Business

European Stocks Surge as Valuations Attract Investors Amid Optimism

FRANKFURT, Germany — European stock markets are experiencing a notable resurgence in 2025, revitalized after years of underwhelming performance. The German DAX index has surged nearly 17% year to date, while France’s CAC 40 has risen 11.5% and Britain’s FTSE 100 has increased by nearly 9%. In stark contrast, the S&P 500 has barely climbed, gaining less than 1% since January.

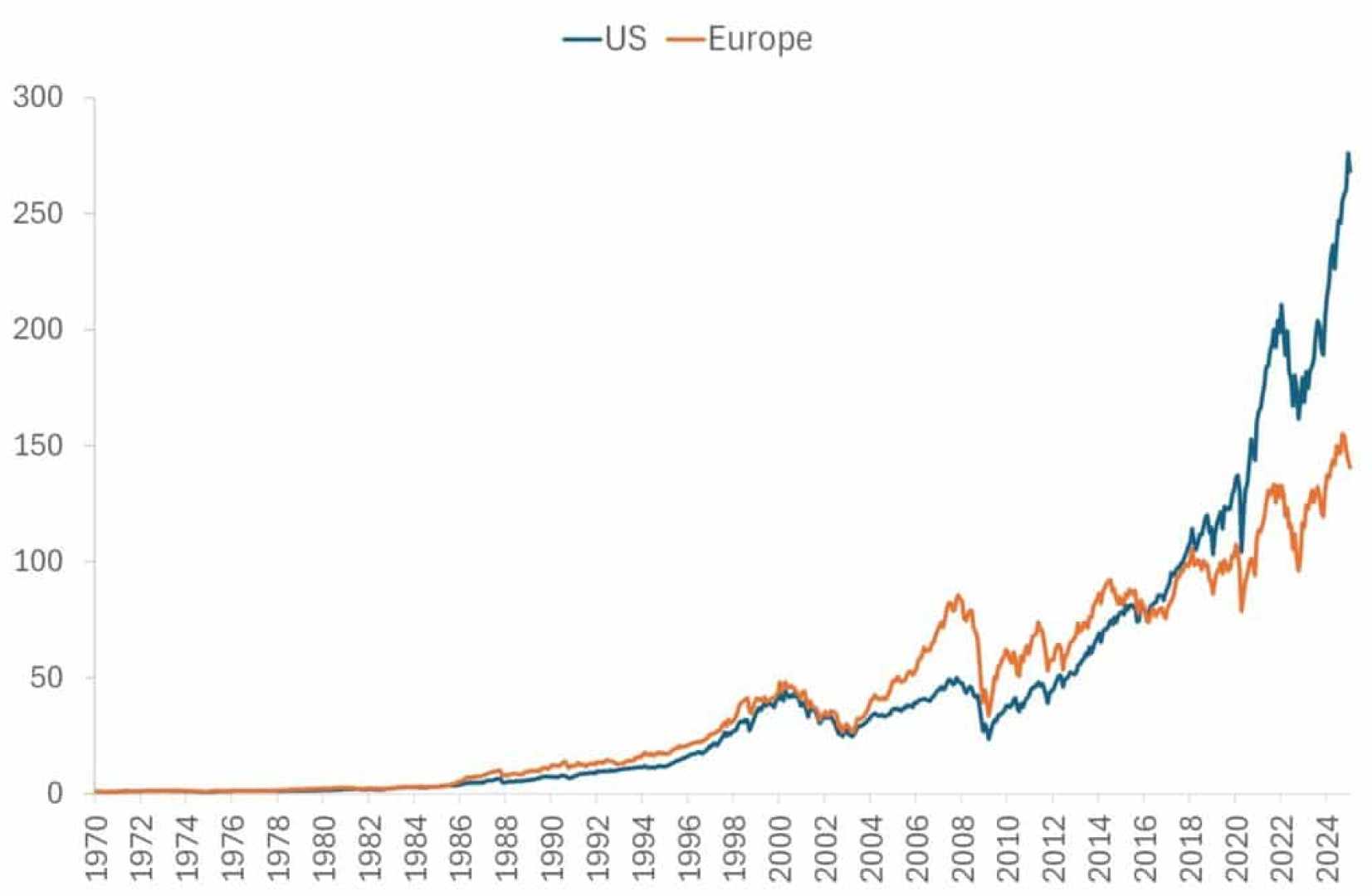

According to a recent report by Morgan Stanley, such significant outperformance by European equities compared to U.S. stocks has not occurred since 2000. Currently, the forward price-to-earnings ratio for the MSCI Europe Index stands at just 14 times earnings, markedly lower than American stocks’ 22 times, highlighting the widest valuation gap seen in decades. This disparity has prompted many investors to pivot toward Europe in search of better returns amidst concerns about U.S. stock valuations and an uncertain economic outlook.

“European stocks are looking attractively priced compared to their American counterparts,” said an analyst from Morgan Stanley, emphasizing the potential for earnings growth in the region.

In addition to valuation factors, geopolitical developments may also be influencing investor sentiment. The ongoing conflict in Ukraine is seen by some analysts as nearing a potential resolution, which could significantly bolster European markets. The World Bank estimates reconstruction efforts in Ukraine may require nearly $500 billion over the next decade, signaling future investment opportunities.

Should the war come to an end, it could also restore natural gas supplies from Russia, helping to decrease energy costs and alleviate inflation across Europe.

Furthermore, defense stocks have been buoyed by a shift in European nations’ defense spending, a reaction to comments from the Trump administration regarding NATO allies. As these leaders contemplate bolstering military budgets, investor confidence in defense sectors has increased.

Europe’s economic landscape is showing signs of improvement after years of stagnation. Recent Purchasing Manager Index (PMI) reports indicate that both manufacturing and service sectors are recovering, fostering optimism regarding corporate earnings growth. According to LSEG Data & Analytics, European mergers and acquisitions (M&A) activity rose over 20% year-over-year in the first two months of 2025.

Analysts foresee a more supportive monetary policy in Europe compared with the U.S., where expectations for interest rate cuts have been considerably tempered this year. Investment strategies focused on stimulus measures, whether through increased defense spending or support for Ukraine’s reconstruction, aim to reignite the European economy.

“There’s potential for renewed fiscal spending post-German elections, and a stronger push from European governments to deregulate could stimulate growth significantly,” said Peter Oppenheimer, chief global equity strategist at Goldman Sachs Research.

Despite this optimism, caution remains due to uncertainties surrounding U.S. foreign policy and its implications on global alliances. Analysts from Morgan Stanley stress that President Trump’s approach to Russia and the Ukraine conflict could hint at a multi-generational shift in global dynamics, leaving markets to grapple with substantial uncertainties.

As investment landscapes shift, many will be closely monitoring the developments overseas, weighing opportunities against potential geopolitical risks.