Business

Marathon Digital (MARA) Stock: Earnings Anticipation and Market Sentiment

Marathon Digital Holdings, Inc. (MARA), a digital asset technology company focused on the bitcoin ecosystem, is gearing up for its earnings report scheduled for November 12, 2024, after market close. This upcoming event has significant implications for investors and market analysts.

The options market is showing heightened activity ahead of the earnings release. The open interest in MARA options has climbed 2.0% to 1.6 million contracts, surpassing its 52-week average of 1.3 million contracts. This increased open interest indicates a high level of market anticipation and uncertainty.

Market sentiment, however, appears bearish on MARA Holdings. The implied volatility skew shows that the market is pricing in a larger fear of a downside move, with the current 25-Delta Put-Call Spread at -1.0, above its 20-day moving average of -4.8. This suggests that investors are more cautious about potential negative outcomes following the earnings announcement.

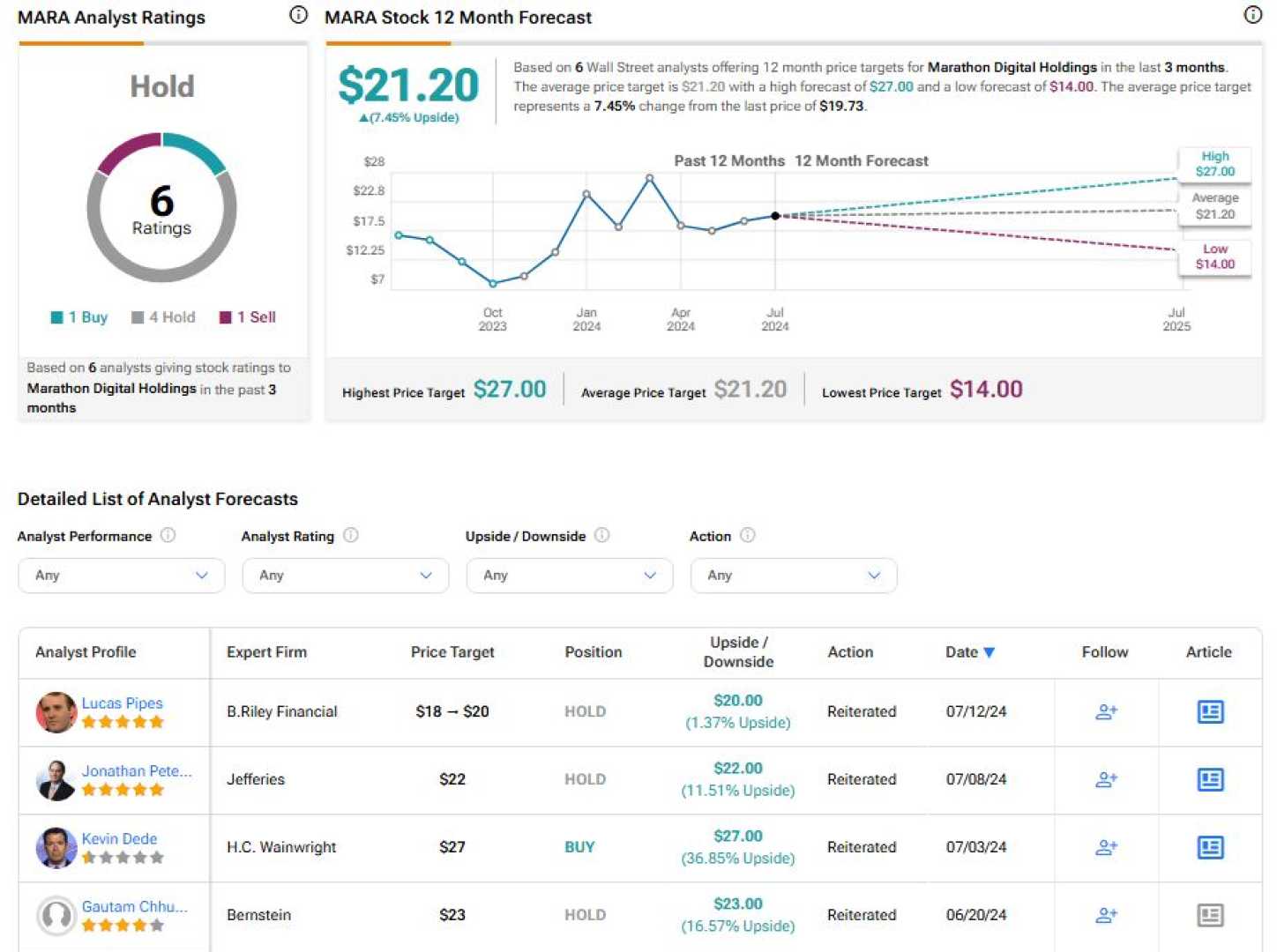

Analyst forecasts for MARA stock are mixed, with a consensus rating of “Hold” based on ratings from eight Wall Street analysts. While one analyst has given a sell rating, three have issued hold ratings, and four have recommended buying the stock. The average twelve-month stock price forecast is $21.43, indicating a potential upside of 32.93% from current levels.

The historical data on MARA’s earnings moves also provides some insight. The options market has overestimated MARA’s stock earnings move 67% of the time in the last 12 quarters, with an average predicted move of ±11.0% versus an actual move of 8.3% in absolute terms.