Business

High Dividend Stocks Show Mixed Performance Amid Economic Shifts

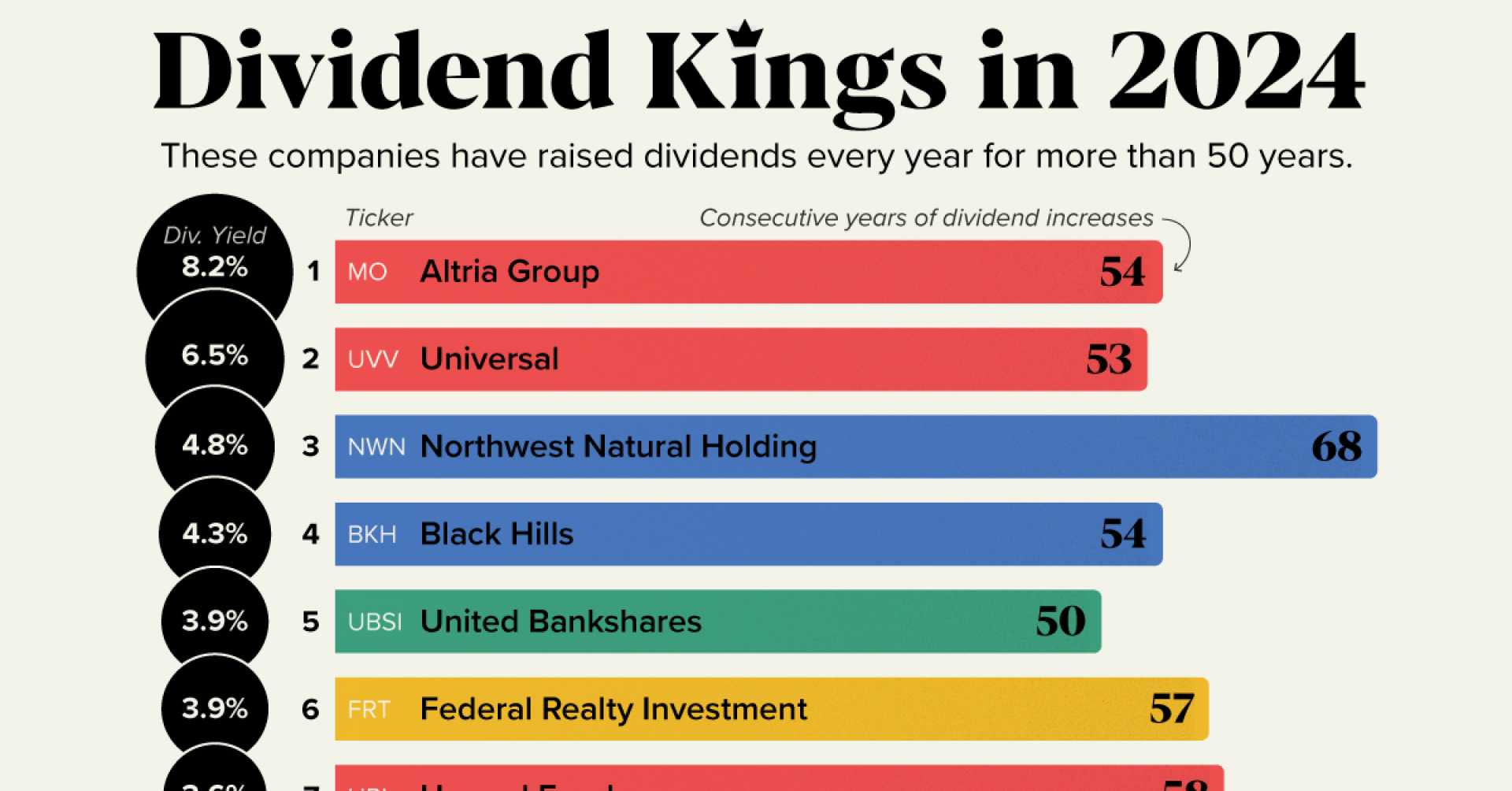

NEW YORK, N.Y. — High dividend stocks, those offering yields well above the market average, are facing mixed results as of July 10, 2025. This report highlights several companies that have been evaluated based on their dividend safety and yield, with a focus on the 7 best high-yield securities.

The high dividend stocks list includes a variety of securities like stocks, REITs, and MLPs with yields of 5% or more. Notably, Polaris Industries reported a first quarter revenue decline of 11.5% to $1.54 billion, prompting concerns about its dividend sustainability.

Universal Corporation, also facing challenges, reported revenues of $702 million in its fourth quarter, marking a decline year-over-year. Despite its status as a Dividend King with 54 years of raises, its adjusted earnings-per-share fell notably.

In contrast, HA Sustainable Infrastructure Capital has continued to focus on climate solutions with a $14.5 billion investment portfolio. However, it experienced an 8% decline in total revenues for Q1 2025, largely due to lower gains on asset sales.

Edison International turned a significant profit of $1.44 billion in Q1, showcasing a shift to renewable energy despite a decline in overall revenue. The company aims to maintain its 2025 core earnings guidance.

Shutterstock is navigating a merger with Getty Images while reporting solid growth, with adjusted EPS increasing by 12%. Meanwhile, Enterprise Products Partners showed resilient cash flow, declaring a 3.9% increase in quarterly distribution.

Altria, known for its tobacco products, reported a 5.7% revenue decline attributed to lower cigarette shipments. However, its adjusted diluted EPS rose 6% year-over-year, indicating some stabilization amid changing market demands.

The High Dividend 50 Series continues to analyze the highest-yielding stocks, with meticulous research guiding rankings of securities based on yield and safety metrics.

Investors are urged to monitor these stocks closely, particularly those with high yields as market conditions evolve. Effective strategies can significantly enhance investment outcomes in the dynamic landscape of high-yield securities.