Business

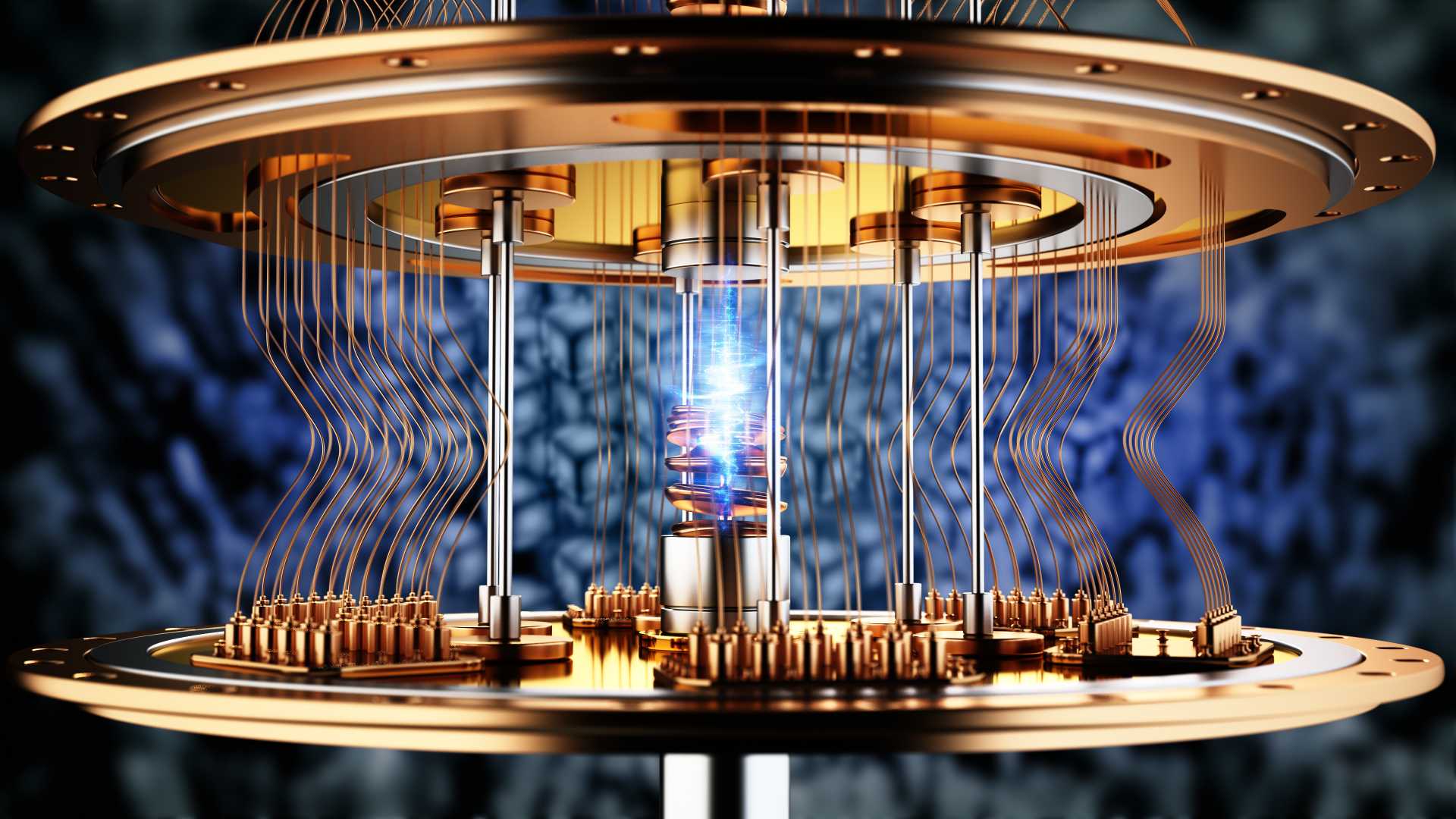

IonQ Stock Faces Volatility Despite Record Quantum Computing Milestone

NEW YORK, NY — IonQ‘s stock experienced notable volatility following the company achieving a record 99.99% two-qubit gate fidelity, a significant milestone for the quantum computing firm. Despite this achievement, the stock declined as investors reacted cautiously to the market, reflecting mixed sentiments about its future growth prospects.

IonQ, specializing in trapped-ion technology for quantum processors, made headlines earlier this month when it closed at $82.59, marking a staggering +75% gain year-to-date. On Monday, October 20, shares opened near $65 but fluctuated greatly, briefly climbing to $65.50 and falling to about $58.80 during the day, finally stabilizing around $62.50, essentially flat compared to the previous week’s close.

A major driver for the market’s cautious stance appears linked to a recent equity offering by IonQ valued at $2 billion, diluting existing shareholder value and prompting traders to take profits amid the stock’s rapid rise. Current trading activity indicates a yearly price performance increase of 38.05% and an average trading volume of over 26 million shares.

IonQ’s CEO, Peter Chapman, expressed the company’s confidence in its market positioning, citing, “IonQ has world-class talent, cash, and a strengthened unique position to expand our ecosystem.” However, concerns still linger about IonQ’s lofty valuation, which stands near $200 times its forward sales, leading to skepticism on Wall Street. Analysts have highlighted the need for company performance to match the aggressive market expectations.

As the quantum computing sector continues to attract attention, IonQ’s next earnings report on November 5 will be closely watched to gauge its revenue traction and future viability. Experts remain divided on IonQ’s potential, with many agreeing that volatility is likely to persist as new technological announcements and funding developments play pivotal roles in determining stock performance.