News

Georgia Tax Refunds Roll Out Gradually; Many Still Waiting

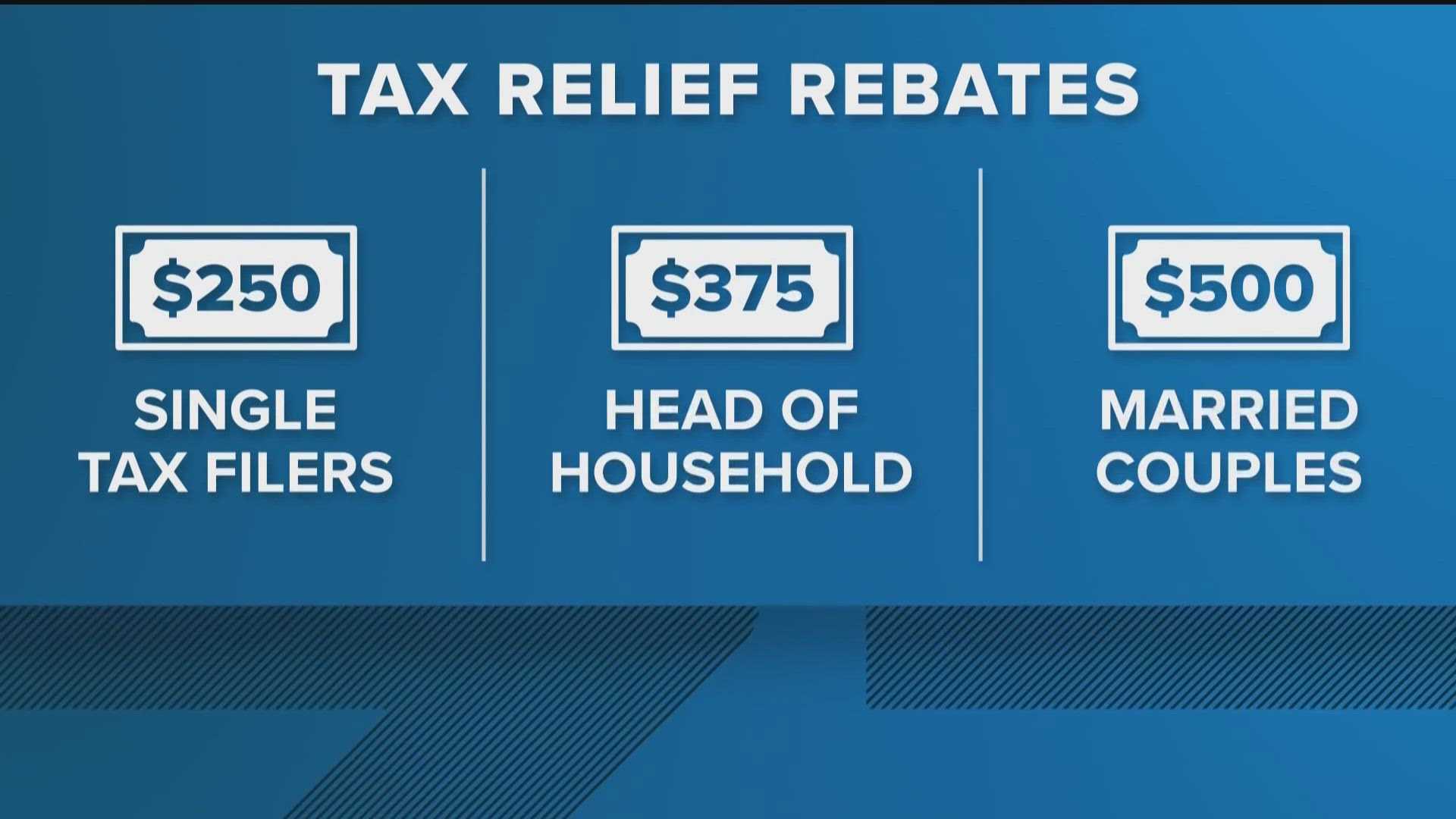

ATLANTA, Ga. — Some Georgia taxpayers received their surplus tax refunds this week, but many are still waiting for their deposits. The state’s Department of Revenue is issuing the refunds in batches to ensure accuracy and avoid technical issues.

According to Joe Snowden, Director of External Affairs and Communications for the Department of Revenue, “The Department is issuing surplus refunds in batches, and the number of refunds issued will increase week over week.”

After extending Georgia’s tax deadline to May 1, 2025, the state announced that refunds would begin going out six to eight weeks later, specifically between June 12 and June 26.

Snowden emphasized that this gradual approach is a precautionary step to avoid errors. “It’s a precautionary step,” he said, “to help avoid errors and make sure everything runs smoothly.”

Taxpayers can check their eligibility and refund status on the Department of Revenue’s website. By entering their information, they can find out if they qualify and when to expect their GASTTAXRFD deposit.

The refunds are based on taxpayer income, and importantly, they are not taxable under Georgia law and will not accrue interest. This is a one-time benefit issued from the state’s surplus budget.

Many residents have wondered if the “GASTTAXRFD” label refers to a gas rebate, but that is not the case. The term stands for “Georgia Surplus Tax Refund,” related to the 2025 income tax surplus refund approved by state lawmakers.