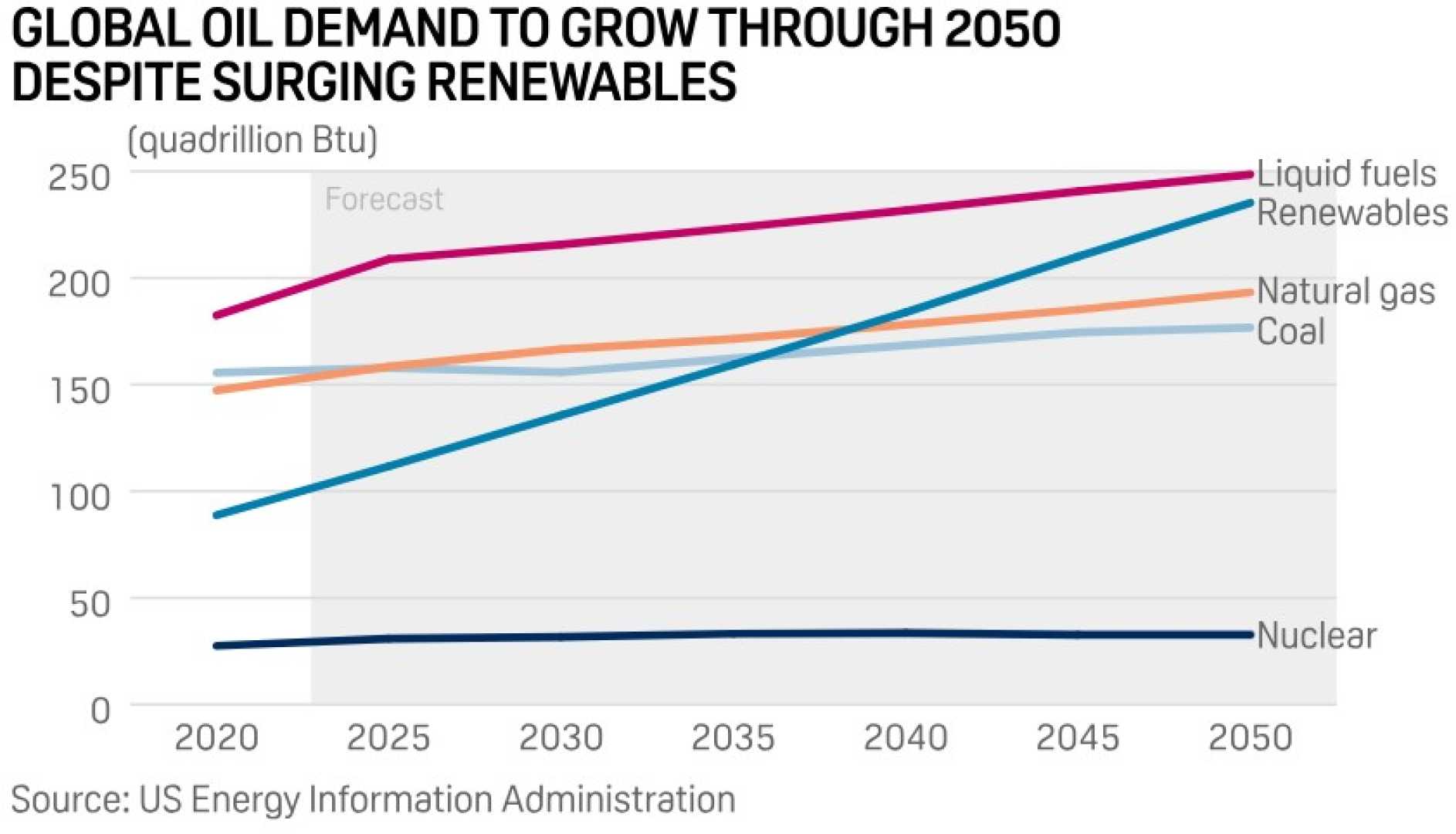

These energy stocks offer a compelling combination of value and income potential, particularly for investors seeking stability in a volatile market. With oil and gas expected to remain key components of the global energy mix, ConocoPhillips, Kinder Morgan, and Phillips 66 are well-positioned for long-term growth.