Business

Home Sales Improve as Economic Conditions Stabilize in May

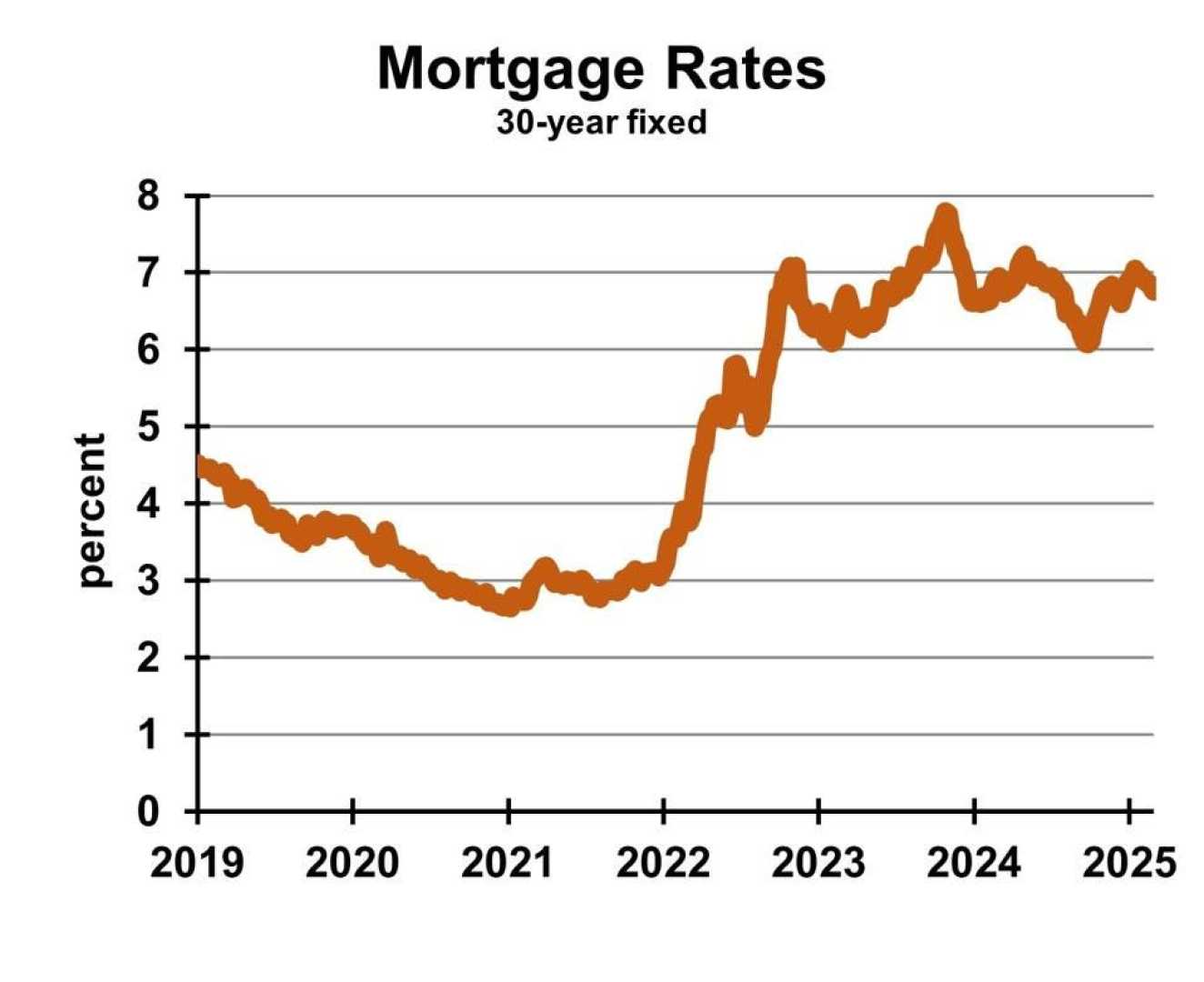

SEATTLE, June 16, 2025 /PRNewswire/ — Home sales in May saw an uptick, aided by more stable economic conditions and a higher number of available properties. According to the latest report from Zillow, buyers are experiencing lower mortgage rates and more options than the previous year, although sales are still lagging behind historical averages.

Kara Ng, a senior economist at Zillow, stated, “Home buyers today have a few factors in their favor: Rates are lower than last year, they have more homes to choose from, and sellers are cutting prices at record rates. But they still face major obstacles, particularly saving up enough for a down payment and finding a home within their budget.” Many families aiming to upgrade are finding that renting a starter home can be more cost-effective than purchasing.

A rise in economic uncertainty caused by trade tariffs and a downturn in the stock market resulted in fewer newly pending sales than anticipated in April, with a decline of 2.5% compared to the previous year. However, as concerns regarding tariffs eased and the S&P 500 improved in May, sales increased by 3.5% from April and by 0.9% year-over-year.

The increase in inventory, nearly 20% above last year’s numbers, provided homebuyers with the most options since July 2020. Despite this, the number of sellers still exceeds buyers, giving the latter more time to make decisions and better negotiating power. Zillow also noted that competition among buyers hit its lowest point for May since 2018.

Over the past year, home values fell in 22 of the nation’s largest metro areas, with sellers reducing prices on nearly 26% of listings nationwide, marking a record in Zillow’s history. Homes that sold did so in an average of 17 days, which is about four days longer than last year but still two days shorter than pre-pandemic averages.

Although the market has become less competitive for buyers, the trend indicates that renting a starter home is financially advantageous in many parts of the country. On average, the rent for a typical single-family home is approximately $100 less per month than the mortgage payment on a typical U.S. home, even with a 10% down payment. This situation reflects a significant shift from six years ago when renting was $373 more costly than buying.

As the gap between buying and renting narrows, Zillow’s data suggests that single-family rent growth is stabilizing, while mortgage costs remain lower than in previous years due to reduced home value growth and slashed mortgage rates. Zillow forecasts that single-family rents will grow faster than home values throughout the year.