Business

Federal Reserve Expected to Cut Interest Rates Twice in 2025

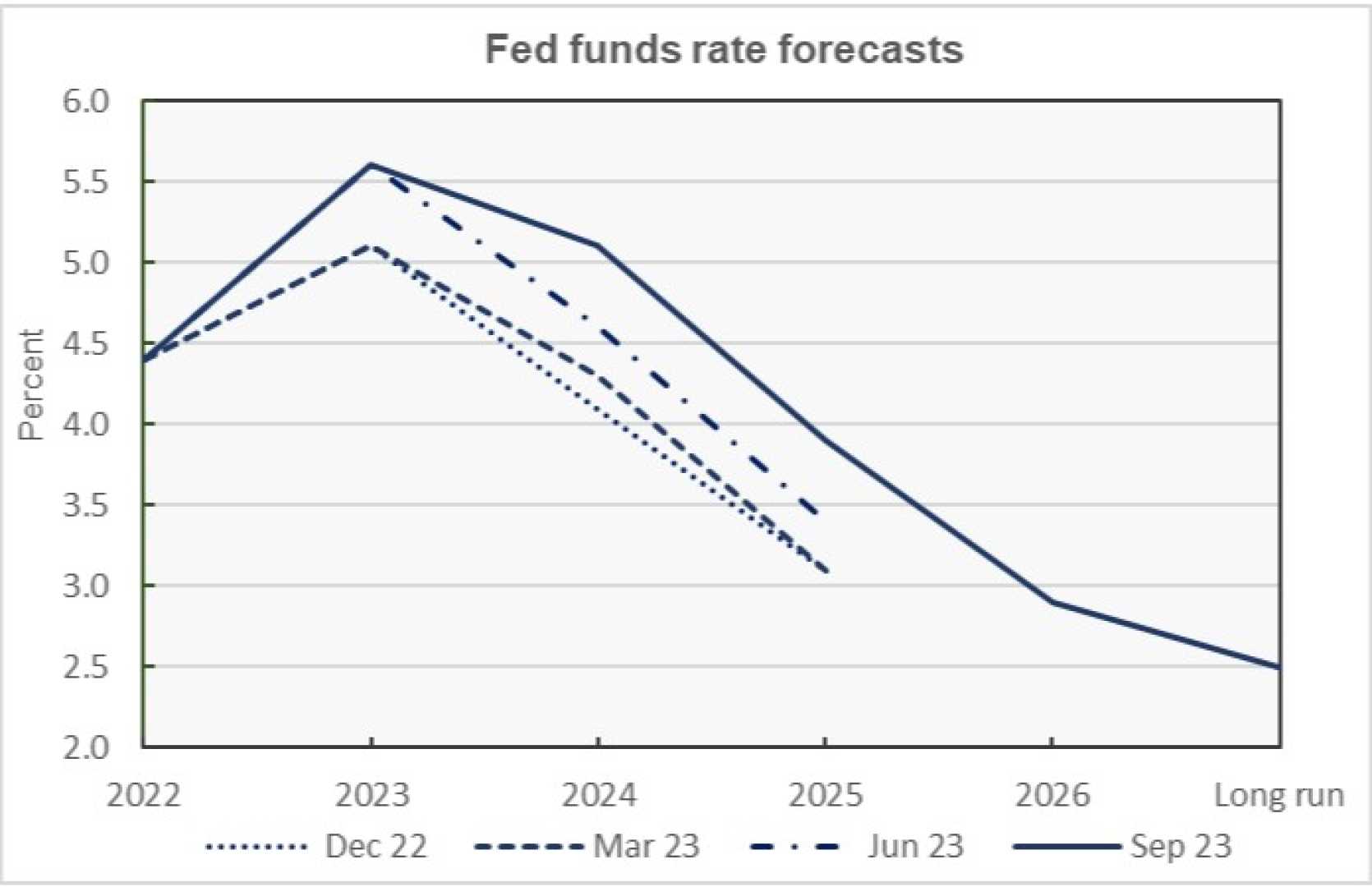

Fixed income markets anticipate that the Federal Reserve will cut interest rates twice in 2025, with short-term rates expected to end the year close to 4%, down from the current range of 4.25% to 4.5%. This forecast, based on December 2024 projections, assumes steady economic growth, unemployment slightly above 4%, and inflation near 2.5% by year-end.

The Federal Open Market Committee (FOMC) is scheduled to meet eight times in 2025, with the first decision on January 29 likely to hold rates steady. The next potential cut could come on March 19, followed by possible reductions in July or September. The second half of the year remains less predictable, with outcomes ranging from no change to up to five cuts, though two reductions are the most likely scenario.

“The FOMC emphasizes that interest rate decisions are data-dependent,” said a senior financial analyst. “With inflation easing from elevated levels, the committee appears comfortable with the current rate trajectory.”

Unemployment, which stood at 4.2% in November 2024, is expected to remain stable, with any increases likely to be gradual. A sharp rise in unemployment could prompt more aggressive rate cuts. Inflation will also be closely monitored, with most forecasts predicting it will remain near 2.5% in 2025. If inflation accelerates, the FOMC may reconsider its stance, though such a scenario is not currently anticipated.

Overall, the Federal Reserve’s cautious approach reflects a balancing act between supporting economic growth and managing inflation. While two rate cuts are the baseline expectation, the outlook could shift depending on economic performance in the coming months.